This week I face a Dirty Harry moment where I have to ask myself: “Do I feel lucky?” You see, we’re currently in a market pullback or even correction phase but my 12 months view is that I want to be long stocks, especially growth stocks.

My investment technique is to buy quality stocks or ETFs when I think the market is going ‘truly, madly, deeply negative. Over the past 12 months I’ve told you I was keen on a top 100 Nasdaq stock ETF called HNDQ, which is a hedge version of NDQ. Year-to-date, this ETF is up 37.8%.

Two quality tech stocks that I’ve like have been Megaport (MP1) and Xero (XRO). Those two stocks are up 93% and 74% respectively. Another is Audinate (AD8), which is up 66.58% this year.

I never rated them as top-quality companies like Macquarie or CBA, but I saw them as good quality tech companies, which meant I didn’t go as long as I might have for a company like CSL.

All up, I think buying historically good companies with prospects, when the market is temporarily more against the sector these companies are in rather than the company itself, is a pretty good investing strategy.

Currently, a lot of the companies I like have already moved higher, though I still like Resmed, Ramsay, CSL and Macquarie on a 12-months basis. These businesses could be what I buy this week, but I go back to my Detective Harry Callahan line: do I feel lucky, especially with the timing of the purchases?

You see, this week the Yanks get some important inflation data that could send stocks up or down. So, if I buy early this week, I could cop a sell-off loss or win on a market take-off after key data drops.

What’s the key data? Try these US-time numbers:

1.Monday: US consumer inflationary expectations.

- Tuesday: business optimism.

- Wednesday: the latest CPI in the States, which is huge!

- Thursday: the US Producer Price Index (PPI), along with retail sales.

- Friday: consumer sentiment and industrial production.

After all these data drops, there’s likely to be a strong opinion about what’s probably happening to US inflation, and then what the Fed is likely to do.

On CNBC, Brian Belski, chief investment strategist at BMO Wealth management, summed up the market attitude before the data above arrives: “Right now, we’re in that strange phase where good news can be bad news, but I don’t think that lasts too long.”

Belski says softening consumer spending could flip that narrative but “…we’re just not there yet.” So, he’s saying if US consumers look like they’re buckling under the pressure of higher interest rates, then the Fed will keep pausing ahead of declaring “mission complete.” While that could take some time, it will make my 12-months positive call on stocks ‘on the money’.

This week, Abby Joseph Cohen, former top gun economist and forecaster for Goldman Sachs (who’s now a business professor at New York’s Columbia University) thinks the Fed is underestimating the gathering recessionary forces out there, which don’t need more rate rises to make these forces worse.

This is why the data drop is so crucially important to what happens to stocks. September is the scariest month for stocks, while the December quarter is historically a ripper. As Barron’s points out: “The end of the year is usually when people fund their retirement accounts, so new money is rushing into the market, pushing prices higher.” And it often hosts a Santa Claus rally.

On the stocks out-of-favour that I like for a 12-months hold, here’s what the analysts surveyed by FNArena are saying:

- Ramsay Health Care (RHC)

The consensus call is 17.1% upside, with five out of five analysts liking the company. Two analysts from Ord Minnett and Morgans see a 35%+ rise ahead.

- Resmed (RMD)

The consensus tips a rise of 49.5%. Five out of six analysts have big price rise calls. In fact, Ord Minnett and Citi both have 66.3% upside calls.

- CSL

Here the consensus sees 22% upside, while six out of six analysts like the company.

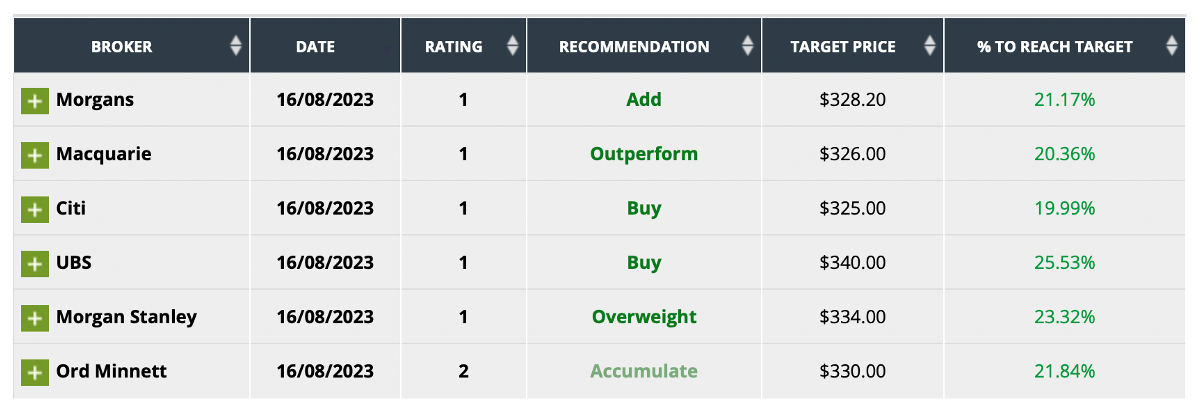

- Macquarie Group (MQG)

MQG has a consensus call of plus 11%, and five out of five expert company watchers like the prospects of the business. Three out of five analysts see a gain between 13% to 22% for MQG, while two only see a 2% gain.

- GEAR

If I do feel lucky, I could pile into GEAR. I’ve talked about this ETF before. Remember, this is a risky leveraged play on a rising S&P/ASX 200. So, here’s a HUGE caution: it can fall as hard as it can rise!

My final word

I could buy all five of the above-mentioned plays: the out-of-favour four and GEAR to be diversified. However, this question remains: will I buy early in the week, or after seeing the inflation number in the US? This CPI inflation number will be the make-or-break economic reading for the market this week.

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances