The onset of the Omicron variant of the Coronavirus produces a ‘suck it and see’ situation for stocks. It’s a classic uncertain curveball that share markets cop all the time and because the past virus threats have led to lockdowns and restrictions, inevitably some companies will experience lower profits and therefore their share prices fall.

On the flipside, other companies will benefit from restrictions and threats to travel — that’s why Zoom Video Communications’ share price spiked on Friday in the US, rising 5.72% while Boeing saw its price cop a downdraft losing 5.39%.

It’s why Qantas lost 5.48% on Friday and Corporate Travel Management slumped 12.65%, while online businesses such as Temple & Webster saw their share price defy the 1.73% market sell-off to be actually up over 0.5%.

If this new variant starts to grow here and lockdowns look likely, these online businesses again will spike. But it’s early days and both Federal and state governments will be moving heaven and earth to avoid shutting down their economies again.

Obviously, Omicron will threaten the reopening of our international borders and along with related other demand and supply chain problems, this will take down our S&P/ASX 200 Index and negatively affected companies. But if there’s an overreaction and largely unaffected businesses are dumped by stock players, it will create buying opportunities for the patient investor.

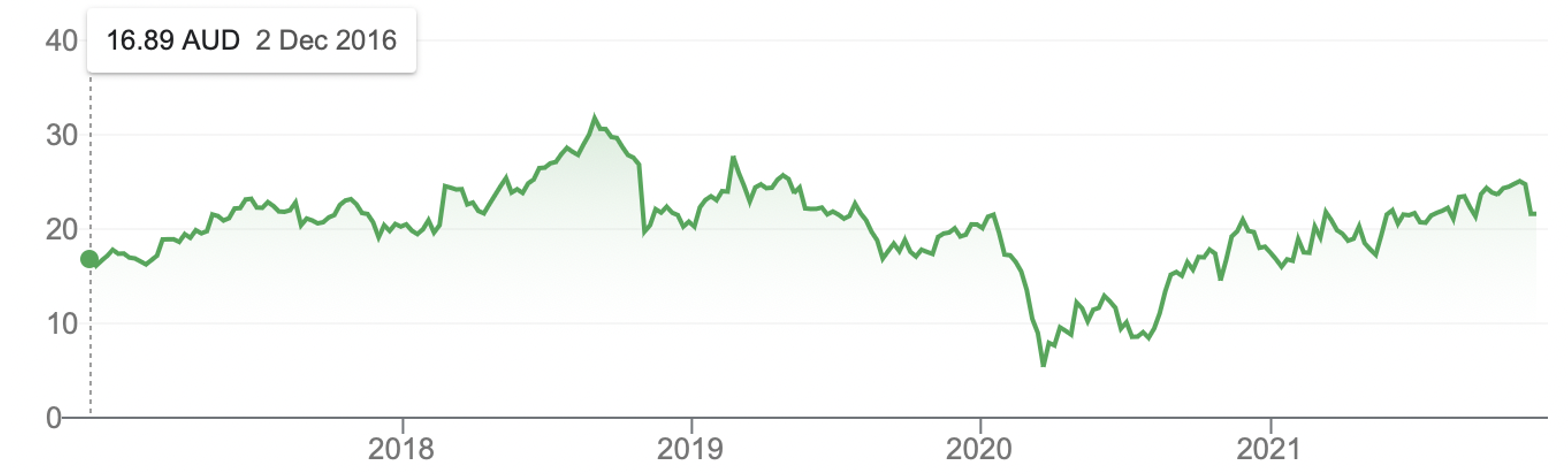

And it’s worth looking at what has happened to the overall stock market when we had our most recent lockdowns. This chart right here shows them pretty clearly:

S&P/ASX 200 Index

The first lockdown was not only national it was international, and that’s when the market fell about 35%. The next was around Melbourne’s second lockdown and added to border closures. Our market fell about 5%. Then this year, when NSW and Victoria embraced more lockdowns, the fall was about 6%.

So we didn’t even see a correction, which is a 10% or more fall in the share market. It’s why I see this current sell-off as a buying opportunity for stocks that I believe will one day rise as we get back to normal and learn to live with the Coronavirus and its many variants.

I love to make money short term but that’s always a bonus. I expect my investing strategy will make money long term via buying good businesses when the market overreacts and dumps them causing a big fall in their share prices.

Remember, most fund managers, who play around with a lot of money and therefore influence share prices, are shorter-term players compared to anyone building a portfolio for future wealth.

This chart of Corporate Travel Management (CTD) shows how the longer players have benefitted from buying every dip and I believe this is just another one.

Corporate Travel Management (CTD)

Sell-offs in March 2020, then June 2020, then November of that year and again in March 2021, have been a smart play, clearly based on the belief that normal local and global travel will one day show up.

Anyone who had the courage or long-term nous to buy CTD at the March 2020 low has pocketed a 296% gain. This is the payoff from being a long-term player focused on buying good businesses when the market gets short-term nervous.

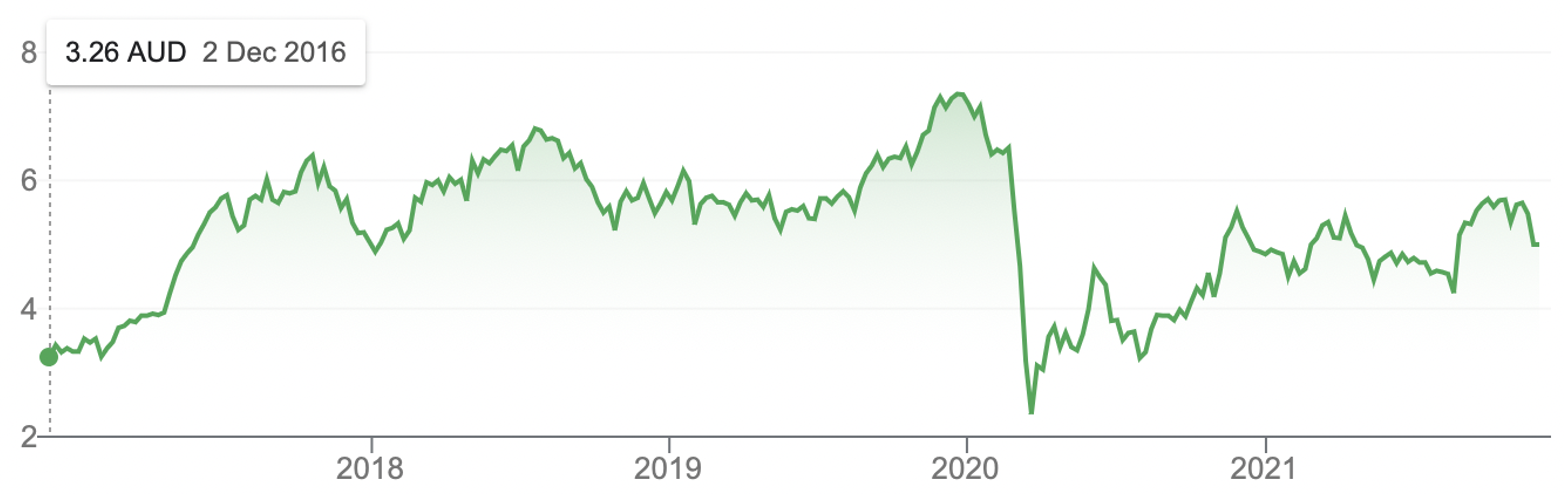

For those who want an even higher quality play on this dip, they could ‘fly business class’ with Qantas, which has proved to be a reliable play since late March 2020. Here this less volatile/more conservative operation compared to a travel business has returned 118% since late March 2020.

Qantas (QAN)

Webjet is another stock that will cop it with the new threat to its business from Omicron but it has defied its critics since the market crash of March 2020. And my recent interview with the company’s MD, John Gusic, reinforces my long-term view of his business.

Let’s get out of holiday mode and look to other businesses that could suffer a sell-off because of the new variant but are essentially good businesses.

Another company that was down 4% in early trade on Monday was EML Payments. Recently, it received the good news that the Irish central bank was backing off restrictions linked to the questionable behaviour of a company that EML acquired.

The company’s share price was up 24% in a week but analysts think it still has 18.3% upside and fund manager Ron Shamgar of Tamim Asset Management, which holds a lot of EML, believes the company is on a roll.

You can watch my in-depth discussions with John Gusic and Ron Shamgar about these respective companies here. [1]

It does have a part of its business exposed to shopping cards and loadable cards used in casinos, which ultimately could suffer if lockdowns come into play again. But over time normalcy will be good for the company’s bottom line and share price.

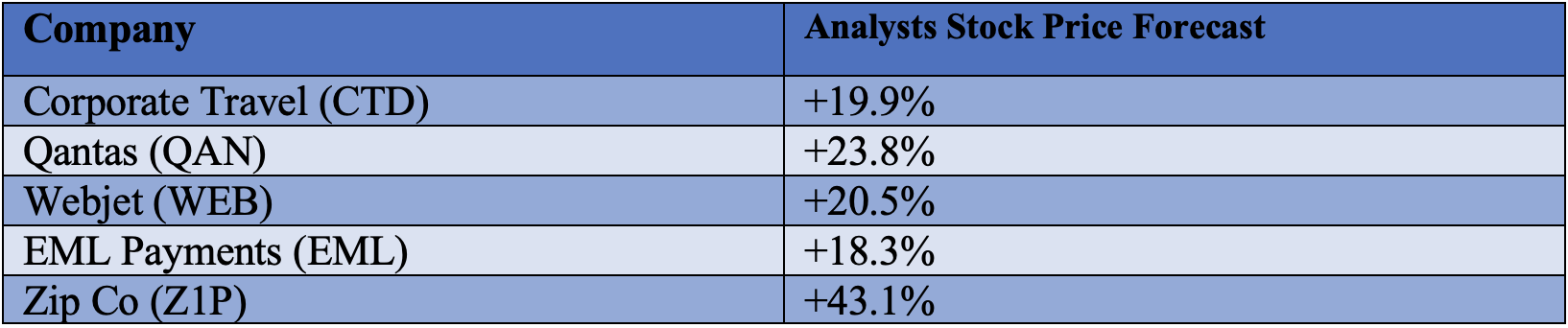

Finally, one company that the analysts think has a huge 41% upside is Zip Co. This has been beaten up as tech and payments companies have been dumped as there’s a view that interest rates will be rising in 2022 and this isn’t good for tech stocks.

Also, the BNPL space is crowded but these guys have 2.9 million local users and now that Afterpay is owned by Square, Zip should benefit from the return to normalcy over 2022.

Also, if this variant proves more troubling than we hope, interest rate rises will be later than we expect, which is good for tech companies. And retail spending at home will remain strong as less overseas travel will be likely.

Zip is also a possible takeover target, given what happened to Afterpay.

To sum up, let’s see if the analysts back me on these gift-stocks that have the potential to keep on giving in the years ahead.

The average gain for these five stocks is 25%. And remember this is not just me talking but a pile of people who are paid to assess these companies on a daily basis, so I hope they’re on the money.

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.