At this time every year, there’s inevitably talk of stronger Mergers and Acquisitions activity in the next 12 months. Usually, the bullish sentiment comes from those with a vested interest in M&A deals: investment banks, lawyers and brokers that love a hostile takeover.

M&A activity is building due to low interest rates, cashed-up corporates and CEOs eager to buy something (and get paid even more). But I doubt we’ll see a rush of hostile takeovers where multiple bidders slug it out to buy assets, and shareholders win from higher prices.

The wildcard is superannuation. A consortium of industry super fund investors backed the winning consortium for the $17.5bn takeover of Sydney Airport Holdings this year. Clearly, super funds have a growing appetite to privatise listed infrastructure and utility companies.

Recently, the Australian Real Estate Investment Trust (A-REIT) sector has emerged as a potential target for super funds. It’s too early to tell if that will happen – listed property hasn’t featured strongly in M&A activity overseas. So far, super funds seem more interested in privatising infrastructure and utility companies than listed property trusts.

But there’s logic in large super funds buying high-quality office, industrial and retail property, and taking it private. The best property assets are a good fit with the long-term investment needs of superannuation funds. Some A-REITs would be better off privatised.

As I’ve written many times, never buy a company on the basis of takeover alone. Takeover targets are hard to pick and getting the timing right is akin to guessing. Buy high-quality companies when they trade below their fair value. Treat any takeover as a bonus.

As promised last week, this week’s column focuses on large-cap takeover targets. A feature is the number of infrastructure, utility and property companies on the list. Here are seven ideas:

1. Crown Resorts (CWN)

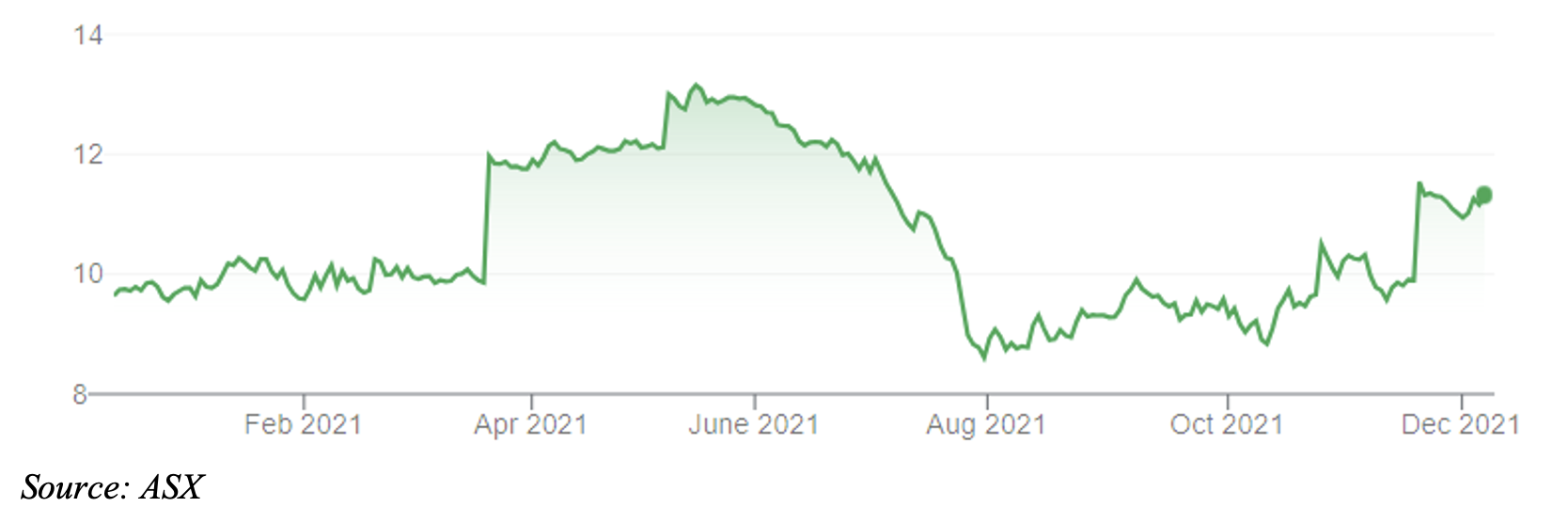

No surprises here. It seems a matter of when, not if, for the embattled casino operator to be acquired. In early December, Crown’s board recommended against the acquisition proposal from Blackstone, the US private equity giant, to buy Crown at $12.50 a share.

By giving Blackstone limited due diligence, Crown effectively signalled to other bidders that it is for sale, at the right price. Crown has a long list of problems after the Victorian Royal Commission’s findings on money-laundering at its casinos. But the company also has fabulous property and casino assets in Sydney and Melbourne that are hard to replicate.

Crown Resorts (CWN)

2. Aurizon Holdings (AZJ)

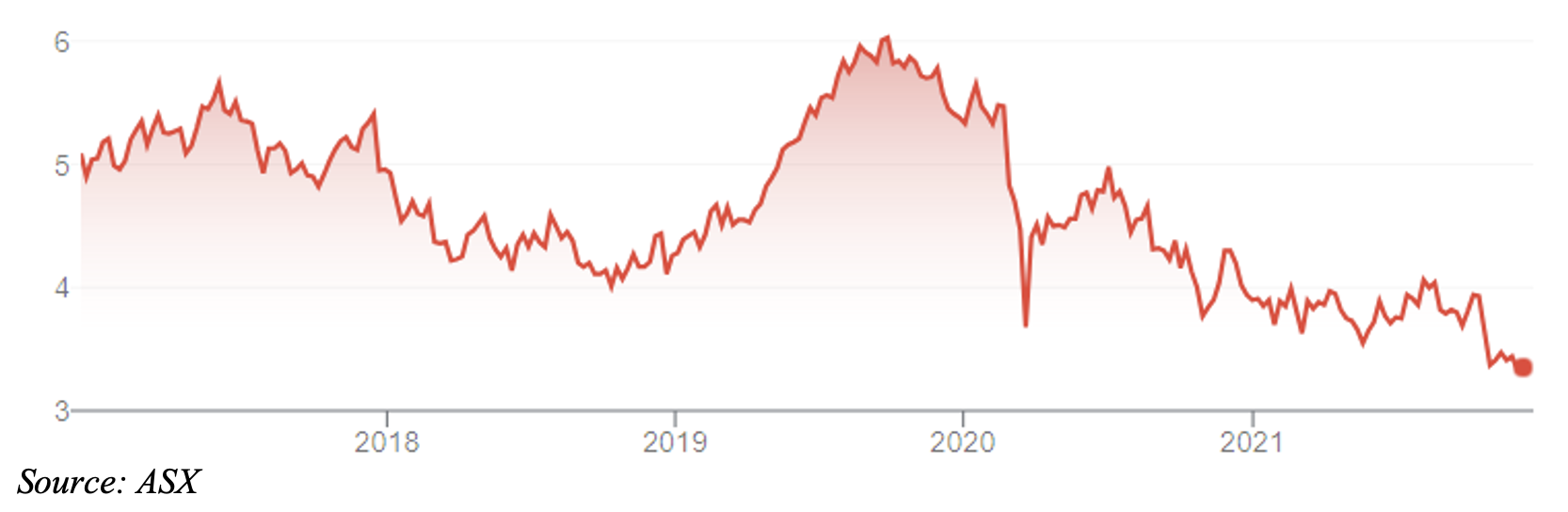

A rail operator that still makes most of its revenue from transporting coal seems an unlikely fit for super funds eager to display their environmental, social and governance (ESG) credentials and climate-change focus. But that view overlooks the quality of Aurizon’s rail infrastructure and its eagerness to grow its bulk-freight operations and rely less on coal.

Aurizon looks undervalued at $3.30 a share. Morningstar values the stock at $4.70. Yes, coal freight has long-term challenges as the world moves towards carbon neutrality by 2050. But rail infrastructure has a critical, expanding role in Australia’s logistics future. Aurizon would perform better as a privately owned business as it transforms its operations away from the glare of the share market.

Aurizon Holdings (AZJ)

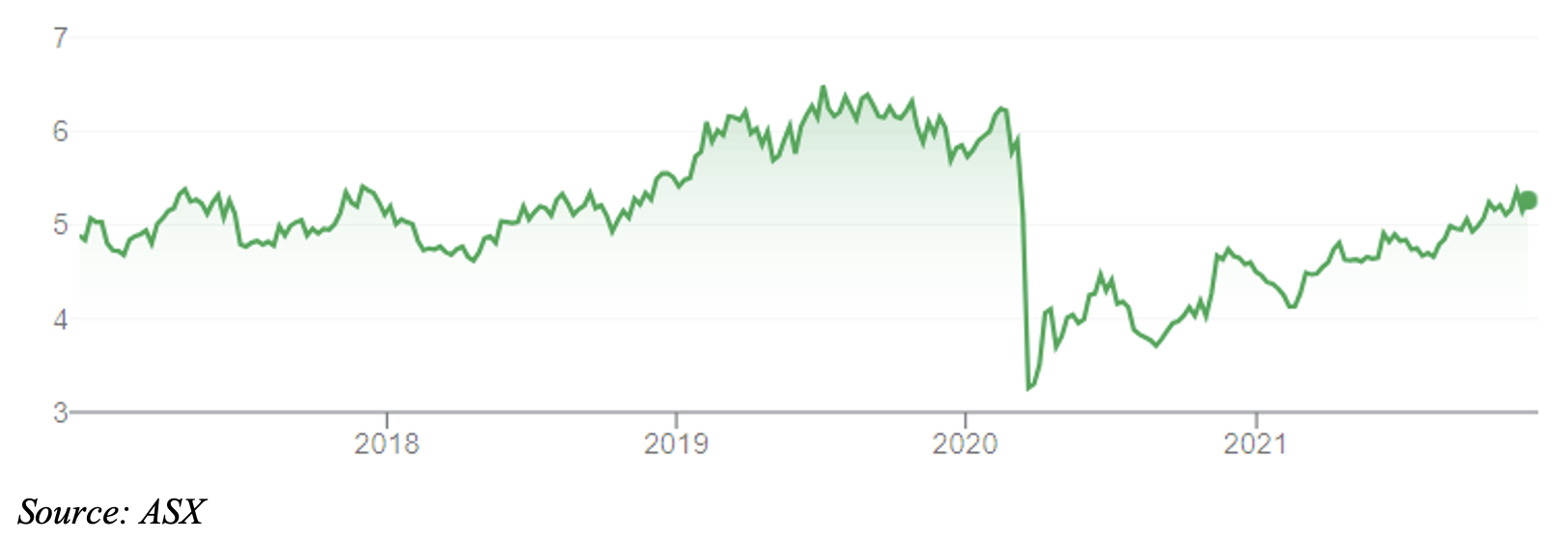

3. GPT Group (GPT)

It would be ironic if the big foray into A-REIT takeovers by super funds came via GPT Group, the market’s first listed property trust (GPT celebrated its 50th listing anniversary this year). GPT, owner of prime retail, office and industrial properties, has underperformed the market with a five-year annualised total return (including distributions) of 5.3%.

Super funds would be buying the property assets at a discount: GPT’s latest net tangible assets (NTA) per security of $5.86 (at the FY21 interim results) compares to its unit price of $5.20. UniSuper owns 15.26% of GPT, according to Morningstar shareholder data. GPT, a quality A-REIT, looks like a solid buy at the current price, with or without a takeover.

GPT Group (GPT)

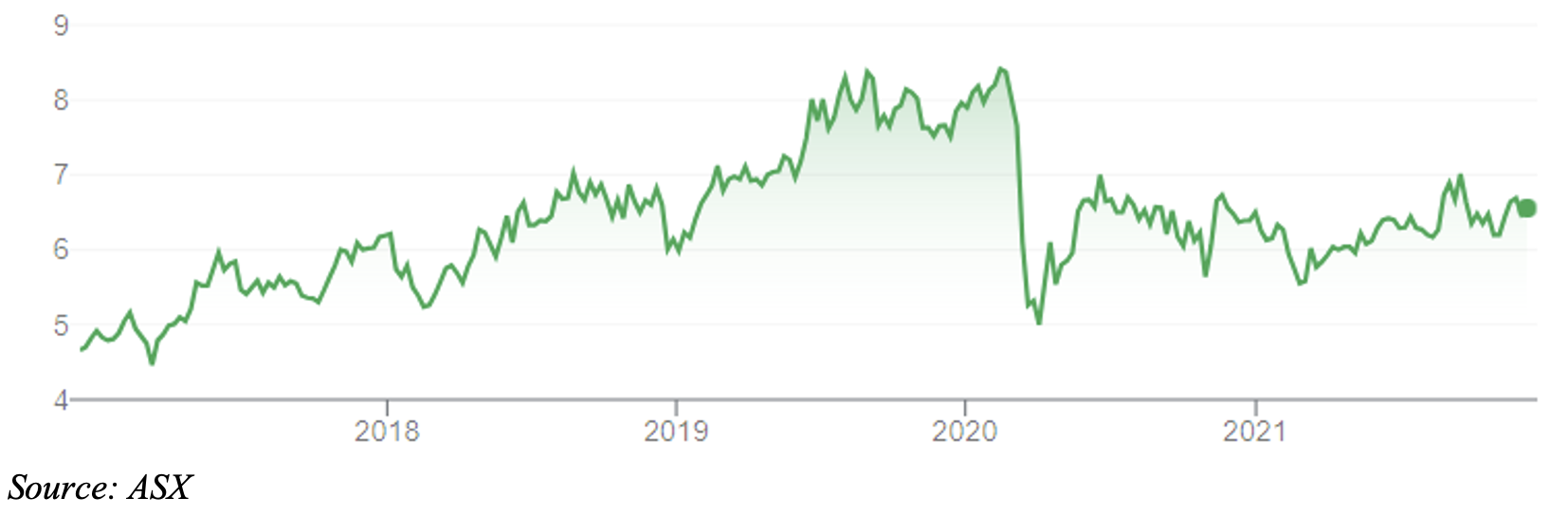

4. Atlas Arteria (ALX)

If super funds can snap up a trophy asset like Sydney Airport, Atlas Arteria is well within their reach. The listed infrastructure company owns and develops toll roads in France, the United States and Germany. It has an excellent portfolio of fully or partly owned major toll roads and is an obvious winner from the Covid recovery as more people drive to work again.

Atlas Arteria is no bargain. A consensus share-price target of $6.81 suggests the stock is trading slightly below fair value (the current price is $6.53). That might be enough for Australian super funds that have a long-term investment focus, have keenly bought overseas infrastructure in the past decade, and are showing greater interest in privatising listed transport infrastructure.

Atlas Arteria (ALX)

5. Origin Energy (ORG)

The bids this year for AusNet Services reinforce the industry and private equity interest in prime utility assets. Origin Energy is a different beast: it controls about a third of the Australian energy retailing market and has the Australia Pacific LNG project. That gives Origin a higher risk profile than other energy retailers. Origin has underperformed the market for a decade.

Origin could easily attract a predator. It is trading below fair value (the consensus target price of $5.73 compares to the share price of $4.93). Presumably, the new owner could split up the business and strengthen the balance sheet. Energy retailing is a highly competitive, low-margin business in a mature industry. Still, Origin could be worth more in the hands of a new owner that could break the business up and maximise its value.

Origin Energy (ORG)

6. Challenger (CGF)

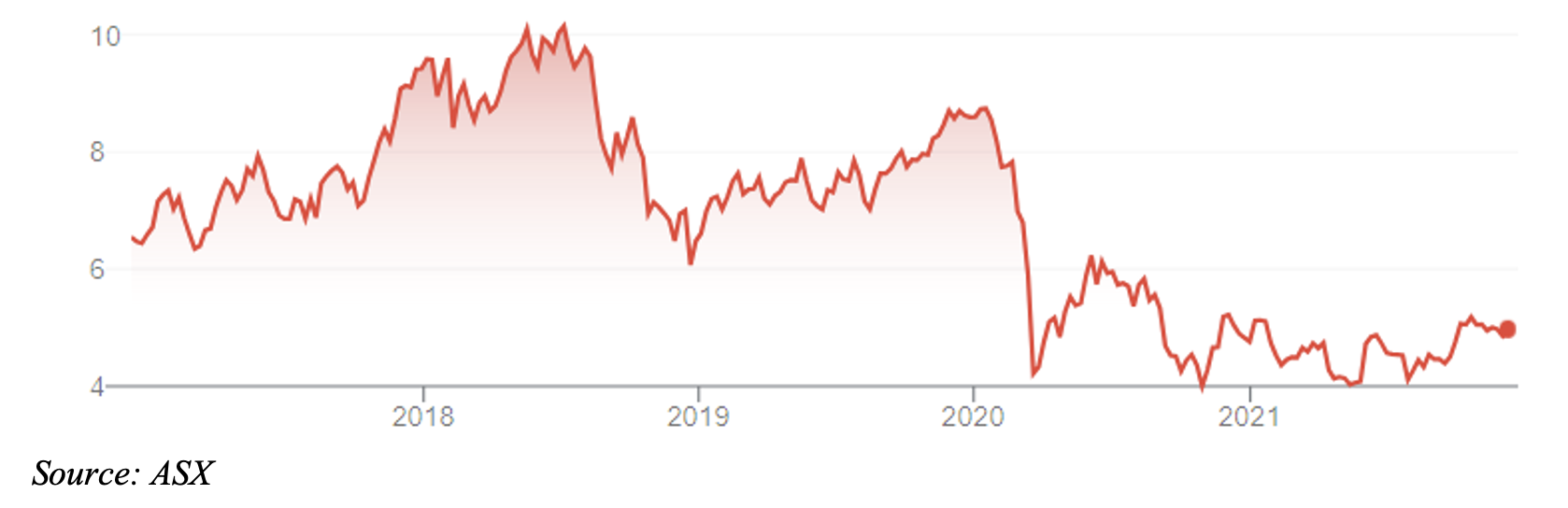

How much longer can the retirement-investments provider underperform the market before a predator steps in? Challenger’s five-year annualised total return of -7.5% is disappointing for a company of its quality and market position. It’s also an opportunity for a larger player.

Challenger has had many headwinds in a low interest rate environment. But it has a valuable position in annuities – a key investment product for an ageing demographic and expanding number of retirees.

Challenger’s core annuities business continues to benefit from Australia’s compulsory retirement-savings regime. The Retirement Income Framework should boost Challenger’s annuity sales in the medium term as it puts more onus on advisers to develop safe income streams for clients. With or without takeover, Challenger looks undervalued at $6.34 a share.

Challenger (CGF)

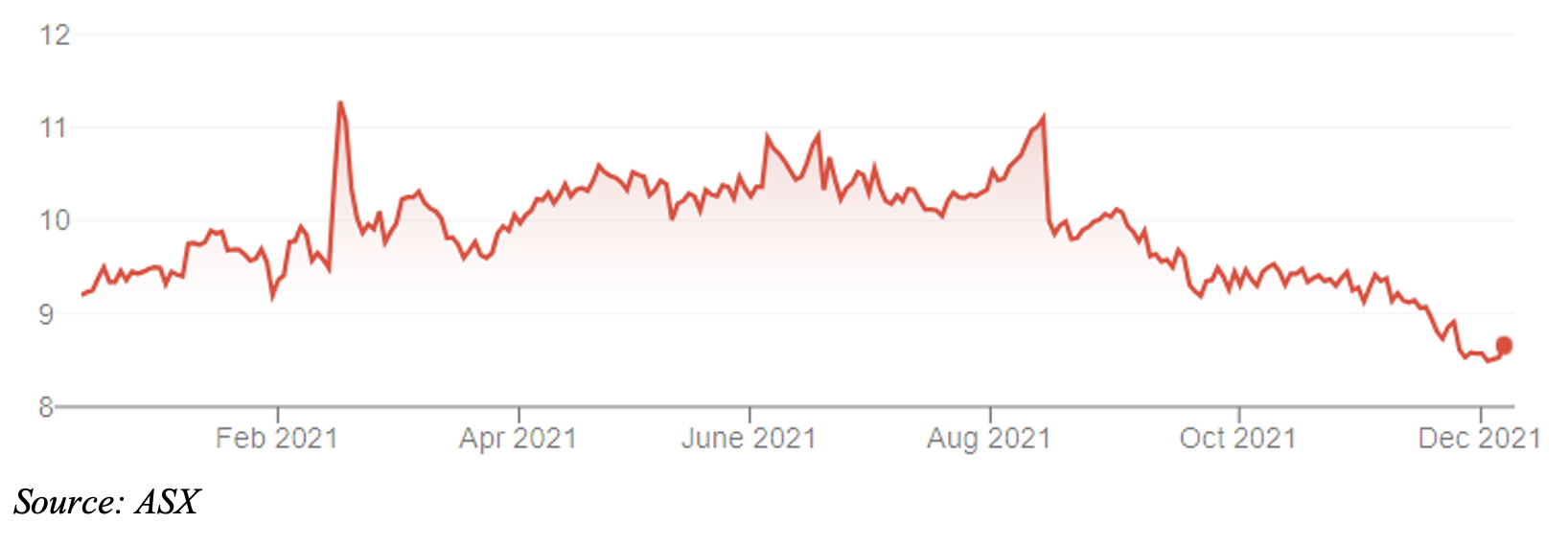

7. Bendigo and Adelaide Bank (BEN)

Those hoping for a fifth force in Australian banking to emerge have been disappointed many times before. So, too, those (including me) who thought Bank of Queensland (BOQ) and BEN would one day merge to create a genuine new rival for the big-four banks. BEN seems more interested in acquiring smaller rivals to increase its banking market share.

Bank of Queensland’s acquisition this year of ME Bank for $1.325bn gives it much-needed firepower to challenge the big-four banks. It also makes BEN increasingly look like the odd bank out in the sector – and in need of greater scale through a merger. BOQ is the obvious merger candidate but has plenty on its hands with its clever ME Bank acquisition.

The good news is that BEN looks undervalued, with or without takeover. Morningstar’s $10.20 valuation per share compares to the current price of $8.53. On a forecast Price Earnings (PE) ratio of about 10 times FY23 earnings, BEN is arguably the best-value bank stock now, provided investors are comfortable owning a mid-cap bank.

Bendigo and Adelaide Bank (BEN)

Tony Featherstone is a former managing editor of BRW, Shares and Personal Investor magazines. The information in this article should not be considered personal advice. It has been prepared without considering your objectives, financial situation or needs. Before acting on information in this article consider its appropriateness and accuracy, regarding your objectives, financial situation and needs. Do further research of your own and/or seek personal financial advice from a licensed adviser before making any financial or investment decisions based on this article. All prices and analysis at 7 December 2021.