A few weeks back, I posed the question: Is it time to take some money off the table, and if so, where? (https://switzerreport.com.au/is-it-time-to-take-some-money-off-the-table-and-if-so-where/ [1] ). In response, several subscribers wrote asking for more information about protection strategies.

Here are six simple ways to protect your share portfolio. They provide a variable level of protection, coming at different costs and ease of execution. At the most basic level, stopping your portfolio from growing by turning off dividend re-investment plans, through to buying put options or by investing in bear market ETFs.

1. Turn off dividend re-investment plans

The easiest strategy to implement, and arguably costless. While it doesn’t provide any real protection, why let your portfolio grow by 4% to 5% each year due to dividend re-investment when it doesn’t need to? Switch off “auto-pilot” investing and build up your cash reserves.

2. Use the bull market to sell your “dogs”

Most of us have a “dog” stock or two in our portfolio. These are the companies that rarely seem to go up, even in a bull market. Characterised by a weak leadership team, peripheral (not market leading) position in their particular industry, incoherent strategy, chequered performance history and often failed acquisitions, these companies just have the odour of being failures. Some were once market darlings, but time and the market moves on.

In a bull market, bids can be found for most assets, but in a bear market, buyers are far, far more selective. So the time to throw out your “dogs” is before the market turns, not after it. And even if you get the timing wrong and the bull market keeps going, the chances are that your dog stocks will not go up that much.

3. Adjust your portfolio and make it more defensive

This is the strategy where we get more deliberative about what we sell. The aim is to make the portfolio a little more defensive with better quality stocks such that if the bear market persists, we will not be hurt as bad. Also, when the bear market comes to an end, our portfolio will recover. Of course, you could sell your whole portfolio – but that’s a big call and could in itself be quite high risk.

In a bull market, pricing multiples (e.g. price/earnings ratios) typically expand and in a bear market, they typically contract. So stocks/sectors that have enjoyed the greatest expansion in the bull market often fare worst in a bear market. Cyclical stocks, those that benefit from an expansion of economic activity, often suffer in a bear market because the market fall foreshadows the onset of a recession or higher interest rates.

Defensive sectors and defensive stocks include consumer staples such as supermarkets, utilities, health care and sometimes real estate investment trusts. Cyclicals include companies involved in building and construction, materials, retail, travel, automotive and consumer discretionary .

High growth companies, particularly technology stocks that are priced on a multiple of revenue rather than a multiple of earnings, are also vulnerable.

Quality companies that have a track record of paying dividends, preferably dividends that have been increasing, will usually be the first companies to rebound when the bear market finishes.

4. Buy ETFs that profit from bear markets

An easy way to get “100%” exposure is to buy exchange traded funds (ETFs) designed to profit from a falling sharemarket. These are actively managed funds that invest in derivatives such as ASX SPI 200 futures contracts, potentially something we could do ourselves if we had the time, financial resources and expertise to do so.

BetaShares has two funds: the BetaShares Australian Equities Bear Hedge Fund (which trades on the ASX under the code BEAR), and the BetaShares Australian Equities Strong Bear Hedge Fund (ASX: BBOZ).

BEAR seeks to generate returns that are negatively correlated to the sharemarket (as measured by the S&P/ASX 200 Accumulation Index). On a given day, the Fund’s exposure should correlate to between 90% and 110% of the sharemarket’s movement. So if the ASX falls by 1% , the value of BEAR units should rise by 0.9% to 1.1%. If the ASX rises by 1%, the value of BEAR units should fall by about 1% (between 0.9% and 1.1%). All monies are invested in cash or as collateral with the ASX for the derivative contracts.

Management costs are 1.38% pa.

BBOZ generates magnified returns from a fall in the share market. It is similar to BEAR in that it is investing in derivatives, but more than doubles the exposure such that a 1% fall in the share market can be expected to deliver a 2.0% to 2.75% increase in the value of the Fund. For example, if you invest $10,000 in BBOZ and the share market falls by 1%, the value of your BBOZ units should increase by between $200 and $275. Conversely, if the market rises by 1%, your investment will decrease in value by between $200 and $275.

Both BEAR and BBOZ can be bought or sold on the ASX.

5. Buy Index Put Options

A little like an insurance policy, you can buy an index put option to provide downside protection. It is over the S&P/ASX 200 index, so it provides broad share market protection.

Index options are traded on the ASX. Like all options, buyers (also called ‘takers’) are under no obligation to exercise the option contract and only do so when it is in their interest to do so. Buyers of put options profit when the market falls below a particular level. Sellers (also called ‘writers’) receive a premium from the buyer.

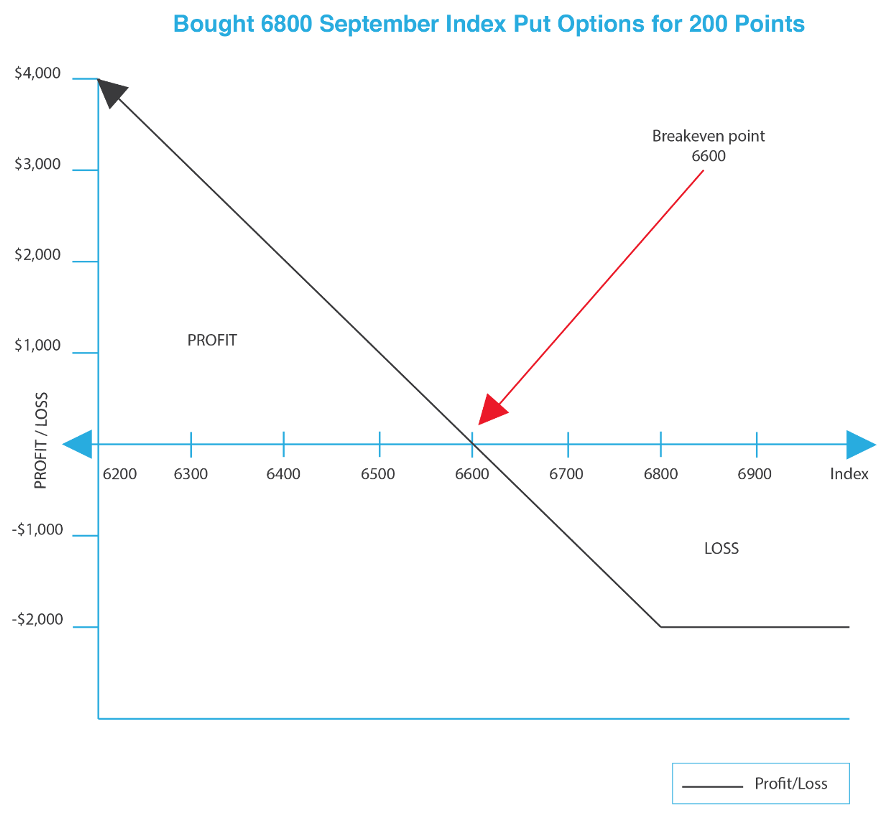

Let’s take an example. Suppose you buy 1 September 6800 Index Put option for 200 points. This means:

- The Put Option expires in September;

- The exercise price is 6800. On the expiry date, this is the level that the S&P/ASX 200 must be below for you to receive a return.

- The cost (or premium) is 200 index points. This is multiplied by $10 (a multiplier set by the ASX) to give a premium value of $2,000.

The profit outcomes are illustrated in the diagram above. If the S&P/ASX 200 index in September is 6800 or higher, the option expires worthless. You have lost your premium ($2,000). If the S&P/ASX 200 Index is less than 6800, then for each index point below, your option is worth $10. If it is 400 points below (i.e. at 6400) it is worth $4,000. If it is 600 points below (i.e. at 6200) it is worth $6,000. Against this, you have paid a premium of 200 points or $2,000, so your net profits are $2,000 and $4,000 respectively. The break-even point is 6600 – the exercise price of 6800 less the premium of 200 index points.

Index options expire on the third Thursday of the calendar quarter (there are also monthly expiries, however the volume is concentrated in the calendar quarter). In our example, the September 6800 Index Put expires on 16 September. They are cash settled based on the opening calculation of the S&P/ASX 200 index on the expiry date. They are European options, meaning that they can only be exercised on the day of settlement. This usually isn’t any real drama because the options are readily tradeable on the ASX and will change hands at a price that exceeds any intrinsic value.

Index options only provide protection up until the expiry date, so if you want to continue that protection, you will need to purchase another option series. The further the option is away from expiry, the higher the premium because you are getting cover for longer. As the option gets closer to expiry, its value will decrease. Another consideration is that the protection is “imprecise” in that you get protection for a drop in the index. Your share portfolio may not always perform like the index – the correlation may not be that strong. And if the exercise price for the put option is a long way out of the money (i.e. much lower than the current market value), the market will need to fall a long way before you get any protection at all.

You can also buy put options over specific shares. These are available on most of the major companies. Similar to index put options, they have expiry dates on the third Thursday of a month, various exercise prices, and are usually for 100 shares (1 option contract is 100 shares). They are American options, meaning that they can be exercised at any time, and are settled by physical delivery of the stock. If you purchased 1 CBA $90.00 September Put Option, you would exercise it by delivering 100 CBA shares. The writer of the option would pay you $90.00 per share.

6. Write call options on stocks in your portfolio

A passive options strategy is to write (or sell) call options over stocks in your portfolio. Also called a ‘covered call’ strategy, this suits long term investors who are comfortable to sell individual portfolio stocks. It is a way of “grossing up” your portfolio, getting a bit of extra income in the form of the options premium.

It is “passive” because as the writer (seller) of the option, you have absolutely no control over whether the option will ever be exercised. This rests solely with the buyer of the option. Further, it may not provide any portfolio protection because the option may never be exercised.

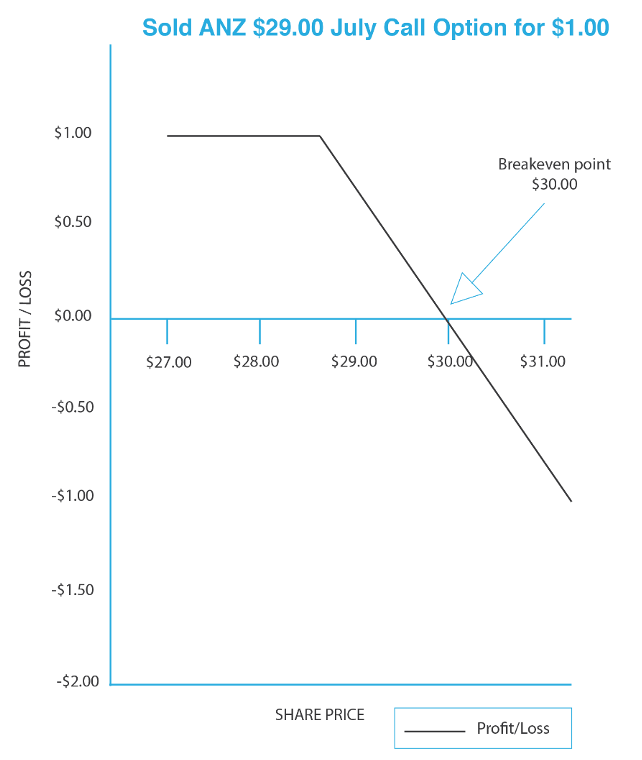

Let’s take an example. Suppose you own 100 ANZ shares which are currently trading at $28.00. You sell 1 ANZ $29.00 Call Option.

This means:

- The Call Option expires in July (on the third Thursday);

- The exercise price is $29.00. If exercised, you will deliver 100 ANZ shares and be paid $29.00 for each share by the buyer of the option;

- The premium you will receive for writing the option is $1.00 per share.

The profit outcomes are illustrated in the diagram above.

As the writer of the option, the most you can make is the premium of $1.00 per share. The break-even point is $30.00 per share. If you are exercised, that is your effective selling price – the $29.00 you receive for the shares plus the $1.00 premium. If ANZ’s share price continues to rise above $30.00, then arguably you have sold shares below the current market value.

And of course, if the option is never exercised, you haven’t sold your shares. You have, however, received additional income of $1.00.

Typically, covered call writers select exercise prices that are “out of the money”, at prices they believe are good long term selling levels, and roll the strategy from one contract to the next, using the option premium to gross up their portfolio.

There is a plethora of strategies that can be employed with options, using both put and call options, to provide protection to big or small movements in the market or to individual stocks. The ASX has a comprehensive set of on-line course that you can access – these are freely available at www.asx.com.au [2]. Contracts for difference (CFDs), futures contracts and other derivatives can also be accessed to protect share portfolios.

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.