I’m always a little apprehensive when asked to write on takeovers. I’m not afraid of nominating takeover targets, but believe investing on the basis of M&A is risky.

Too often, stocks tipped as takeover targets stay that way for years. They are finally acquired after shareholders have suffered years of wealth destruction.

Moreover, takeover pundits often select companies on their knees and seemingly at the mercy of a predator. More often, it’s strong companies with rising share prices that get acquired.

I prefer finding quality companies that are trading below their intrinsic (fair) value and have identifiable re-rating catalysts. Companies that offer value, with or without takeover.

Seldom do I include “takeover appeal” as a re-rating catalyst. It’s hard enough picking companies that will be taken over, let alone getting the timing right. That’s guesswork.

My sense is that takeover premiums in Australia are contracting (I can’t find academic evidence to back that up) and that more “indicative proposals” to acquire a company go nowhere. Nor does there seem to be as many heated takeover battles that drive prices through the roof.

That said, a takeover bid can crystallise years of potential shareholder gains into days or weeks if you get the timing right. Also, thinking about takeover candidates can be useful to refocus on companies left behind or strong companies worth more to a larger rival.

Here is a snapshot of three large-caps and three small-caps that have takeover potential. Some have struggled on the market for years; others have rocketed higher than ever.

LARGE-CAPS

1. Treasury Wine Estates (TWE)

No surprises here. Takeover rumours have swirled around TWE, a former market darling, this year. Speculation has centred on a European beverage giant or a global private-equity group acquiring TWE and restructuring it.

I wrote favourably about TWE for this report in January 2021 at $8.98 a share. TWE rose to $10.93 this month after a trading update. The stock is still a fraction off previous highs thanks to Chinese tariffs on Australian wine exports and general trade tensions.

TWE is modestly undervalued and appeals to long-term investors, regardless of takeover. My sense is it is only a matter of time before another star Australian agricultural company is owned by foreigners.

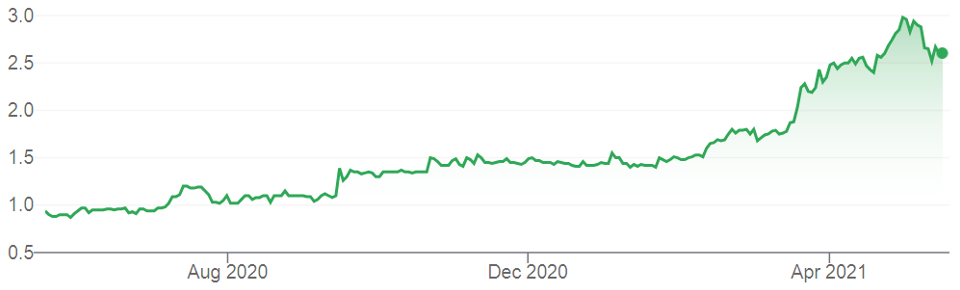

Chart 1: Treasury Wine Estates (TWE)

Source: ASX

2. The a2 Milk Company (A2M)

Confessions first: I got the a2 Milk Company wrong. In March 2021, I wrote favourably on it for the first time, at $8.99 a share. Although it looked cheap, A2M has fallen to $5.12.

It was a reminder of the dangers of buying stocks in rapid descent (“catching a falling knife”, in market parlance). Normally, I combine charting with fundamental analysis to identify when fallen stocks are forming an accumulation (sideways) pattern. Not this time.

A2M’s latest profit downgrade has yet again shaken the market’s faith. Analysts are downgrading expectations of high growth in an A2M infant formula in China, as Chinese-label formulas increase their share. It’s hard to think of an ASX large-cap company with more headwinds.

For all its problems, A2M still has a valuable market position in the booming Chinese market. The company must look attractive at these levels to a global consumer-goods giant. But the risk is buying A2M at $5 and watching it tumble to previous support around $4.

Better to stand aside for now during this market pullback and wait for the selling to exhaust itself and a share-price base to form. A takeover predator could pounce on A2M but I wouldn’t buy it on that basis alone.

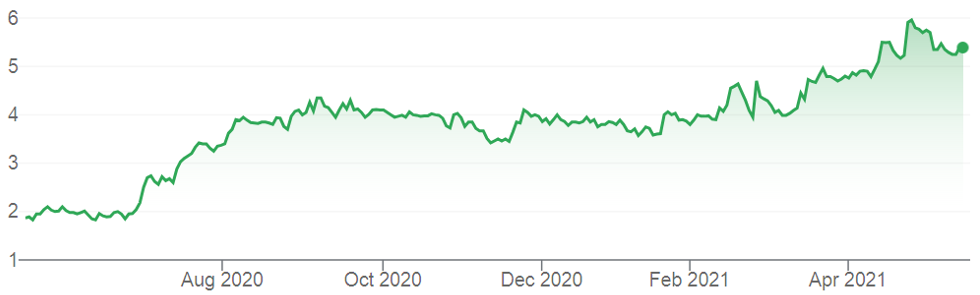

Chart 2: a2 Milk (A2M)

Source: ASX

3. Challenger (CGF)

The wealth manager has disappointed this year. At the end of last year, I expected Challenger to be among the market’s best-performing large-caps by the end of 2021. But it has fallen from $5.95 (when I wrote about it in December) to $4.90 after a poor trading update.

The market hated Challenger’s guidance downgrade, but it was probably more due to timing issues than structural flaws in its business model. A sharp decline in credit spreads over the year affected Challenger’s margins and earnings.

For all the recent weakness, Challenger still has an excellent position in the growth market: providing annuity investment products for retirees. Last year’s Retirement Income Review reinforced the need for retirees to have greater income certainty in retirement and better confidence to draw down on their capital. That has to mean higher use of annuities.

Challenger has had a rough few years. The stock was hammered by the market effects of COVID-19 and the associated disruption to financial-adviser distribution of annuity products, and low interest rates. Its three-year annualised total return is minus 25%.

I still regard Challenger as a strong company with a strong position in an attractive long-term growth market, as the population ages. If the market can’t see latent value in Challenger, a larger Australian or global financial-services firm surely will if its price keeps falling.

Chart 3: Challenger (CGF)

Source: ASX

SMALL-CAPS and MICRO-CAPS

4. Lark Distilling Co (LRK)

Readers will recall I wrote several favourable columns on alcohol-related stocks earlier this year [1]. Micro-caps such as Lark, Digital Wine Ventures (DW8) and Australian Vintage (AVG) were identified. Lark is up 185% over one year; DW8 soared from 4 cents in February 2021 to 20 cents (and is now 10 cents) and AVG has a total return of 76% over one year.

I also outlined a favourable view on hotel-property owners and operators, such as Hotel Property Investments, ALE Property Group and Redcape Hotel Group (RDC).

Lark, a premium whiskey maker, looks the likeliest takeover target among the micro-cap alcohol stocks. Global alcohol companies continue to pounce on boutique spirit and craft-beer producers with premium brands and products. Lark makes a cracking whiskey.

A larger pullback or consolidation in its share price is likely after the magnitude of gains in the past few months. That could be a trigger for a global alcohol company to snap up Lark and more aggressively market one of Tasmania’s great attractions – its whiskies – to a global market.

Australian Vintage also looks attractively priced as it moves its strategy further away from lower-margin bulk wines to more premium products.

Chart 4: Lark (LRK)

Source: ASX

5. Life360 Inc (360)

I wrote positively about the San Francisco-based company for this Report in July 2020 at $2.01 a share. Life360 has soared to $5.25, having reached $6.20 last month.

The company’s flagship product is the Life360 App that shows the location of family members via connected smartphones and has extra paid features such as safety and roadside-help alerts. I saw Life360 as a play on parents wanting more safety information on their kids during COVID-19.

Valued at $793 million, Life360 looks pricey for a company still making losses. But it now has more than 28 million monthly active users in 195 countries and 916,000 “paying circles” (paid memberships). The company also has unique, proprietary technology.

I believe Life360 would be worth a lot more in the hands of a global tech giant as a bolt-on acquisition. Then, boost investment in Life360 so it can expand faster into adjacent opportunities, such as home security, seniors monitoring (at-home care), home and life insurance, roadside assistance and insurance, and pet tracking.

Don’t fall for the trap that all takeover targets are companies with fallen share prices and vulnerable to predators. Life360 could attract suitors because it has technology that can scale in a range of directions and global markets, assuming it finds a partner with deep pockets.

Chart 5: Life360 (360)

Source: ASX

6. Monash IVF Group (MVF)

Monash was majority owned by private equity before its IPO on ASX in June 2104. And that is where its ownership will probably end up again if the company cannot get its share price firing.

I wrote positively about Monash for this report last month at 87 cents a share. It is now 84 cents and looks to be consolidating its share-price rally in late March.

Monash and its nearest listed company, Virtus Health, are a play on recovering demand for in-vitro fertilisation (IVF) services after COVID-19.

Monash’s latest half-year result impressed and it said the “current new patient pipeline indicates strong growth and above historical industry averages in second-half FY21”.

I wrote in that column: “Don’t be surprised if Monash attracts an offer from a private-equity group or larger IVF firm. I suspect Monash would perform better under private rather than public ownership. Private-equity firms are reportedly looking at acquiring IVF providers in NZ and other markets, suggesting another round of industry consolidation is underway.”

Nothing has changed in that view. I’ve long thought IVF is an industry that suits private rather than public ownership. For all the recent share-price volatility, IVF has solid long-term growth prospects as more women delay childbirth in developed and emerging countries.

I wouldn’t be surprised if Monash ends up in private-equity ownership again, or as part of a larger global IVF firm. For all its recent problems, Monash has excellent technology, a strong position in the Australian market, and appears to be improving operationally.

Chart 6: Monash IVF

Source: ASX

Tony Featherstone is a former managing editor of BRW, Shares and Personal Investor magazines. The information in this article should not be considered personal advice. It has been prepared without considering your objectives, financial situation or needs. Before acting on information in this article consider its appropriateness and accuracy, regarding your objectives, financial situation and needs. Do further research of your own and/or seek personal financial advice from a licensed adviser before making any financial or investment decisions based on this article. All prices and analysis at 19 May 2021.