My idea of an ‘income” stock is that it should be relatively defensive (hold its value in a “down” market), pay a reasonable dividend and have growing earnings. While It is unlikely that the growth will be high, importantly, it won’t be going backwards. Also, it won’t be particularly vulnerable to exogenous shocks or things it can’t control. The latter eliminates most resource companies.

Leaving the major banks to one side, here are five stocks to consider for 2024. They are from five different sectors which provides support to diversification objectives.

.

1. Telstra (TLS)

Telstra need no introduction. It had an interesting 2023, proving to be remarkably resilient in the earlier part of the year, before coming off when it “disappointed” the market when it announced that it would keep its infrastructure company (InfaCo) rather than spin it out. Clearly, the market liked the “sum of the pieces” story more than the “whole”.

More recently, concerns about increasing capex have weighed on the stock. It is also seen in the “defensive” category, so when growth becomes fashionable, it tends to be left behind (or sold to make way for growth stocks).

Telstra – last 12 months

Source: nabtrade

That all said, there are several things to like about Telstra. Most importantly, earnings are on the rise as a result of some tough work on costs, competitive pressures easing in the mobiles market and improved execution by the Telstra management team. Optus’s problems should also help Telstra in the medium term.

At $3.92 and on a forecast dividend of 17.5c for FY24, Telstra is yielding a prospective 4.5% (fully franked).

The major brokers are moderately bullish on Telstra, with a consensus target price of $4.37, about 11.5% higher than the last ASX price. The range is a low of $4.00 through to a high of $4.75. According to FN Arena, there are 4 ‘buy’ recommendations and 2 ‘neutral’ recommendations.

2. Ampol (ALD)

Ampol is Australia and New Zealand’s leading transport fuel and convenience retailer. It operates the Lytton fuel refinery in Brisbane (which is eligible for the Federal Government’s fuel security services program), 6 pipelines and 24 terminals. In retail, it has more than 1,800 sites in Australia (company owned, leased, dealer owned) mainly under the ‘Ampol’ brand, and a further 500 sites in New Zealand under the ‘Z Energy’ and ‘Caltex’ brands.

Ampol shares have climbed steadily in 2023 and the major brokers (according to FN Arena) now see the company as fully priced. There is one ‘buy’ recommendation and 3 ‘neutral’ recommendations, with a consensus target price of $35.60, about 0.1% higher than the last ASX price of $35.54.

Ampol (ALD) -last 12 months

Source: nabtrade

For the FY23 year (which ends on 31 December), the brokers forecast a total dividend of 238c per share (following an interim dividend of 95c), implying a current yield of 6.7% (fully franked). Earnings and dividend are expected to decline in FY24 (due to lower oil prices and refinery margin), with a resultant dividend of 212c per share and a prospective PE multiple of 12.7 times. The prospective yield for FY24 is 6.0%, which should be fully franked.

While Ampol is still somewhat exposed to the global oil market, in particular refinery margins, it is in an overall sense less vulnerable than it used to be due to steps taken to expand its convenience retail business and potential payments by the Government to secure the refining business. It is well capitalised, and the prospect of a potential capital return (or special dividend) and ongoing high dividend payments should provide support to the share price.

3. APA Group (APA)

Utility APA is an energy infrastructure business that owns a $22 billion portfolio of gas, electricity, solar and wind assets. Formerly known as the Australian Pipeline Authority, most of its revenue (and earnings) comes from the network of gas pipelines that it owns and manages. It is also involved in power generation (gas and renewables) and electricity transmission. Strategically, it has been diversifying away from gas into renewables.

It recently acquired for $1.7bn the Alinta Energy portfolio of power assets in the Pilbara that supplies power to the major iron ore mines. In addition to debt funding, it raised capital at $8.50 per share to complete the transaction.

APA Group (APA) – last 12 months

Source: nabtrade

APA has guided to a distribution of 56c per unit in FY24 (up 1c on FY23), putting it on a yield of 6.3% (unfranked). For FY25, the brokers expect a marginal increase to 57c per unit.

The brokers are neutral on the stock. According to FN Areana, there is 1 ‘buy’ recommendation and 3 ‘neutral’ recommendations. The consensus target price is $9.10, about 2.7% higher than the last ASX price of $8.86.

4. Medibank Private (MPL)

Leading health insurance provider Medibank Private (MPL) has recovered remarkably from its “near death” cybercrime and data incident in October 2022 with the share price rising back to pre-incident levels. This is part due to ongoing policyholder growth, productivity savings and low claims inflation.

MediBank Private (MPL) – last 12 months

Source: nabtrade

At the Company’s AGM in November, it reconfirmed guidance for the full year relating to policy holder growth, productivity savings, claims inflation and cybercrimes costs.

In FY23, Medibank paid a dividend of 14.6c per share (fully franked). For FY24, the brokers forecast a dividend of 15.9c per share, putting the company on a prospective yield of 4.4% (fully franked). For FY25, the brokers forecast 17.0c per share.

At $3.58, the major brokers feel that the company is close to fully priced. The consensus target price is $3.78, 5.6% higher than the last ASX price. Targets are in a relatively tight range, from a low of $3.50 through to a high of $4.30. There is 1 ‘buy’ recommendation and 5 ‘neutral’ recommendations (no ‘sell’ recommendations).

5. JB Hi-Fi (JBH)

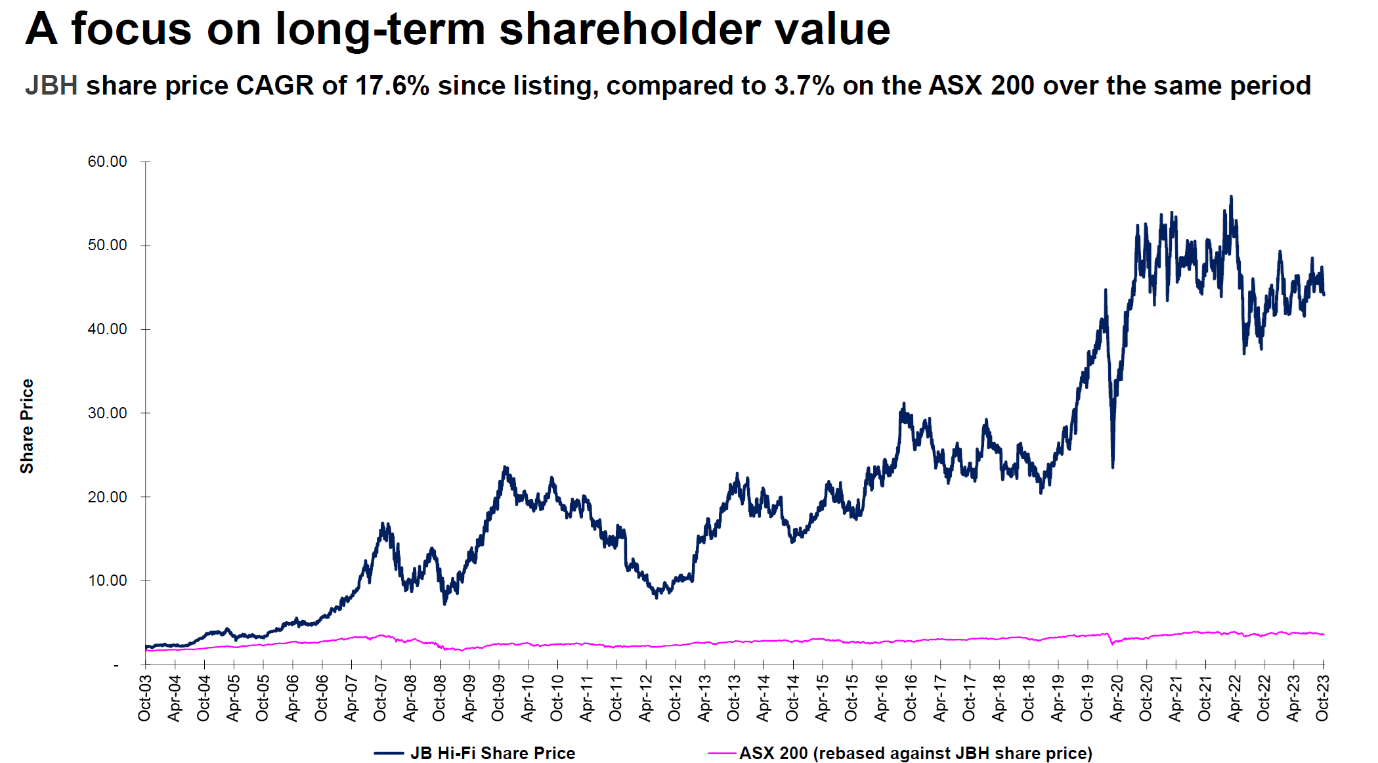

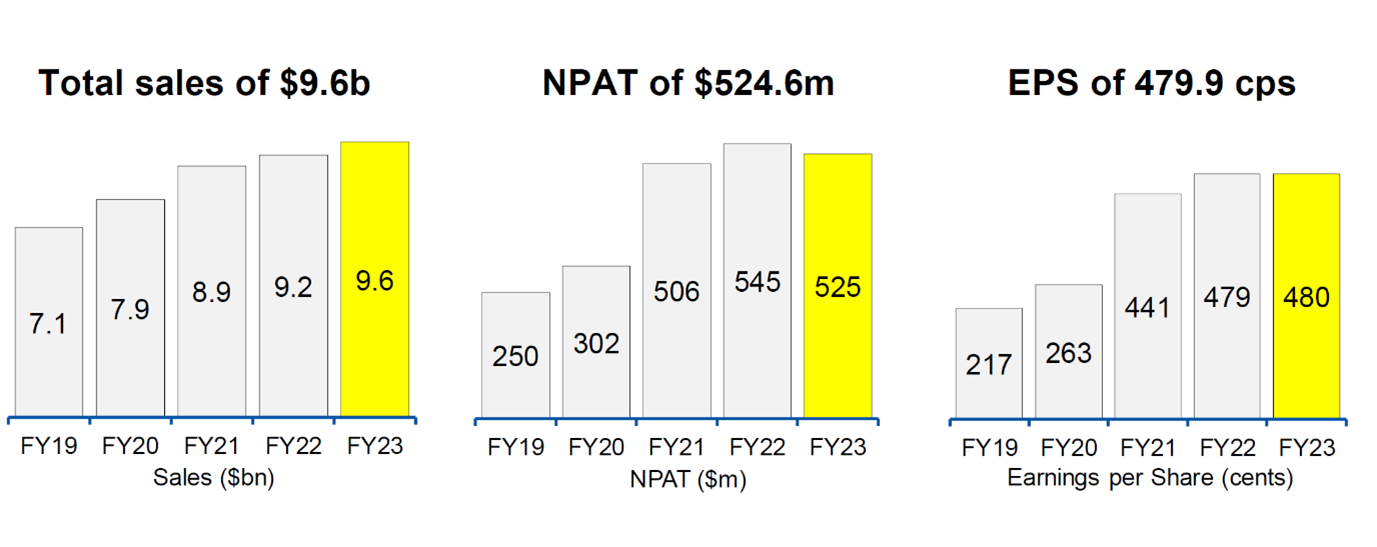

Electronics and furniture retailer JB Hi-Fi (JBH) is one of my favourite stocks. The charts below show why.

The analysts have been quite bearish on JB Hi-Fi (and other discretionary retailers) expecting higher interest rates to impact consumer spending and hurt sales. However, JB Hi-Fi has defied expectations and in 2023, the shares have rallied quite strongly. Accordingly, the major brokers now feel that it is very expensive – currently trading at $50.90, at 14.0% premium to the consensus broker valuation of $44.65.

JB Hi-Fi (JBH) – last 12 months

Source: nabtrade

Following the very recent fall in bond yields, it is quite likely that the analysts will re-rate JB Hi-Fi. However, with 3 ‘neutral’ recommendations and 3 ‘sell’ recommendations, it is still likely to be viewed as expensive. For FY24, the brokers have JB Hi-Fi paying a dividend of 217c per share, down from the 312c paid for FY23. This looks a little low to me, but if the brokers are right, this puts the stock on a prospective yield of 4.3% (fully franked).

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.