My idea of an ‘income” stock is that it should be relatively defensive (hold its value in a “down” market), pay a reasonable dividend and have growing earnings. While it is unlikely that the growth will be high, importantly, it won’t go backwards in a big way. Also, it won’t be particularly vulnerable to exogenous shocks or things it can’t control. The latter eliminates most resource companies.

Leaving the major banks to one side, I nominated last December five stocks to consider for 2023. They are from five different sectors which provides support to diversification objectives.

Firstly, how are they doing?

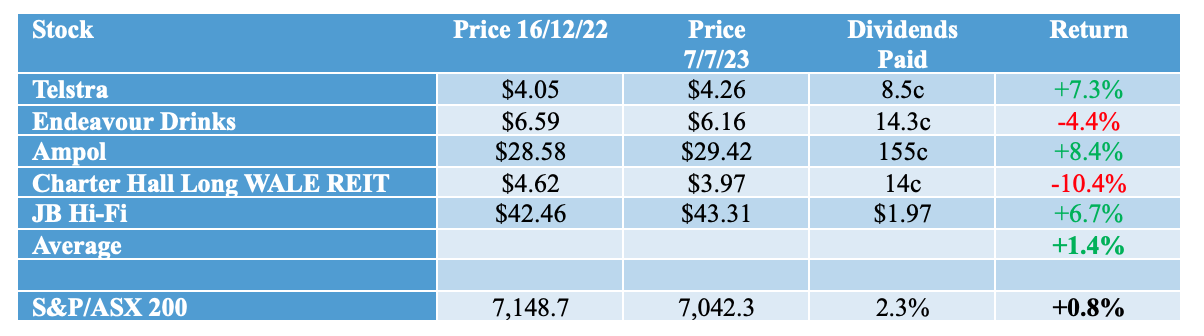

The table below shows the five stocks, the movement in price over the period, the dividends paid and all up return.

As shown above, three have gone up, two are down, and in aggregate, the average return of 1.4% for the period is higher than the overall market of 0.8%, as measured by the S&P/ASX 200 accumulation index. Four out of five are fully franked, and the overall income of almost 3.5% is better than the market’s 2.3%. So far, the performance is solid.

One point of concern is that I had hoped for more capital stability, so the performance of the Charter Hall Long WAQLE REIT is disappointing. Where to from here?

Here is an update on the five stocks (including what the brokers think).

- Telstra (TLS)

Telstra need no introduction. It has proved to be a remarkably resilient stock in 2022/23, largely trading in a very tight range between $3.90 and $4.35.

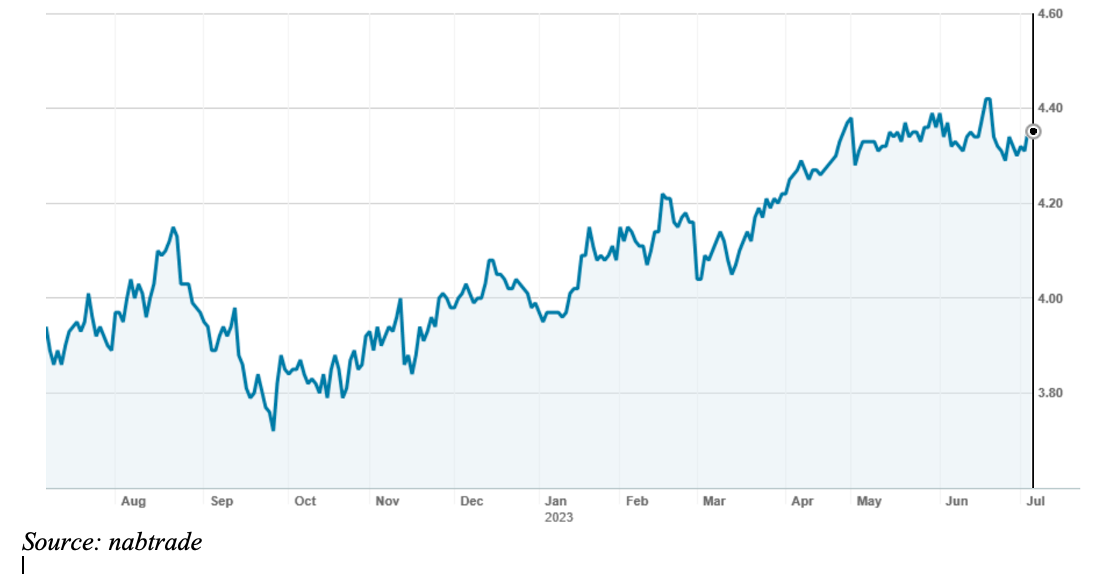

Telstra – last 12 months

The good news is that earnings are on the rise as a result of some tough work on costs, competitive pressures have eased in the mobile market and Telstra’s management team has demonstrated that it can execute. In the medium term, the potential spin-off of ‘Infra Co’ is viewed as a bonus. A full year dividend of 17c per share is expected for FY23, rising to 18c in FY24 (broker UBS thinks 19c).

At $4.26, Telstra is no bargain, and the prospective yield for FY24 of 4.2% fully franked is interesting without being compelling. But if you are waiting for a sell-off, don’t expect too much of a pullback.

For the record, the major brokers are moderately bullish on Telstra with a consensus target price of $4.68, about 9.8% higher than the last ASX price. The range is a low of $4.50 through to a high of $4.75. According to FN Arena, there are 4 ‘buy’ recommendations and 1 ‘neutral’ recommendation.

- Endeavour Drinks (EDV)

Specialty drinks and hotel operator Endeavour Drinks won’t suit all investors due to its exposure to hotels and poker machines. Spun out of Woolworths in 2021 (Woolworths maintains a shareholding of 9.1%), Endeavour has been a little out of favour with the market recently due to increasing costs, potential gaming reform and because it is somewhat exposed to consumer sentiment.

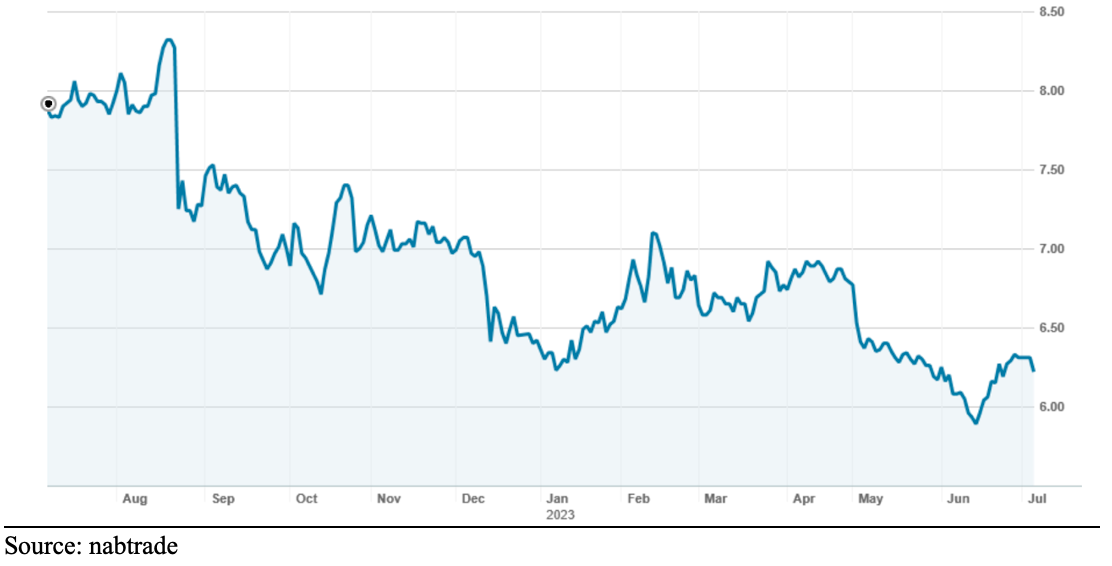

Endeavour Drinks – last 12 months

Endeavour comprises two major business units: the retail drinks business (Dan Murphys, BWS etc) and the hotels business. The former had EBIT of $666m in FY22, while the higher margin hotels business delivered EBIT of $315m. Both are cycling periods of Covid and lockdowns, with third quarter sales in hotels up 18.5% on the comparable period of FY22 but retail only up by 1.2%.

Following the fall in share price, the major brokers are marginally positive on the stock with 2 ‘buys’, 2 ‘neutrals’ and 1 ‘sell’. The target price is however 8.9% higher than the last ASX price of $6.16 at $6.71.

The brokers forecast a full year dividend of 21.5c, putting Endeavour on a yield of 3.5%. This will be fully franked.

While the yield is not particularly attractive, it is a relatively low risk stock and if you are ok with its ownership of poker machines and attended gaming risk, there is value in Endeavour around current prices.

- Ampol (ALD)

Ampol is Australia and New Zealand’s leading transport fuel and convenience retailer. It operates the Lytton fuel refinery in Brisbane (which is eligible for the Federal Government’s fuel security services program), 6 pipelines and 24 terminals. In retail, it has 670 company-controlled sites, another 1,860 branded network sites and 526 network sites in New Zealand through Z Energy.

According to FN Arena, the major brokers see upside in Ampol. There are four ‘buy’ recommendations and 1 ‘neutral’ recommendation, with a consensus target price of $34.50 – about 17.3% higher than the last ASX price of $29.42.

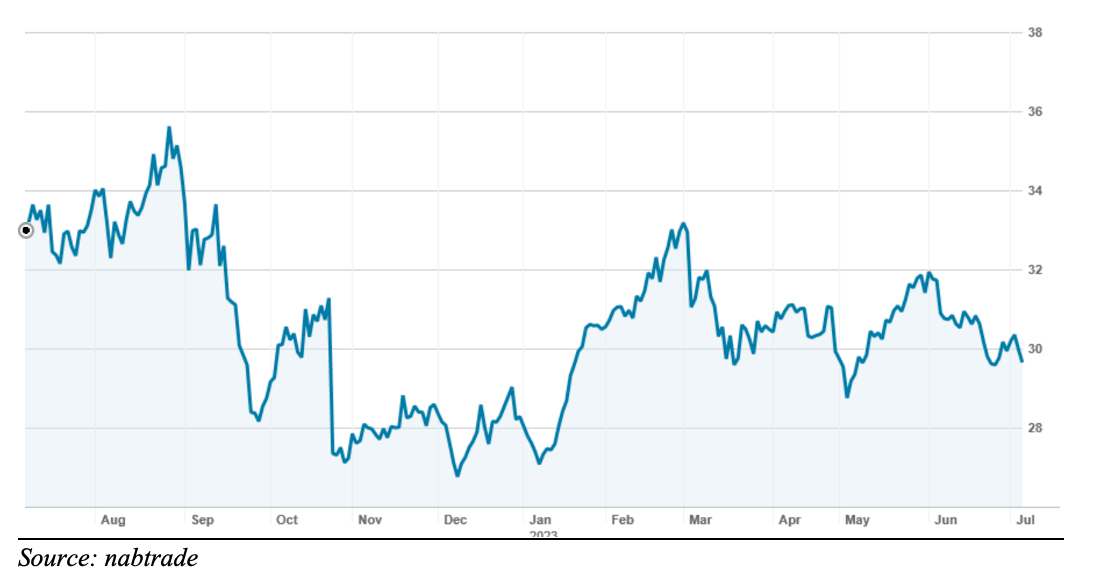

Ampol (ALD) – last 12 months

For the FY23 year (which ends on 31 December), the brokers forecast a total dividend of 200c (down from 275c for FY22), implying a current yield of 6.8%. This follows a decline in earnings due to a lower oil price and refinery margin. The brokers have Ampol trading on a multiple of 10.5x forecast FY23 earnings and 11.1x forecast FY24 earnings. While Ampol is still somewhat exposed to the global oil market, in particular refinery margins, it is in an overall sense less vulnerable than it used to be due to steps it has taken to expand its convenience retail business and potential payments by the Government to secure the refining business. It is well capitalised, and the prospect of a potential capital return and ongoing high dividend payments should put a floor under the share price. Talk of potential interest by Ampol in acquiring the 7 Eleven chain of convenience stores may in the short term dampen the share price. In the longer term, it may need to adjust its business as consumers switch to electric vehicles.

- Charter Hall Long WALE REIT (CLW)

Charter Hall Long WALE REIT is a listed property trust that invests in real estate assets that are leased to corporate and government tenants on long term leases. The $6.8bn portfolio consists of 550 properties in convenience retail, hospitality, industrial and logistics, office, agri-logistics and social infrastructure. The WALE (weighted average lease expiry) is 11.8 years, with 99.0% of the portfolio leased.

Like all property trusts, higher interest rates have taken their toll on CLW meaning that it is now trading at a significant (around 30%) discount to NTA (net tangible asset value) – on the ASX at $3.97 compared to a 31 December pro-forma NTA of $5.65. The trust has guided to earnings per unit of 28.0c for FY23 and a distribution return of 28.0c per unit. This sees it trading on a prospective yield of 7.0% (unfranked).

Charter Hall Long WALE REIT – last 12 months

The brokers feel that Charter Hall Long WALE REIT is undervalued but are wary of the debt on its balance sheet and aren’t rushing to label it a “buy”. According to FN Arena, the consensus target price is $4.61, about 16.2% higher than the last ASX price. There is 1 “buy” recommendation and 4 “neutral” recommendations.

My sense is that there is some value in Charter Hall Long WALE REIT, but with further writedowns expected and interest rates remaining firm, it is hard to see the catalyst for a short-term market re-rating.

- JB Hi-Fi (JBH)

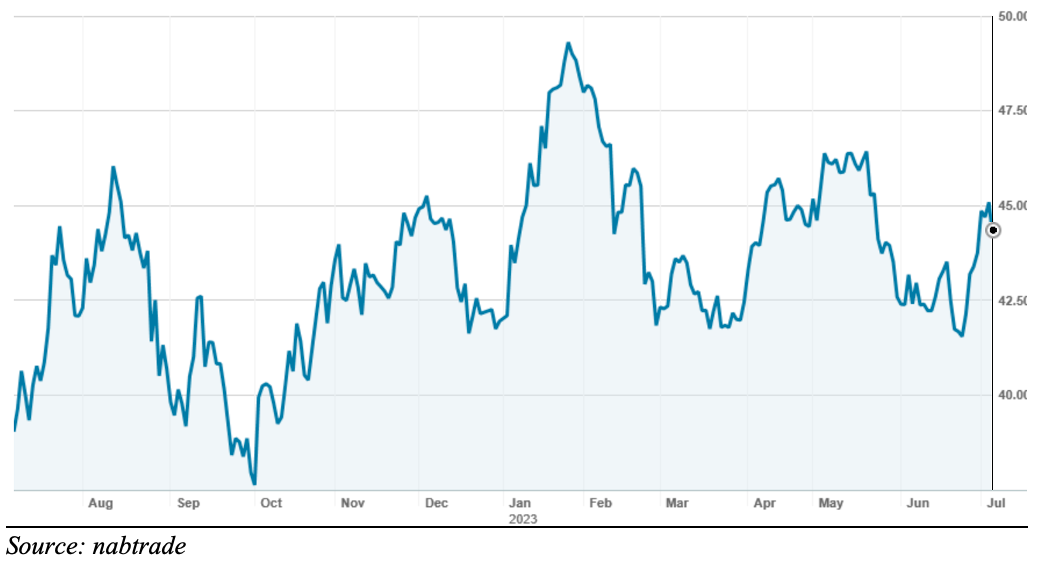

One of the best if not the best retailer in Australia, I have been singing the praises of JB Hi-Fi for years. As a retailer, it gets “caught up” in the plethora of statistics that come out on the retail sector – from ABS data on retail sales or consumer confidence through to individual company reports and market updates – so it can be a little more volatile on a day-by-day basis. However, as the following graph shows, it has largely been trading between $41 and $46 over the last 12 months.

JB Hi-Fi – last 12 months

The major brokers are cautious to negative on JB Hi-Fi, expecting 2023 to be challenging year for consumers with discretionary spend expected to weaken. According to FN Arena, there are 3 “sell” recommendations, 2 “neutral” recommendations and only 1 “buy” recommendation. The consensus target price of $43.50 is almost the same as the last ASX price of $43.31.

They forecast earnings per share falling by 3.6% in FY23 to $4.61 per share and by a further 27.6% in FY24 to $3.34 per share, putting JB Hi-Fi on a multiple (price earnings) of 9.4x FY23 and 13.0x FY24 earnings. The dividend is forecast to be $3.02 for FY23 and $2.18 for FY24, – a prospective fully franked yield of 7.0% in FY23 and 5.0% in FY24.

Of the five stocks, JB Hi-Fi is the most exposed to a slowing economy and market sentiment. But it has proved to be a great business and more resilient than the market expects at managing economic and other competitive pressures. The track record is worth backing.

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.