I received this request the other week. I have had many like it.

“Many of us are looking for advice on which stocks to buy that will produce an income over 3% and be fully franked. Apart from the banks and Telstra, which everyone holds, we are looking for ideas to produce income with very little risk but with full franking”.

Of course, there are almost no investments with “very little risk”. I would only classify government bonds and bank term deposits in this category, certainly not any stocks. But I understand the intent of the question, lower risk stocks where the downside risk is not as high.

Using the following criteria, I have come up with 5 candidate stocks:

- No banks or Telstra;

- No resource companies (because they are ‘price-takers’ and have almost no influence over the revenue they earn);

- ASX top 150;

- Reasonably defensive (as demonstrated by a low beta and qualitative assessment);

- Expectation that earnings and dividends should continue to grow;

- Forecast dividend yield higher than 3.0%;

- Preference for franking; and

- Variety of industry sectors to support diversification objectives.

Here are the five (in alphabetical order).

1. Amcor (AMC)

Sector: Materials

Last price: $15.39

Broker Target Price: $17.15

FY21 Forecast Dividends 63.2c FY21 Forecast Yield: 4.1%, unfranked

FY22 Forecast Dividends 66.0c FY22 Forecast Yield: 4.3%, unfranked

Beta: 1.11

Leading packaging manufacturer Amcor might sound like a strange choice for an income stock, particularly with a 5 year historical beta of 1.11, but since acquiring the US based Bemis Company in 2019, earnings reliability has increased and the stock has been less volatile.

Amcor provides packaging solutions (flexible packaging and rigid plastics) for the global food, beverage and pharmaceutical sectors which are in themselves quite defensive sectors. It operates in more than 40 countries, with 230 manufacturing sites, 47,000 employees and sales over US$12.5bn .

Its primary listing is on the New York Stock Exchange, and as such, reports quarterly and pays dividends quarterly. The analysts forecast these to total AUD 63.2c in FY21 and 66.0c for FY22, putting it on a yield of 4.1% for FY21 and 4.3% for FY22. With the vast bulk of earnings being derived in the USA and Europe, the dividend is unfranked.

Amcor promotes that it has maintained an investment grade credit rating for more than 20 years, and over the last decade, has delivered EBITDA growth at a compound annual growth rate of 6%, earnings per share (EPS) growth of 8% pa, paid an average dividend of 4.6% and delivered total shareholder returns of 15% pa. For FY21, the company has forecast EPS growth of between 14% and 15%.

At $15.39, Amcor is trading on the relatively undemanding multiple of 15.7 times forecast FY21 earnings and 14.6 times FY22 earnings. The dividend payout ratio looks sustainable at 64%.

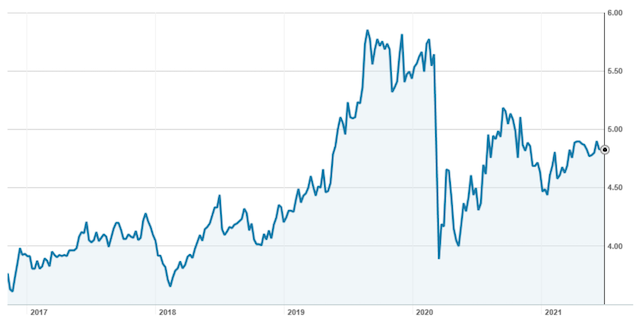

Amcor (AMC) – 7/16 – 7/21

Source: nabtrade

Risks include currency (if the AUD appreciates, Amcor’s earnings will be impacted), and environmental with the headwind of sustainable, less voluminous packaging. Amcor says that it is investing in what it calls “responsible packaging”, and is committed to making all its packaging recyclable or reusable by 2025.

2. Charter Hall Long WALE REIT (CLW)

Sector: Real Estate

Last price: $4.80

Broker Target Price: $5.17

FY21 Forecast Dividends 29.2c FY21 Forecast Yield: 6.1%, unfranked

FY22 Forecast Dividends 30.9c FY22 Forecast Yield: 6.4%, unfranked

Beta: 0.83

Charter Hall Long WALE REIT is a $5.5bn property trust that owns a portfolio of high quality real estate assets with a long WALE (weighted average lease expiry). The WALE is currently 13.2 years.

There are 467 assets across industrial and logistics, retail, office, telco exchanges and agri-logistics. By value, approximately 23% is in industrial, 32% in retail (BP service stations, pubs and bottle shops, David Jones), 25% in office and the balance of 20% in telco exchanges and agri-logistics. The portfolio occupancy is 97.8%.

Portfolio credit quality is high with 61% of tenants (by income) independently rated ‘investment grade’. Of the balance, this includes names such as Brisbane City Council, Myer, Endeavour Group, Metcash, David Jones and Arnott’s.

In CY20, CLW delivered operating earnings of $125.8m or 28.5c per unit. It has a policy to payout 100% of operating earnings (net property income less operating expenses and finance costs), and paid out 28.5c per unit in distributions (14.0c for 2H20 and 14.5c for 1H21).

For FY21, it has guided to operating EPS of no less than 29.2 cents per unit, and for FY22, growth of no less than 4.5% (at least 30.5c per unit). This puts CLW on a yield of 6.1% (unfranked), and for FY22, a yield of at least 6.3% (unfranked).

The brokers remain favourably disposed. According to FNArena, of the 5 major brokers that cover the stock, there are 3 buy recommendations and 2 neutral recommendations. The consensus target price is $5.17 (range $4.94 to $5.35), a 7.6% premium to the last ASX price of $4.80. The last reported NTA (net tangible asset value) is $4.65 as at 31 December, but according to a portfolio valuation update of 7 June, this has increased to $5.24 per unit.

Charter Hall Long WALE REIT (CLW) – 11/16 – 7/21

Gearing (on a look through basis) has increased to 39.9%, and while the fund has no debt facilities maturing in the next two years, if bond yields increase, this could put pressure on the unit price.

3. Coles (COL)

Sector: Consumer Staples

Last price: $16.72

Broker Target Price: $17.69

FY21 Forecast Distribution 60.0c FY21 Forecast Yield: 3.6%, 100% franked

FY22 Forecast Distribution 59.6c FY22 Forecast Yield: 3.6%, 100% franked

Beta: 0.72

Experience says that eight out of ten times, you are better off sticking with the “market leader” rather than the “number two”. But Coles (COL) has pulled back over the last few months as Woolworths (WOW) has rallied into its demerger with Endeavour Drinks (EDV), so there is more to like about Coles now.

Coles (COL) -11/18 – 7/21

Whether a discount on forward price multiples of almost 20% is sufficient (Coles is trading at a multiple of 22.7 times forecast FY22 earnings, Woolworths at 27.8 times forecast FY22 earnings) only time will tell, but for income seekers, Coles is pretty “rock solid” when it comes to the dividend. With most brokers forecasting total dividends of 60c in FY21 and FY22, this puts Coles on a prospective dividend yield of 3.6% (fully franked).

While the payout ratio is high at 80% and capital expenditure needs are increasing as Coles invests in new distribution centres, technology and store refurbishments, the market believes Coles has the cash flow and balance sheet to support this. Sales are normalising as the impacts of Covid lessen, and the downward competitive pressure on prices and margins has eased.

Coles is a classic “income stock” – with predictable top line and bottom line numbers, low beta (market volatility), and for the shareholder, reliable and consistent dividends. Further, if Management can execute well, it has the opportunity to close the gap on the market leader.

4. JB Hi-Fi (JBH)

Sector: Consumer Discretionary

Last price: $50.33

Broker Target Price: $51.90

FY21 Forecast Distribution 264.4c FY21 Forecast Yield: 5.3%, 100% franked

FY22 Forecast Distribution 204.4c FY22 Forecast Yield: 4.1%, 100% franked

Beta: 0.87

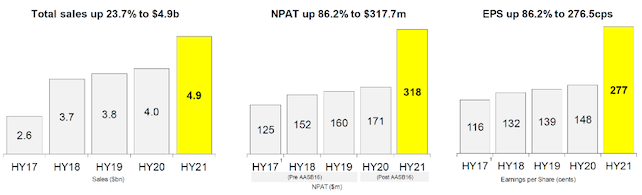

Unquestionably Australia’s best retailer, JB Hi-Fi is one of my favourite stocks. It has delivered in spades for shareholders, with year on year increases in sales, profit and earnings per share. This chart from their February half year report (the half year was buoyed by the impact of Covid and increased consumer spending) says it all.

Dividends have increased from $0.89 for FY15, $0.99 for FY16, $1.18 for FY17, $1.32 for FY18, $1.42 for FY19 and $1.89 for FY20. For the first half of FY21, JB Hi-Fi paid an interim dividend of $1.80, up 82% on the dividend paid for the first half of FY20.

With consumer spending returning to normal, the brokers expect the full year FY21 dividend to total 264.4c before easing in FY22 to 204.4c per share. This puts JB Hi-Fi on a prospective yield of 4.1% for FY22 (fully franked).

JB Hi-Fi (JBH) – 7/16 to 7/21

Source: nabtrade

My main concern about JB Hi-Fi has been its soaring share price. While in calendar 2021 it has traded either side of $50, it has put on around 25% since Covid hit. But even at its current price of $50.53, the multiples are not demanding. The brokers have JB Hi-Fi trading on a multiple of 12.5 times forecast FY21 earnings and 16.4 times FY22 earnings.

CEO transition is another watch point, with Richard Murray set to leave at the end of August and pass the reigns to Terry Smart. The latter was previously CEO of JB Hi-Fi from 2010 to 2014, returning to the Group in 2017 as the Managing Director of The Good Guys.

5. Medibank Private (MPL)

Sector: Financials

Last price: $3.15

Broker Target Price: $3.13

FY21 Forecast Distribution 12.1c FY21 Forecast Yield: 3.8%, 100% franked

FY22 Forecast Distribution 12.3c FY22 Forecast Yield: 3.9%, 100% franked

Beta: 0.69

Despite the challenges facing private health insurance, in particular participation and affordability, I like Medibank Private because over the last few years, it has increased its number of policyholders and its market share. When you are the clear market leader in a highly regulated market, this is hard – so this tells me that the team at Medibank is executing well. Further, it is advancing a number of initiatives such as in-home care, health and wellbeing services, and telehealth ancillary services to create a competitive advantage in health insurance.

David Koczkar has recently stepped up as CEO, taking over from the highly respected Craig Drummond.

In the 10 months to end of April, Medibank grew the number of policyholders by 3.9% or 70,200. This included growth in both brands – the premium ‘Medibank’ brand and the youth oriented ‘ahm’ brand.

For the full year, Medibank has guided to policyholder growth of between 3.5% and 4.0%, a 2.5% increase in average claims expense per policy unit, management expenses of $530m and a productivity target of $20m.

Medibank says that the dividend payout ratio is expected to be at the top end of their target range of 75% to 85%. This has the brokers forecasting a total dividend of 12.1c for FY21, rising to 12.3c per share for FY22. At $3.15, a yield of 3.8% to 3.9%, fully franked.

Medibank Private (MPL) – 7/16 – 7/21

Source: nabtrade

The brokers feel that Medibank is fully valued, with a consensus target price of $3.13. According to FNArena, there are 3 ‘buy’ recommendations and 4 ‘neutral’ recommendations, with the range of target prices from a low of $2.80 to a high of $3.25.

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.