A big boom is coming and Wall Street simply can’t ignore it. And there’s not a central bank boss or government leader anywhere in the world telling us that they’re going to get in the way of it! Our own Dr Phil Lowe of the RBA and Jerome Powell of the Fed had chances to warn us this week that they were central bankers who feared inflation and excessive wage rises, but instead they’re openly saying they want it!

OK, that’s an economic story of what lies ahead — rising inflation and a big delay before official interest rates rise. But what’s the stock market story ahead?

History tells us that April is a good month for stocks, and it has been so far, with our S&P/ASX 200 index up about 4%, though it tends to be better at the beginning of the month, compared to the end. And remember, there’s that old market piece of advice: “Sell in May and go away…”

This was based on the fact that the stock market performed better November to April than May to October. Of course, this rule of thumb was dumb last year because the market was rebounding out of the Coronavirus crash.

S&P/ASX 200

The market was up 13% May to October, and even though I wouldn’t be surprised that we see some pullbacks, the burgeoning boom belief will keep buyers seizing upon any sell-off as a buying opportunity.

But could it be a goer this year? In 2010, the second year after the GFC crash, selling in May worked out right, but the loss to the end of October was only 3%!

There was a lot of stimulus and low interest rates but nothing like now. Michael Knox of Morgans (who gave me the insight about 10 months ago that we might get a roaring 20s rerun after vaccinations meet the huge government spending program and historically low interest rates) is now seeing the potential boom more like the bigger post-World War 2 boom!

And stock buyers won’t ignore that but I’m going to be watchful for the tone from central bankers to start changing about interest rate rises, before I start to warn you that this upward trend for stocks is done and dusted.

I loved the take from Tom Lee of Fundstrat in the US, who’s a pretty good market caller, who said he’s getting ready for a “face ripper rally” in April! He was then trumped for news by JPMorgan’s Jamie Dimon, who came up with these litany of reasons for thinking this boom lasts until 2023: “With excess savings, new stimulus savings, huge deficit spending, more QE, a new potential infrastructure bill, a successful vaccine and euphoria around the end of the pandemic…[the] U.S. economy will likely boom.”

He wasn’t done yet, adding: “This boom could easily run into 2023 because all the spending could extend well into 2023.”

And at an IMF debate this week, Jerome Powell refused to say he was spooked by the strength of the boom, despite economists tipping the second quarter will bring 9% economic growth. He’s also currently ignoring what the market is saying following data released recently, that “the fed funds futures market began to immediately bring forward expectations for a Fed rate hike to December 2022, from the spring of 2023.” (CNBC)

That said, he did leave the door open for U-turning on the subject, saying at the IMF debate that this could happen if the Fed sees inflation expectations “moving persistently and materially above levels we’re comfortable with.”

Interestingly, this week, the Producer Price Index in the US jumped in March, rising 1%, compared with a projected increase of 0.4% from economists surveyed by Dow Jones.

And if you need anymore proof that investors in the US are committed to stocks, then here’s an unforgettable fact from the Bank of America: “More money has gone into stocks-based funds over the past five months than the previous 12 years combined!

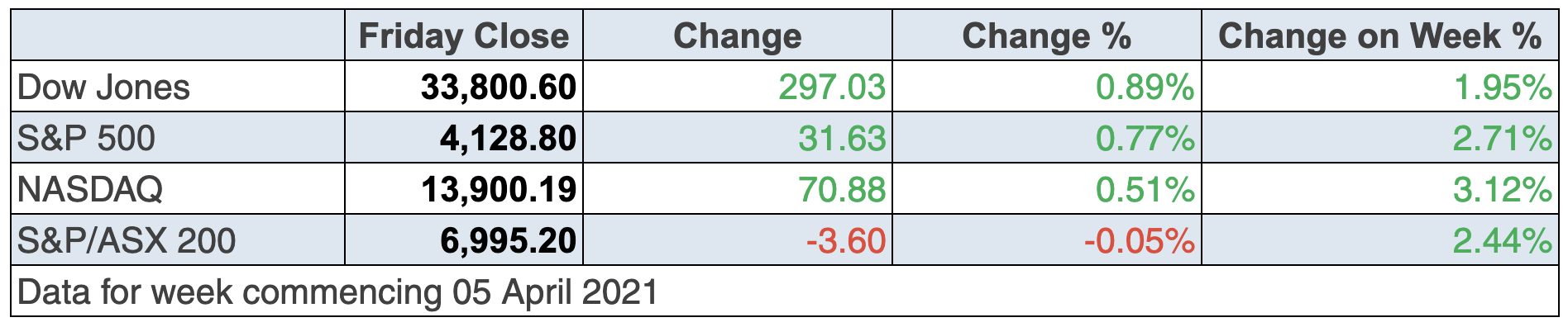

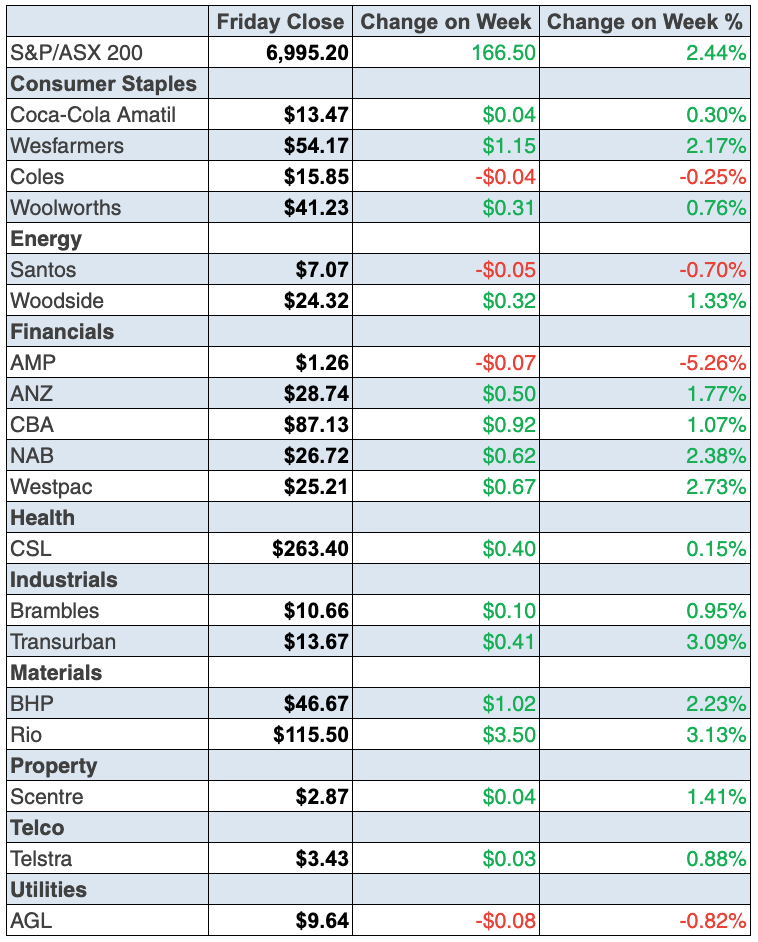

To the local story this week and Friday saw a small 3.6 drop in the S&P/ASX 200 index but for the four-day week it was a 2.4% gain, which wasn’t bad and we even cracked the 7000-level intraday. The final level was 6998.8, which only tells me that we have plenty of upside ahead, with any sell offs simply buying opportunities for the patient/wise investor.

What was laughable was the comeback for tech stocks when only weeks ago you could hardly give them away! The boom I’ve been talking about will be good for tech stocks long term, but right now there’s a tug of war between rotation into reopening trade stocks and growth stocks. However, eventually the good tech businesses with real potential will keep on rising until interest rate rises spook the market.

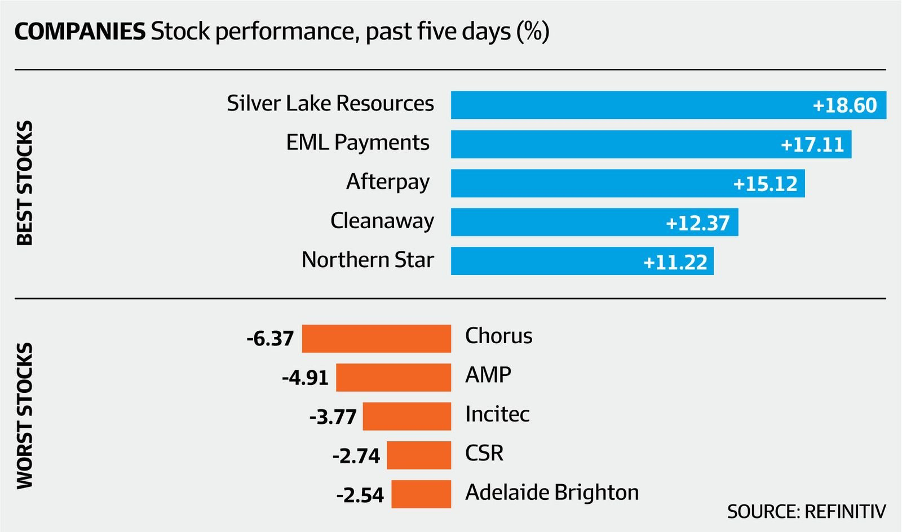

Afterpay wacked on 10% and Zip Co climbed 9.1%, while EML Payments (part of my ZEET group of stocks) surged 17.11% after entering into a binding share purchase agreement to acquire 100% of Sentenial Limited and its wholly owned subsidiaries. This includes its open banking product, Nuapay. This gives EML more diversification and the market liked the implications.

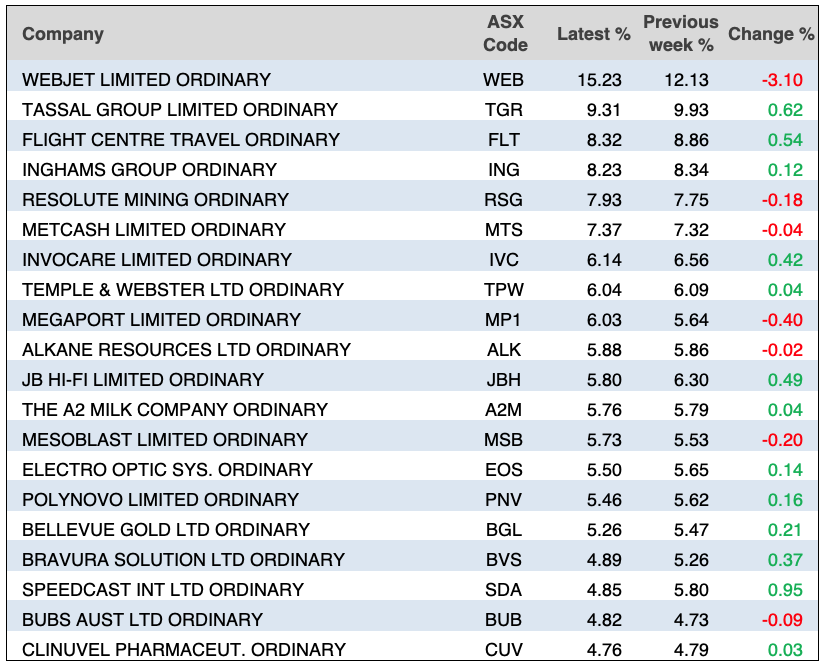

Here’s the AFR’s table of winners and losers for the week:

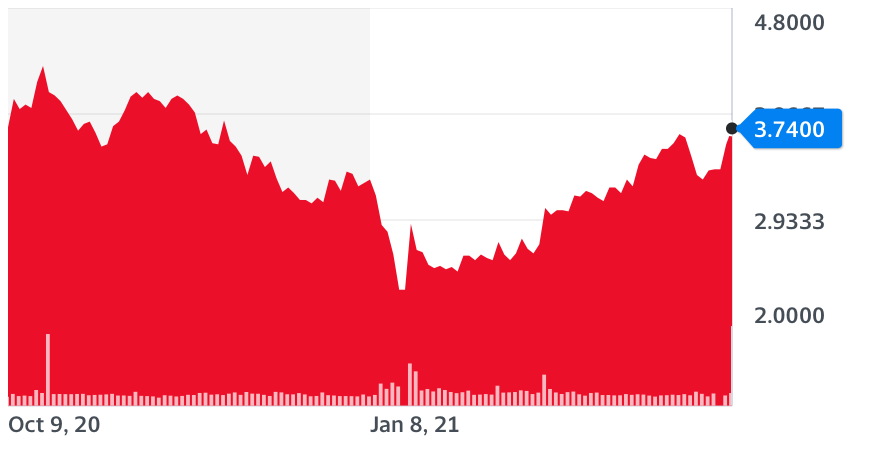

Since I first wrote about Zip, EML, ELO and Tyro on May 29 last year, my ZEETs are up 40.3%, and that’s despite Tyro being a victim of that hedge fund negative report by Viceroy. That report took its share price down to $2.32, but after the report was seen as largely rubbish, its share price has rebounded to $3.74. That’s a 61% gain for those who saw through that rubbish report as nothing more than a market-manipulating opportunity to take investors for a ride!

I hope my subscribers bought more Tyro at these lows as I recommended.

TYR 6 months

Obviously, travel stocks lost ground this week because of vaccination concerns here, with Flight Centre down 2.7% to $18.42 and Webjet off 2.5% to $5.40. But this only provides a buying opportunity for the longer-term investor.

What I liked

- ANZ job advertisements rose by 7.4% in March to a 12-year high of 190,542 available positions. Ads have lifted for 10 successive months to be up 39.7% from a year ago.

- The Australian Industry Group (AiGroup) and HIA Performance of Construction Index (PCI) rose by 4.4 points in March, up from 57.4 to a record (16-year) high of 61.8 points. Readings above 50 indicate an expansion of activity.

- New vehicle sales totalled 100,005 units in March, up 22.4% on a year ago.

- The headline measure for inflation rose by 0.4% in March to be up 1.8% on a year ago. The trimmed mean gauge rose by 0.5% to be up by 0.7% on a year ago.

- The AiGroup Performance of Services index rose by 2.9 points to a 2½-year high of 58.7 in March – the sixth successive monthly expansion in activity (reading above 50).

- The ‘final’ IHS Markit services purchasing manager index rose from 53.4 in February to 55 in March. The composite index, which measures combined services and manufacturing output, rose from 53.7 to 55.5. Readings above 50 indicate an expansion of activity.

- The International Monetary Fund now expects the global economy to grow by 6% in 2021, up from the previous estimate of 5.5% made in January.

- From the US, the ISM services index rose from 55.3 to a record 63.7 in March (survey: 59). The Markit services index rose from 59.8 to 60.4 in March (survey: 60), while the composite index rose from 59.5 to 59.7 (survey 59.1).

- The IBD/TIPP Economic Optimism index for the US rose from 55.4 to 56.4 in April (survey 55).

What I didn’t like

- The AstraZeneca news for under 50s.

- Eurozone unemployment was unchanged at 8.3% in February, but on the plus side its composite business conditions PMI for March was revised up to a reasonable reading of 53.2. However, renewed lockdowns suggest it may fall again in April.

- The weekly ANZ-Roy Morgan consumer confidence rating fell by 4.6 points or 4.1% to 107.7 points (long-run average since 1990 is 112.6). It was the biggest decline in nine months. Confidence is still up by 64.9% since hitting record lows of 65.3 on 29 March 2020 (lowest since 1973).

How do you play vaccine problems news?

It’s a short-term blip that will create buying opportunities for reopening trade stocks. Keep the faith until interest rates tell you the party is over!

The week in review:

- Tony Featherstone gave us a snapshot of 3 climate-change-related ETFs [1]: VanEck Vectors Global Clean Energy ETF (CLNE), BetaShares Climate Change Innovation ETF (ERTH) and ETFS Battery Tech and Lithium ETF (ACDC).

- James Dunn shared his thoughts on Altium (ALU), NextDC (NXT), Megaport (MP1), Superloop (SLC) and the BetaShares Cloud Computing ETF (CLDD) [2] in the $390 billion cloud services market.

- Our “HOT” stock this week was Credit Corp (CCP) [3] selected by Michael Gable from Fairmont Equities.

- There was 1 upgrade and four downgrades in Buy, Hold, Sell – What the Brokers Say [4] this week.

- And in Questions of the Week [5], Paul Rickard answered questions about the Platinum Investment Bond, Coles (COL), A2 Milk (A2M) and an ETF with exposure to the battery storage/electric vehicle markets.

Our videos of the week:

- Boom! Doom! Zoom! | April 08, 2021 [6]

- Webinar: Don’t be an April fool! [7]

- 4 stocks the experts say have BIG UPSIDE: RWC, ELO, A2M & MP1 [8] | Switzer Investing

Top Stocks – how they fared:

The Week Ahead:

Australia

Tuesday April 13 – Weekly consumer sentiment (April 11)

Tuesday April 13 – Weekly payroll jobs & wages (March 27)

Tuesday April 13 – NAB business survey (March)

Wednesday April 14 – Building activity (December quarter)

Wednesday April 14 – Overseas arrivals & departures (February)

Wednesday April 14 – Household impacts of Covid-19 survey (March)

Thursday April 15 – Consumer inflation expectations (April)

Thursday April 15 – Labour force (March)

Overseas

Monday April 12 – US Monthly budget statement (March)

Tuesday April 13 – China International trade (March)

Tuesday April 13 – US NFIB small business optimism index (Mar.)

Tuesday April 13 – US Consumer prices index (March)

Wednesday April 14 – US Export/import prices (March)

Thursday April 15 – US Retail sales (March)

Thursday April 15 – US Industrial production (March)

Thursday April 15 – US Philadelphia Fed manufacturing index (April)

Thursday April 15 – US NAHB housing market index (April)

Thursday April 15 – US Business inventories (February)

Friday April 16 – China Economic (GDP) growth (March quarter)

Friday April 16 – China Retail sales/production/investment (Mar.)

Friday April 16 – US Housing starts & building permits (March)

Friday April 16 – US University of Michigan consumer sentiment

Food for thought:

“In many ways, the stock market is like the weather in that if you don’t like the current conditions all you have to do is wait awhile.” – Lou Simpson

Stocks shorted:

ASIC releases data daily on the major short positions in the market. These are the stocks with the highest proportion of their ordinary shares that have been sold short, which could suggest investors are expecting the price to come down. The table shows how this has changed compared to the week before.

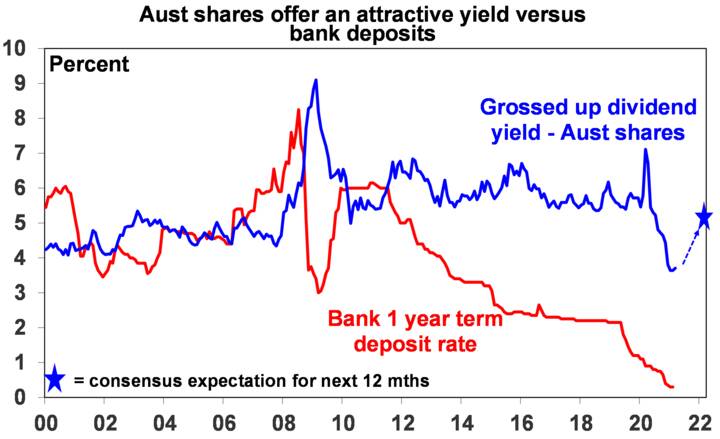

Chart of the week:

AMP Capital’s Shane Oliver published the following table that compares the interest rate for a 1-year term deposit with the grossed-up dividend yield of Australian shares, including an estimated yield of 5.2% over the next 12 months:

Top 5 most clicked:

- 3 climate-change ETFs to consider [1] – Tony Featherstone

- 4 stocks & 1 ETF that will be stars in the cloud computing space [2] – James Dunn

- Questions of the Week [5] – Paul Rickard

- Buy, Hold, Sell – What the Brokers Say [4] – Rudi Filapek-Vandyck

- “HOT” stock: CCP [3] – Maureen Jordan

Recent Switzer Reports:

- Thursday 8 April: 3 climate-change ETFs to consider [9]

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.