“Cloud” computing has been one of the biggest business trends of the last decade, and it shows no sign of slowing down. Cloud computing is simply the ability of computer data and programs to be stored on the internet, and accessed over high-speed internet connection – instead of, as before “the cloud” became an option, sitting on your computer’s hard drive. With the cloud, businesses can use application software through a subscription, rather than buying a software licence and installing it on their physical computers. Think of it as on-demand computing power. The cloud has helped businesses cut their investment in computer software and hardware.

Worldwide, the cloud is a US$300 billion-plus ($390 billion) market, and growing fast. While the COVID-19 pandemic eroded worldwide IT spending by 3.2% in 2020, the digital side of IT spending – where the cloud lives – accelerated, as remote working and education became normal. Research and advisory company Gartner estimates that global spending on public cloud services will surge 41% by 2022, from US$257.5 billion ($334 billion) last year to US$362.2 billion ($470 billion). But even at that level, cloud spending will only represent 14.2% of total IT spending compared with 9.1% in 2020, Gartner says.

Given that much of the world’s digital data and software applications are still maintained outside the cloud, there is a lot of space for cloud spending to grow. Consulting firm McKinsey believes that at present, the cloud’s value in IT amounts to only about 5% of its potential value.

Numbers like these can’t help but attract investors.

On the Australian Securities Exchange (ASX), there are four main exposures to cloud computing – data centre operator NEXTDC (NXT), electronic printed circuit board (PCB) design software company Altium (ALU), network provider Superloop (SLC) – which owns independent fibre connectivity with the data centres – and cloud communications provider Megaport (MP1).

But there is also a host of companies for whom the cloud is their conduit to the customer – Australia’s thriving mini-sector of software-as-a-service (SaaS) stocks. Under the SaaS model, customers subscribe to a software product that does not live on their physical computers, but is hosted in the cloud, where it is continually updated. The software company gets a reliable stream of recurring revenue, and the customer gains flexibility and always-up-to-date software. It is a largely win-win model in which costs to subscribe are comparatively low, customers are very “sticky” if the product meets their needs, and the software providers build up strong recurring revenue and high gross margins.

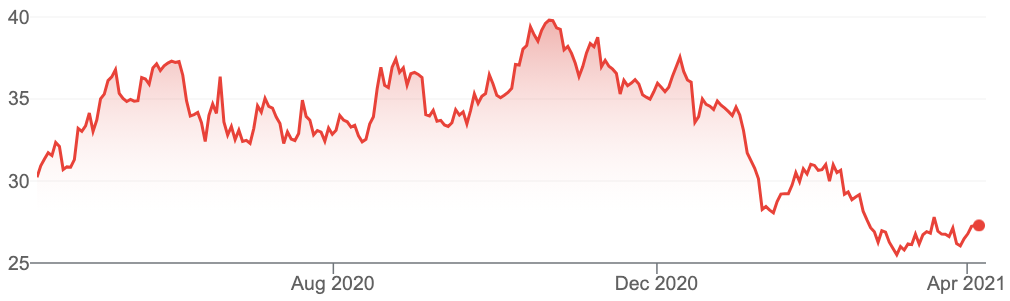

1. Altium (ALU, $27.24)

Market capitalisation: $3.6 billion

Three-year total return: 12.3% a year

Analysts’ consensus valuation: $33.95 (Thomson Reuters), $33.90 (FN Arena)

Electronic printed circuit board (PCB) design software company Altium’s products are deeply embedded in the profound technological shifts that society and business are experiencing, in the rise of forces such as cloud computing, big data, artificial intelligence (AI) and 5G. The PCB is at the heart of the burgeoning use of “smart” connected devices in everyday life – Altium says it is “committed to achieve market leadership to the point of being the dominant provider of PCB design software by 2025.”

Not only is Altium leveraged to the growth of cloud computing, last year it formally pivoted its business towards the cloud with a product called Altium 365, its new cloud platform that could turn the business into a true SaaS operator. Altium describes the launch of Altium 365 as its “Netflix Moment,” referring to the famed company’s move from renting DVDs through the mail to becoming an online streaming platform.

Having come off from levels above $39 last October, Altium now looks to offer quite a bit of value. The company is a profitable dividend-payer, albeit unfranked – Altium is not a yield play.

Altium (ALU)

Source: Google

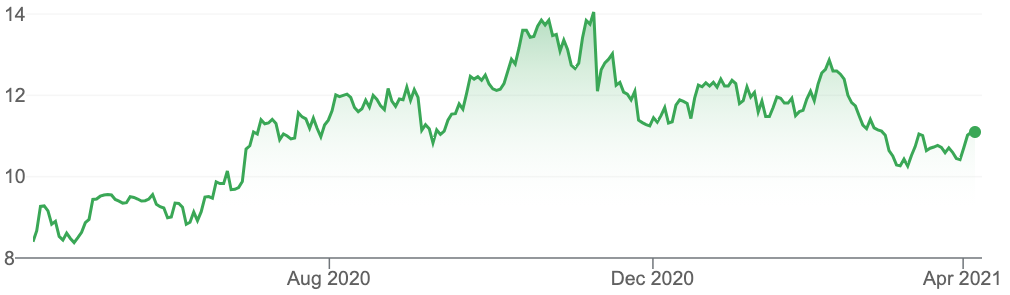

2. NextDC (NXT, 11.02)

Market capitalisation: $5 billion

Three-year total return: 18.9% a year

Analysts’ consensus valuation: $14.02 (Thomson Reuters), $14.09 (FN Arena)

NEXTDC is a leading data centre (DC) owner and operator: companies like NXT are the backbone of the cloud, providing the purpose-built physical infrastructure needed for companies to store and process their vast amounts of data. NXT has nine data centres across five Australian capital cities, which, combined, represent a “Cloud Centre” marketplace from which customers can choose a range of the services they need, selecting from more than 660 cloud providers, carrier networks and ICT service providers. Customers host their own infrastructure or storage within NXT centres, using the facility as an extension of their own property. In fact, NXT acts as a SaaS company itself, offering Data-Centre-as-a-Service (DCaaS) and Data Centre Infrastructure Management-as-a-Service (DCIMaaS) services to customers.

The pandemic-inspired shift to the cloud resulted in NXT reporting extremely strong demand for capacity in its data centres in 2020, with the company accelerating planned capacity additions and data centre developments. The company has also opened offices in Tokyo and Singapore as it eyes international expansion.

While NXT is not expected to turn a profit until FY22, analysts are quite bullish on the company, which appears on consensus valuations to be good buying at these levels.

NextDC (NXT)

Source: Google

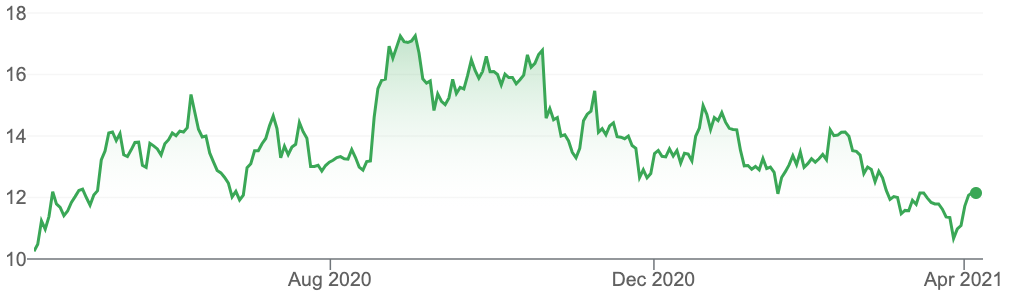

3. Megaport Limited (MP1, $12.07)

Market capitalisation: $1.9 billion

Three-year total return: 47.3% a year

Analysts’ consensus valuation: $16.90 (Thomson Reuters), $14.56 (FN Arena)

Megaport is a leading global provider of elastic interconnection services across data centres globally – it has networking equipment in hundreds of data centres around the world, enabling it to offer scalable bandwidth for public and private cloud connections, metro ethernet, and data centre backhaul. This means that through the Megaport network, its customers can create and manage a global network with or without the need for physical infrastructure.

Megaport enables customers to rapidly and flexibly connect to its partner data centres, cloud service providers, network service providers, and managed service providers. Its Megaport Cloud Router (MCR), launched in January 2018, enables customers to instantly provision and control virtual routers through Megaport’s web-based portal: enterprises and service providers can use services such as cloud-to-cloud networking and deploy Virtual Points of Presence (VPoPs) without the need to buy (or maintain) physical routing equipment.

Megaport is benefiting from the global migration to public cloud infrastructure: however, it’s not yet profitable and is not expected to be so until at least FY23. That doesn’t dissuade analysts from positing consensus valuations well north of the current share price.

Megaport (MP1)

Source: Google

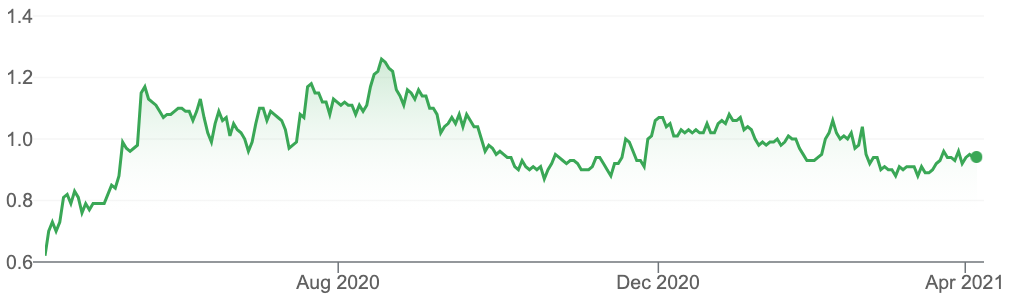

4. Superloop (SLC, 94 cents)

Market capitalisation: $346 million

Three-year total return: –21% a year

Analysts’ consensus valuation: $1.24 (Thomson Reuters), $1.24 (FN Arena)

Superloop is an independent provider of connectivity services within the Asia Pacific metro region, owning and operating carrier-grade metropolitan fibre networks in Australia,

Singapore and Hong Kong, connecting the region’s key data centres and bandwidth-

intensive buildings. Superloop provides wholesale telecommunications services to other providers, and in Australia, also sells NBN plans to retail consumers.

While fibre connectivity and home broadband are its key markets, Superloop is moving into the business internet space, through the US$8 billion ($10.4) cloud-based software-defined wide area network (SD-WAN) market. Unlike the traditional router-centric WAN architecture, the SD-WAN model is designed to fully support applications hosted in on-premise data centres, public or private clouds and SaaS services – Superloop has earmarked a multi-billion-dollar addressable opportunity in SD-WAN market, where it aims to benefit from the exponential growth in data consumption and the move to the cloud.

While analysts expect revenue to grow substantially this financial year (FY21) and next, SLC is not yet a profit-maker – it’s expected to post a net loss this year and FY22. But analysts are bullish on its share price prospects from here.

Superloop (SLC)

Source: Google

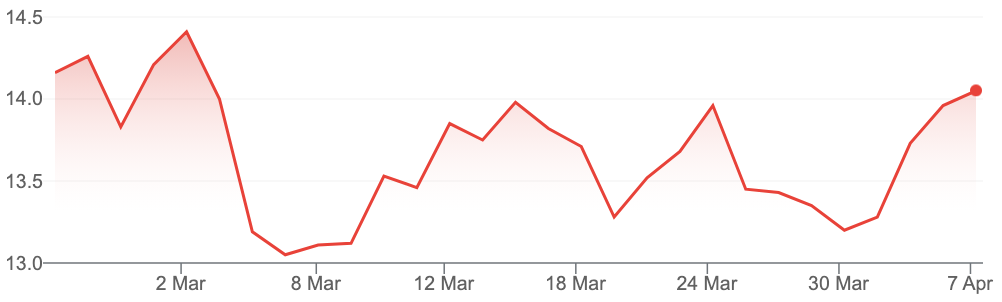

5. BetaShares Cloud Computing ETF (CLDD, $14.05)

For a simple, cost-effective way to gain broad exposure to the cloud computing megatrend, BetaShares’ CLDD exchange-traded fund (ETF) aims to track, before fees and expenses, the performance of an index (the Indxx Global Cloud Computing Index) that provides exposure to leading companies in the global cloud computing industry. These companies are involved in the delivery of computing services, servers, storage, databases, networking, software, analytics, and other services over the internet.

By buying CLDD, an investor gets diversified, cost-effective exposure to leading companies in the cloud computing industry, a sector that is heavily under-represented in the Australian share market. To be eligible for inclusion in CLDD’s portfolio, a company’s share of revenue from cloud computing services must meet a minimum threshold.

Since the inception of the Indxx Global Cloud Computing Index in November 2013, it has returned 32.8% a year, as at 31 January 2021. In the most recent 12-month period, it gained 42.2%.

The three main benefits that CLDD offers ASX investors are: growth potential from the cloud growth space, a ‘pure-play’ exposure to the cloud, and diversification from a basket of shares that are under-represented on the ASX.

At 31 January 2021, CLDD’s top ten holdings were:

Fastly Class A – 5.4%

Zscaler Inc. – 4.9%

Proofpoint Inc. – 4.7%

Twilio Inc. – 4.3%

Xero Limited – 4.2%

Qualys Inc. – 4.1%

Dropbox Inc. – 4.1%

Anaplan Inc. – 4.0%

Akamai Technologies Inc. – 3.9%

Shopify. – 3.9%

The index holds 36 stocks, among which are some of the larger, more familiar cloud giants such as Amazon, Microsoft, Alibaba, Alphabet and Netflix.

CLDD is slightly more expensive than many broader ETFs, costing 0.67% a year.

BetaShares Cloud Computing ETF (CLDD)

Source: Google

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.