Being based in Melbourne, Victoria’s latest lockdown extension has me thinking about companies that will get a lasting boost from COVID-19, rather than a temporary sales jump due to changing consumption patterns during the pandemic.

For investors, a big challenge of COVID-19 is identifying the difference between structural and cyclical gains from the pandemic. Several retailers benefited during COVID-19 from a boom in online sales and government handouts. Much of those gains will be short-lived.

Other companies will have tailwinds for years. For some, COVID-19 was an opportunity to capture a large number of new customers online and swell their database. For others, the pandemic has reinforced the strength of their business model in a post-COVID-19 world.

I’ve searched the Australian share market for companies that will structurally benefit in the medium term (1-3 years) from the effects of COVID-19 – and still offer value. They are not easy to find; obvious beneficiaries of the pandemic are mostly fully valued.

Here are 5 stocks that make the grade. As smaller companies, each suits experienced investors who can tolerate higher share-price volatility.

1. Booktopia Group (BKG)

The Australian-owned online book retailer listed on ASX in December 2020 after seeking $43 million at $2.30 a share in an Initial Public Offering. The float was a long time coming: Booktopia struggled for years to raise significant capital, amid concerns it would be crushed by Amazon.

After peaking at $3.06, Booktopia has eased to $2.57. In February, the company upgraded its forecast for underlying earnings (EBITDA) in FY21 to $12.9 million from $9.4 million in the prospectus. Upgrading forecasts within six months of listing is a good sign.

The well-run Booktopia is growing quickly in a growth industry (online book retailing). Yes, Amazon is an incredible competitor, but there’s enough growth in online book retailing to sustain a small independent company like Booktopia.

I like the outlook for online book sales and have been impressed by Booktopia’s listing so far. I’ll write more on the stock in coming weeks, but the increase in online book sales (in fictional and academic publishing, for example) looks more permanent than temporary.

Chart 1: Booktopia

Source: ASX

2. Collins Food (CKF)

Readers will recall I have written several favourable columns on Collins Food and Domino’s Pizza Enterprises in 2020 and 2021. Both stocks have starred in the past 12 months.

Collins Food, owner of KFC stores, has broken through price resistance on its chart and appears to be forming the next leg of its rally (based on technical analysis).

vOne of Collins’ main attractions is its large network of drive-thru stores, which are so valuable during a pandemic and afterwards as more consumers buy food on-the-go rather than in-store.

High downloads of KFC’s app during the pandemic – and the marketing opportunities that creates – suggest KFC can find new markets in online ordering and home delivery.

Chart 2: Collins Food

Source: ASX

3. Kogan.com (KGN)

Investors could not get enough of the online retailer during the peak of the pandemic last year. Kogan.com shares soared to a 52-week high of $25.57, but now trade at $10.20.

Kogan.com spooked the market when it provided adjusted earnings (EBITDA) guidance well below market expectation. Too much stock led to elevated warehousing costs and the company had to increase its promotions, affecting profit margins.

For all the share-price volatility, Kogan.com has made strong operational gains during COVID-19. Imagine how many Australians used the company for the first time when shops first shut during COVID-19 and how many will keep using the retailer when the pandemic ends.

It wouldn’t surprise if Kogan.com tested its 52-week low of $8.70, such is the downward momentum in its share price. Long-term investors might take advantage of current price weakness in the stock, provided they can tolerate short-term price volatility. Active investors should wait for it to form a base (sideways accumulation pattern) before diving in.

It might take 6-12 months for Kogan.com to normalise its inventory levels and profit margins, but the stock looks slightly undervalued after recent falls. Morningstar values it at $11.50.

Chart 3: Kogan.com

Source: ASX

4. Janison Education Group (JAN)

Online education and training is another permanent winner from COVID-19. More students and employees learning and being assessed online rather than in classrooms is a no-brainer.

I have written extensively on online education and e-learning stocks for this report. I first covered Janison Education Group in August 2019 (“2 potential winners from coming EdTech revolution [1]”) at 28 cents a share. Janison has soared to 89 cents.

The other company featured in that column, ReadyTech Holdings, has risen from $1.70 in August 2019 to $2.08.

To recap, Janison provides digital learning and assessment solutions – a fast-growing market as more education is provided online.

The Janison Learning division sells customised online learning platforms for companies and helps them manage compliance obligations around training. The Janison Insights business helps organisations centralise, streamline and digitise assessments. Some of Australia’s largest State government departments and companies use Janison products.

Janison’s latest investor presentation (May 2021) is worth reading. The company now delivers more than 10 million exams annually in over 110 countries. It’s an attractive, highly scalable business model with recurring income from the global educational sector.

Growth in digital assessments goes hand-in-hand with growth in online learning. Janison is the OECD’s global partner for the PISA for Schools assessment internationally. By April, more than 200 Australian schools had signed up to sit the assessment over 12 months.

Share-price growth might be slower from here as Janison consolidates recent gains. However, its operational performance has impressed this year, judging by the momentum in its OECD partnership and growth in schools signing up to its online assessment products for high-stakes, high-volume exams – a growth market if ever there is one.

Chart 4: Janison Education Group

Source: ASX

5. Doctor Care Anywhere Group Plc (DOC)

Telehealth should be one of the great long-term beneficiaries of COVID-19 as more people have online medical appointments this decade.

Doctor Care focuses on the UK private healthcare market, which its prospectus noted will be worth US$14.9 billion in 2024, from US$5.3 billion in 2019.

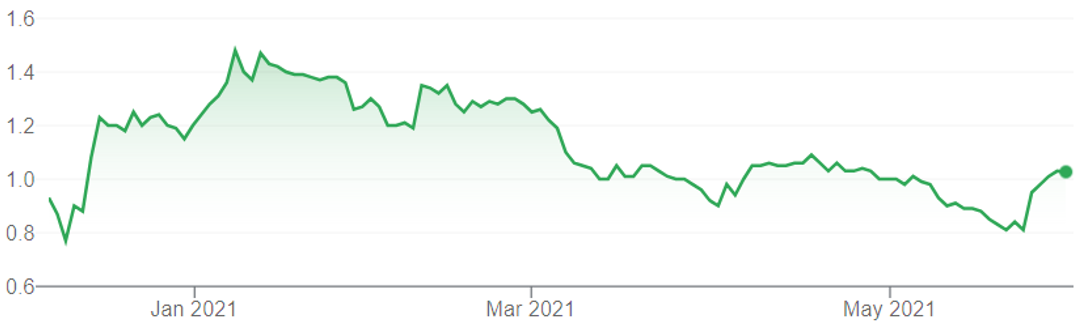

Doctor Care sought $102 million at 80 cents per CHESS Depositary Interest (CDI) in an IPO on ASX in December 2020. After racing to $1.52 within two months of listing, the shares are 99 cents.

The company sources patients through a business-to-consumer channel. Doctor Care services more than 1,500 corporate and small-enterprise clients through its relationship with AXA PPP Healthcare Group and HCA Healthcare UK.

In May, Doctor Care announced an agreement with Nuffield Health, one of the UK’s largest private healthcare organisations, to develop a digitally integrated virtual and in-person primary care service. Its shares rose briefly on the news.

I expect more private health funds to offer online medical services to their business clients. Doctor Care notes in its latest announcement that “70% of all primary care consultations can be conducted virtually”. I doubt we’ll ever get there, but sustained growth (albeit a much slower rates) in online appointments with medical practitioners after COVID-19 is inevitable.

Chart 5: Doctor Care Anywhere

Source: ASX

Tony Featherstone is a former managing editor of BRW, Shares and Personal Investor magazines. The information in this article should not be considered personal advice. It has been prepared without considering your objectives, financial situation or needs. Before acting on information in this article consider its appropriateness and accuracy, regarding your objectives, financial situation and needs. Do further research of your own and/or seek personal financial advice from a licensed adviser before making any financial or investment decisions based on this article. All prices and analysis at 3 June 2021.