Peter, what do you think of Xero, Afterpay, Zip and Tyro?

“I like Xero and Afterpay (but Afterpay is too expensive right now). I like Zip, not because my old mate Joe Hockey now has a contract to represent them in America, but because it’s a good company heading in the right direction.

“If we can call Tyro a tech company, I like that too. And that’s why I have them in my ZEET (Zip, Elmo, EML and Tyro) collection, with Zip at one end and Tyro at the other. Both those companies should do well over the next three years.

“Xero’s a safer play and I’ll try to make money out of it.

“Tyro is going to make money for me. Zip’s good but there could be challenges with new players. We saw PayPal coming out and knocking Afterpay around for a little while.

“With Afterpay, there are still people talking about regulation. Maybe their big lift has already happened. Tyro’s next big lift will happen when the whole economy is up and running again. Then I’ll be interested to see where it heads,” said Peter.

Jun agrees with Peter and likes these four stocks.

“Afterpay is phenomenal and I like Zip as well. Like Peter said, that sector has done so well,” she said.

What would you choose, Jun Bei: Zip or Afterpay?

“Afterpay is a quality company and there’s enough support in there. You just constantly see buying whenever it dips. Zip is smaller and it’s going to take longer to get to that kind of scale. I probably prefer Afterpay at this point,” Jun Bei said.

Zip Co (Z1P)

Afterpay (APT)

What about Tyro?

“Tyro is amazing. Peter’s right. Over the next six months, Tyro will probably be the biggest performer,” she said.

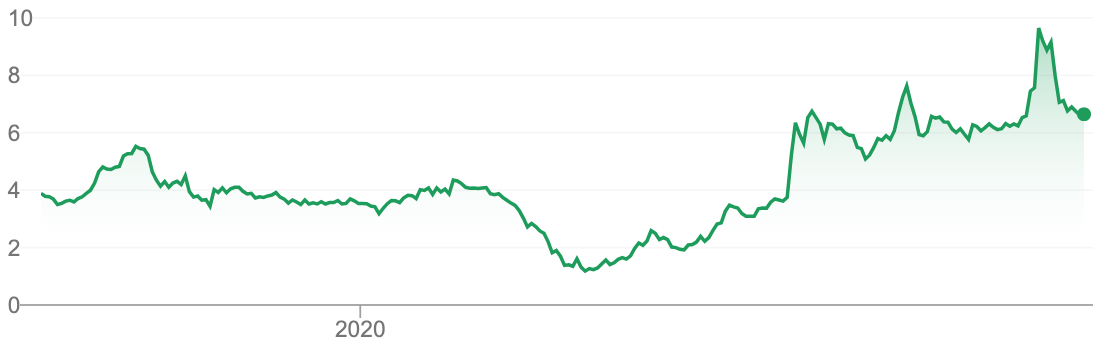

Tyro (TYR)

And Xero?

“With Xero, take a three-year view. It’s perfect. Just buy it and don’t worry about it. This company will go places and will dominate. They’re already showing great numbers in the UK. And the US is still quite small at the moment but they’ll deliver those numbers. Xero is absolutely there,” she added.

Xero (XRO)

Are there any other tech stocks you like, Jun Bei?

“Another one I’d like to mention is Megaport. It’s expensive but it’s one of the very few companies that offer you growth exposure in the cloud space.

Megaport (MP1)

“In a sell off, it’s a great opportunity to buy some of the names I’ve mentioned above. They may have a few down days when tech companies get sold off, but in three years, they’ll be a whole lot bigger than today. As long as the key metrics are ticking higher, these stocks will continue to perform,” she concluded.

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.