“It certainly has been a year of rotation,” said Peter Switzer to the full house at the Switzer Rapid Fire webinar last Friday. “There was rotation into stay-at-home stocks when Covid hit and now people are rotating into the reopening trade,” he added.

According to Peter, December will be a good month for stocks, as historically it always is. And the economic recovery story is being reflected in good energy and commodity prices.

“If you think 2021 is going to be a year of economic recovery, then you have to think the Australian stock market is going to go up,” Peter contended, in his optimistic but learned way.

Forty eight questions were sent in by our subscribers for the two thrill seekers to give their opinion on. What follows are Switzer and Rickard’s “rapid fire” answers and also their picks of the stocks for 2021.

1. Reliance Worldwide Corporation

This now international plumbing business is a company that our dynamic duo both like.

“Analysts think there’s about 3% upside. The analysts are more short than long term,” Peter said.

“It’s a good company. Remember I’m expecting a worldwide improvement in construction, which is good for building related stocks.”

Paul added his view:

“You need people to spend on their homes, but I like Reliance and they were market favourites. They did get sold off and have taken a while to recover.”

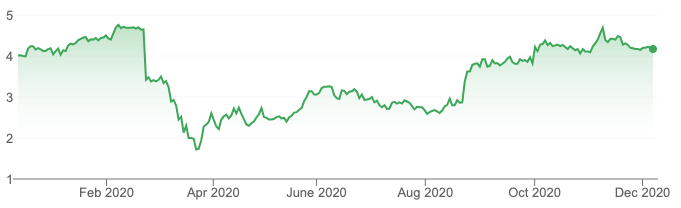

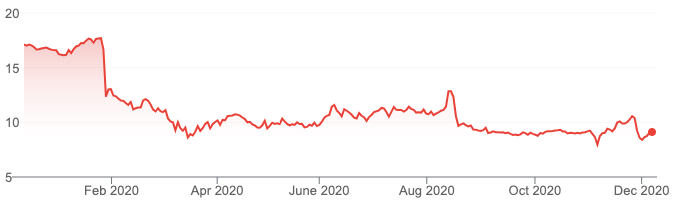

RWC

Source: Google

2. Is it too late to buy Coles? At what price would be reasonable buying?

“Coles should be in your portfolio and it’s a great company that has really delivered,” Peter said.

“Analysts still think it has 9% upside. It has been sold off because of the reopening trade. People have got their toilet paper now!”

Paul has a slightly different view:

“ I prefer Woolworths to Coles but if you want it in your portfolio, this is probably not too bad a level to buy in at.”

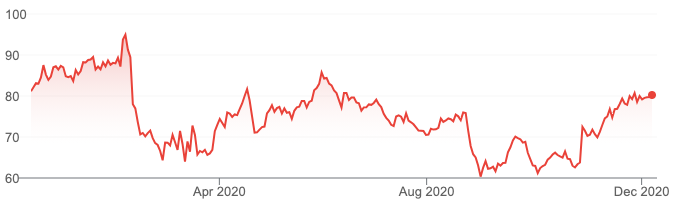

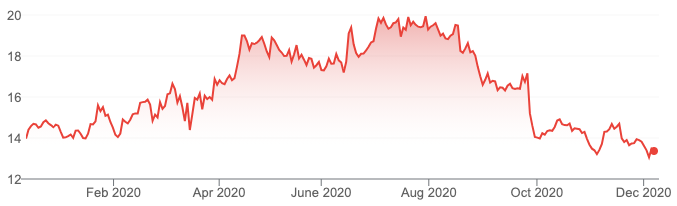

COL

Source: Google

3. BLACKMORES

Peter was a big fan when Christine Holgate was at the helm but he’s not as keen now.

“The analysts think it has a 16.5% downside and they have a bit of a China trade issue as well. It will improve once the tourists come back but I’m not expecting a great result,” he said.

Blackmore’s isn’t on Paul’s list either as the stock just doesn’t get him excited. Certainly the pair can’t see Blackmores returning to its $200 highs.

Source: Google

4. The Big Australian – BHP

BHP is currently booming partly because of better oil and iron ore prices.

“My feeling is that BHP has another six months of doing pretty well, while Brazil still goes through a bad time with the Coronavirus,” Peter said.

Paul thinks our biggest miner should be a core stock in anyone’s portfolio: “It’s diversified, with great assets. The challenge is no one can predict with any confidence what’s going to happen to commodity prices. Iron ore’s unique because of the disruption issue with Vale and Brazil. I see no reason to sell. Its dividends and cashflow are good.”

5. Looking to a 2-to-3-year time frame, at what accumulation price would ANZ and NAB be worth buying more of?

“I wouldn’t be surprised if they get to $30. That’d be my guess call. We’re going to grow really fast next year. The Reserve Bank governor is going to have to break his promise in 2022 about keeping interest rates so low,” Peter said.

“They’ll start raising interest rates in 2022, because the growth’s going to be so strong they’re going to be forced to. We’re going to see inflation going up and unemployment coming down. When the Governor made that promise, I compared it to the George Costanza promise on Seinfeld: It’s not a lie if you believe it’s true when you say it! and Dr Phil believed it but as this economy goes ballistic, not 2021 but 2022, he might be forced to raise rates, which should be good for banks,” Peter said.

Paul says he’d be targeting the share price a bit lower down:

“I don’t disagree with the long-term assumption, but we might get a bit more pullback back in the low twenties again. But you have to be patient sometimes in markets,” he maintained.

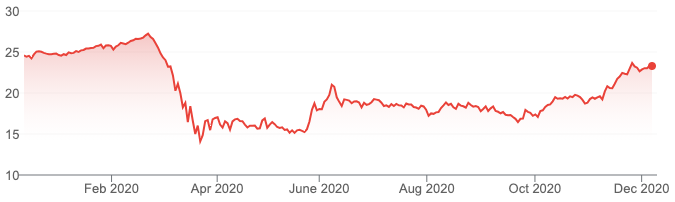

ANZ

Source: Google

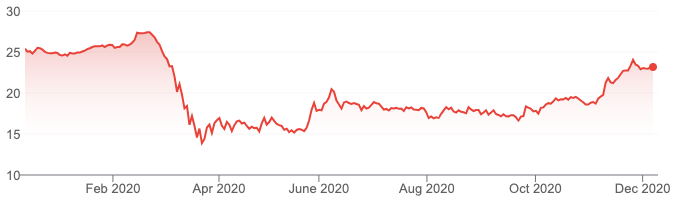

NAB

Source: Google

6. REA Group

A question concerning REA, a top business hero, sparked interest: Is it a hold or a sell?

“It’s a hold,” Peter said in a flash. “I love it,” he added.

Paul Rickard has a penchant for REA as well: “It’s such a better business than the Domain business. It’s a good lesson and we often talk about this. Do you buy the number one or number two? I reckon you always buy the number one. Look at REA versus Domain. Look at Afterpay versus Zip. Look at CBA versus the others. Sometimes going for the number two or number three in a market doesn’t make sense. I’d hold it. I’m not sure I’m a buyer, but if I owned it, I’d be a holder.

REA

Source: Google

7. The final question (for the purposes of this article) asked Peter and Paul to choose a single stock as their standout for 2021

Peter was first out of the barricades, sticking his neck out with something that wasn’t quite as safe as his usual calls.

“I’m going to go for Treasury Wine Estates for two reasons. I think there’ll be a trade solution eventually. Jun Bei Liu from Tribeca likes it but Julia Lee isn’t as keen. But I do think a trade solution will come. I think it’s a best-of-breed company and over time, if a trade solution comes, then boom, it’ll go up,” he said.

Meanwhile Paul was flipping a coin between two favourites:

“As this is a call for 2021, I’m going to say A2 Milk. It’s a great company. Obviously it also has issues with China and a few other things. I’m more confident about JB Hi-Fi but I’m going to go for A2 Milk,” Paul concluded.

TWE

Source: Google

A2M

Source: Google

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.