One of the most widely shared convictions about the Australian stock market for 2023 is that there will be plenty of mergers and acquisitions (M&A) activity, with private equity firms, in particular, on the prowl for under-valued assets in which they can turn a dollar. There is plenty of capital available for high-quality takeover targets, and debt markets are strong – albeit with higher borrowing costs – and as the pandemic impact recedes into the rear-view mirror, takeover activity is expected to be robust in 2023.

While takeovers are not easy to predict, here are four situations in which I think an acquisitive move would not be at all surprising.

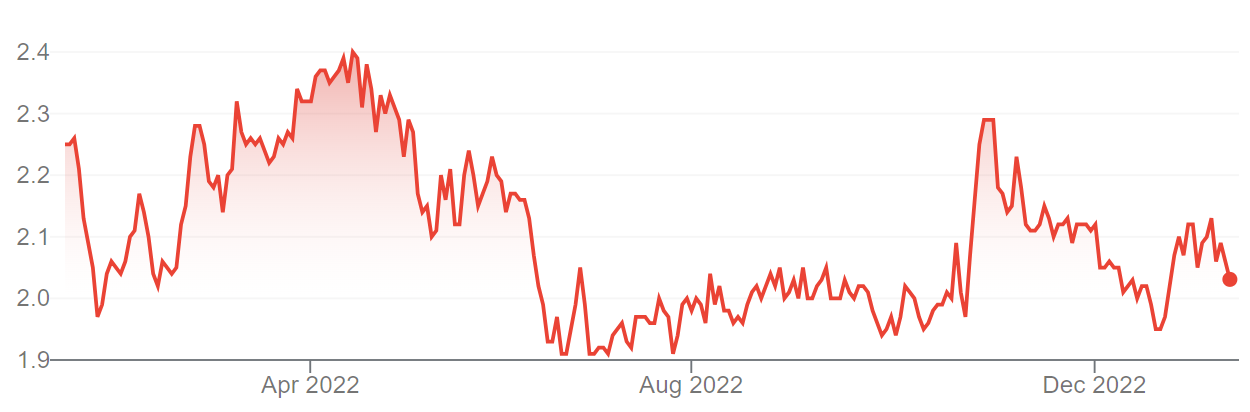

1. Integral Diagnostics (IDX, $3.17)

Market capitalisation: $738 million

12-month total return: –27.4%

Three-year total return: –1.9% a year

Expected FY24 dividend yield: 3.3% fully franked (grossed-up, 4.7%)

Analysts’ consensus price target: $3.15 (Stock Doctor/Thomson Reuters, 15 analysts), $2.80 (FN Arena, five analysts)

Integral Diagnostics (IDX) provides state-of-the-art medical imaging diagnostic services across Australia and New Zealand, serving patients and their referrers at 91 radiology clinics, including 31 comprehensive sites. In the most recent financial year, 2021-22, IDX performed more than 2 million exams on around 800,000 patients, but the combined impact of COVID-19 across the last couple of years, together with influenza in the second half of FY22, has hit the business hard.

In FY22, the diagnostic imaging industry as a whole saw falling activity. In Australia, weighted average Medicare benefits payments for the States in which IDX operates fell by 0.3% in total amount, while Medicare radiology reimbursement declined Australia-wide by 2.8%. This slide followed backdrop of strong, consistent industry growth for more than a decade, at a compound annual growth rate above 6%.

However, Integral Diagnostics has been able to use its strong balance sheet to make a series of well-targeted acquisitions in recent years, and is a much bigger business now, in an industry where the long-term industry fundamentals are strong. Both Australia and New Zealand have growing and ageing populations that will need more diagnostic support into the future. New imaging technologies provide for better, safer and earlier care: IDX is very well-positioned to benefit from these trends. Don’t imagine that private equity groups have not noticed how attractive IDX is on its current valuation.

2. Estia Health (EHE, $2.06)

Market capitalisation: $525 million

12-month total return: –7.5%

Three-year total return: –4.7% a year

Expected FY24 dividend yield: 4.6% fully franked (grossed-up, 6.5%)

Analysts’ consensus price target: $2.60 (Stock Doctor/Thomson Reuters, ten analysts), $2.35 (FN Arena, two analysts)

Aged care operator Estia Health runs At December 2022, it had 72 operational homes, with 6,596 places, and over 7,500 employees. More than half of its client places are in New South Wales and Victoria, with Queensland and South Australia making up the balance.

The demographic driver of an ageing population is behind the aged care industry: the number of people over 85 is projected to increase by 60% in the next decade. But the industry has had an extremely tough time over the last few years in the wake of the Royal Commission into the sector, and also with COVID-19. The reliance on government funding continues, and the regulatory burden on the industry continues to increase, particularly with the recommendations from the Royal Commission. Estia’s share price reflects these factors, having dropped 40% in the past five years.

But the worst is likely over for the industry, and the environment for operators with the capacity to expand by acquisition looks to be improving. Both private equity investors and not-for-profit operators are known to be interested in aged care assets. Earlier this month, Estia Health’s share register was opened wide after its biggest shareholder Seven Group sold its 10% stake – which was seen in the market as a blocking stake – after six years as a shareholder. That is widely seen as putting Estia “in play.”

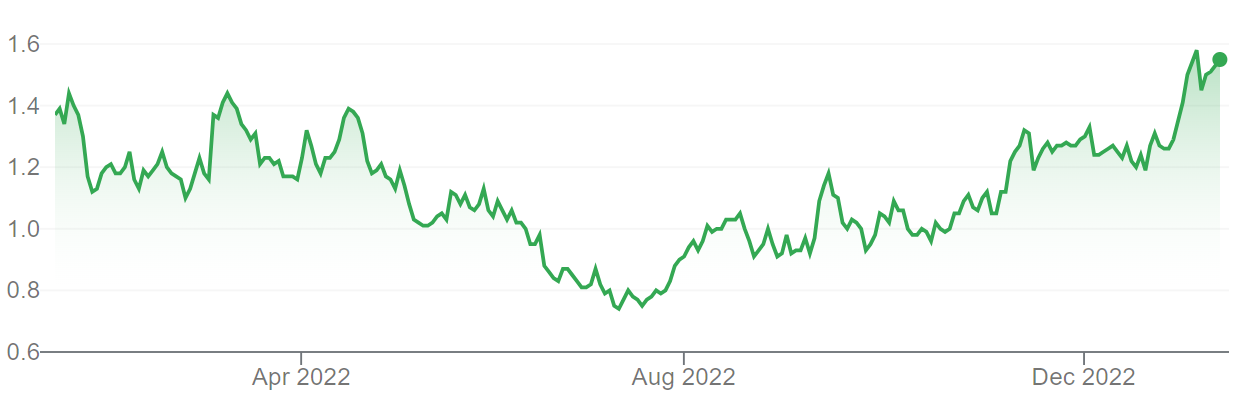

3. De Grey Mining (DEG, $1.53)

Market capitalisation: $2.4 billion

12-month total return: 28%

Three-year total return: 210.7% a year

Expected FY24 dividend yield: no dividend expected

Analysts’ consensus price target: $1.725 (Stock Doctor/Thomson Reuters, ten analysts),

Pilbara-based gold explorer De Grey Mining made one of the best gold discoveries in recent years in December 2019 when it unveiled a large-scale, high-value, near-surface deposit at an area called Hemi, within its wholly owned Mallina Gold Project. The find was a first for the Pilbara region in terms of both the form of gold mineralisation and the scale. It was such a bonanza find, the shares went from 4 cents at the time of the discovery to a peak in 2021 of $1.61, becoming a 40-bagger.

De Grey is working through the process of proving-up what it has on its hands, and it is certainly impressive. In September, the preliminary feasibility study (PFS) on Mallina reported a maiden ore reserve of 103 million tonnes at 1.5 grams per tonne (g/t), giving 5.1 million ounces of gold. The PFS indicated that Mallina would produce 540,000 ounces over the first ten years of its life, with total output of 6.4 million ounces over a 13.6-year period. If borne out, that production rate would place it third behind Newmont’s Boddington mine in Western Australia and Newcrest’s Cadia mine in New South Wales in terms of annual production, based on current rates. The mine is projected to cost more than $1 billion – the definitive feasibility study (DFS) is due for completion in mid-2023, at which point the market will know more about likely costs and funding.

However, we are clearly talking about a mining operation that will be one of Australia’s top five gold producers. De Grey has estimated the mine would operate at average all-in sustaining costs (AISC) of $1,220 an ounce for the first five years, putting it in the lowest quartile of Australian producing gold mines and making it one of the world’s cheapest major gold projects to operate. (AISC is a figure that incorporates not only the “cash cost” of production but all the costs that allow production to be sustained.)

Quite simply, large gold producers around the world would certainly be running the numbers on De Grey. Many bigger gold players do not have large capacity for organic growth and exploration success around their existing operations: De Grey would represent a very significant near-term boost to the production profile. Canadian heavyweight Barrick Gold has been mentioned as a possible suitor, but it would definitely not be the only one of its peers looking at this Australian future producer.

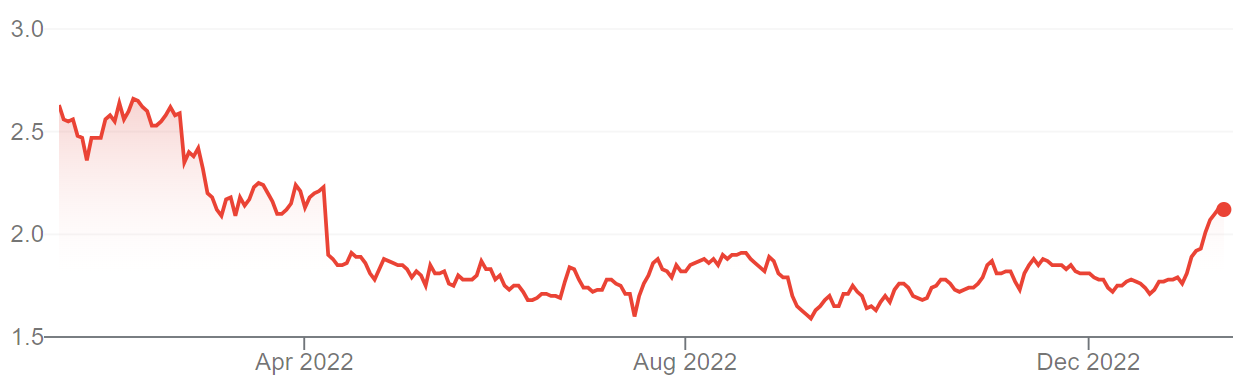

4. Platinum Asset Management (PTM, $2.13)

Market capitalisation: $1.2 billion

12-month total return: –12%

Three-year total return: –18% a year

Expected FY24 dividend yield: 6.1% fully franked (grossed-up, 8.7%)

Analysts’ consensus price target: $1.70 (Stock Doctor/Thomson Reuters, ten analysts), $1.89 (FN Arena, four analysts)

Active global funds manager Platinum Funds Management has struggled in recent years, with the firm – founded by renowned investor Kerr Nielsen in 1994 – battling patchy investment performance in its funds, which have caused many of its investors to jump ship. Platinum is just one – albeit a high-profile example – of the active fund managers around the world that have seen their market heavily invaded by passive vehicles such as index-based exchange-traded funds (ETFs), which charge investors much less to manage their money – usually about 75%–80% less – but counter-intuitively, have in average terms outperformed most active managers after fees.

Add to that a weak couple of years in the general stock market and the incidence of a “first strike” by shareholders against the firm’s executive remuneration, and you have a recipe for a slumping market valuation. In July 2022, Platinum Asset Management shares touched a low of $1.60, the lowest level since the stock listed in 2007, at $5.00. From a peak of $9.15 in February 2015, the shares had slid more than 80%.

PTM has recovered somewhat, to $2.13, as the globally focused “value” manager’s flagship international fund managed to beat its benchmark in calendar 2022, eking out a 3.1% gain as the benchmark slid by 12.5%. (In this regard, Platinum did much better than similarly troubled ASX-listed rival Magellan Financial, whose main global fund underperformed the global benchmark index, losing 15%.)

Platinum would be an obvious target for a fund management company that wanted to expend its offering into international shares, according to Morningstar: the research firm notes that PLM is cheap, its performance is improving, and it also manages higher-margin retail money, which is “stickier” than institutional money (notwithstanding Platinum’s battle against fund outflows.) As very experienced stock market investors, the Platinum team would understand better than most the fact that every company listed on a stock market is up for sale, all day, every day – and theirs is so cheap at its current market valuation, it is an attractive takeover target.

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.