A little over a year ago, Treasurer Josh Frydenberg announced a ban on the payment of stamping fees on listed investment companies (LICs) and listed investment trusts (LITs). The practice, which was inconsistent with the principle of non-conflicted remuneration, saw retail stockbrokers and some financial planners being paid a commission of 1% to 1.5% by the promoters of these investment vehicles.

Not surprisingly, there hasn’t been a single new LIC come to market in that period. In fact, the number of LICs and LITs listed on the ASX has dropped from 111 twelve months ago to 101 as of 30 April 2021.

But this ban is not the only reason for the decline. LICs face the perennial problems of premiums or discounts to underlying value, limited liquidity and a ‘challenger’ in the form of the actively managed exchange traded fund.

Not everyone is bearish on LICs. Geoff Wilson’s and his Wilson Asset Management are launching a new LIC, WAM Strategic Value (ASX: WAR), which will focus on identifying and investing in discounted asset opportunities. Trying to buy $1.00 of value for 80c. WAR seeks to capitalise on share price discounts to underlying asset values of listed companies, primarily LICs and LITs.

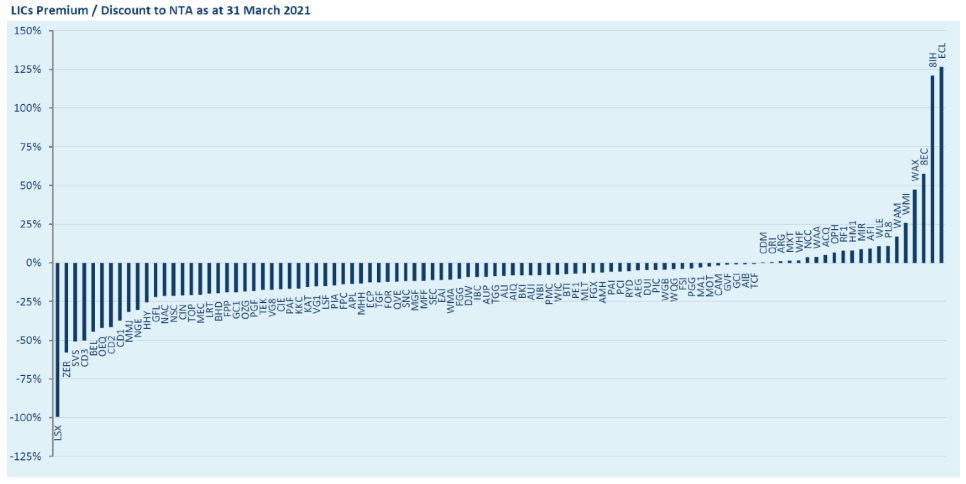

The $225m WAR will have a lot of opportunity, because of the 101 LICs and LITs, 80 were trading at a discount to their NTA (net tangible asset value) and only 21 were trading at a premium. Some of the discounts were over 20%, with the average around 10%. The following diagram from the ASX shows the spread at the end of March.

LICs Premium/Discount to NTA as of 31 March 2021

Source: ASX

Shareholders in WAR will however need to be patient, because while it is easy to buy discounted assets, it is a lot harder to make the gap close and realise the value. In WAR, they have the master in Geoff Wilson, although the market is certainly more attune to his “modus operandi”.

LICs do offer two important advantages over other structures. Firstly, because they are close-ended structures with a finite number of shares, the investment manager has a fixed pool of capital to invest. He/she doesn’t have to worry about inflows or outflows. Secondly, as companies, the Directors can deliver a smoother payment of income to their shareholders because the payment of dividends is discretionary. They can also offer dividend re-investment plans and share purchase plans.

The alternative structure is the exchange traded fund or actively managed quoted fund (which is used by Magellan in MGOC for the Magellan Global Fund or for our Switzer Dividend Growth Fund (SWTZ)). This employs an open-ended trust structure, supported by market makers on the ASX to provide liquidity. It grows in size (or contracts) depending on investors buying or selling on the ASX, with the job of the market maker to ensure that it trades very close to its underlying NTA.

While quoted managed funds are set to be the go forward vehicle, there are still 101 LICs and LITs trading today on the ASX. Typically, poorer performing, smaller and less well marketed LICs tend to trade at a discount to their NTA, while better performing, larger and those LICs that put more effort into shareholder communications tend to trade at a premium. But it is not always the case.

Here are 4 LICs from different sectors to consider buying, and 2 to consider selling.

1. Australian equities – Future Generation Investment Company (FGX)- Buy

The Future Generation Investment Company (FGX) is a fund of funds, set up by the industry as a philanthropic measure to raise money for charities. While investors (shareholders) are charged a management fee of 1.0% pa, leading Australian fund managers donate their time to manage the monies and most service providers do so on a pro-bono basis. This allows the management fees to be donated to Australian children and youth at risk charities.

As an investment, the $514m investment company has exceeded the performance of the S&P/ASX All Ordinaries index over 1 year, 3 years , 5 years and since inception in 2014, with a lower volatility than the market. This is before fees (which are paid to charities), after fees, it is marginally behind (for example, over 5 years, 11.4% before fees compared to 10.7% for the S&P/ASX All Ordinaries Accumulation Index). It accesses 20 different managers such as Bennelong, Paradice, Regal and Eley Griffiths, who each have very specific mandates.

FGX is trading at a discount to its NTA. On 30 April, this discount was 9.3% (down from 15% 12 months’ ago). On Friday, it closed at $1.29, which we calculate is a discount of around 9.2% (our estimated NTA is $1.42).

2. Global Infrastructure – Argo Listed Infrastructure (ALI) – Buy

Global infrastructure, as an asset category for Australian investors, hasn’t exactly set the world on fire in terms of investment performance over the last few years (3% for the last 12 months, 7.6% pa over the last 3 years). But, it is a less volatile asset class and over the long term, returns should be attractive.

One way to access it is through Argo Global Infrastructure (ALI), which invests in a portfolio of globally listed infrastructure companies. Managed by NYSE listed Cohen and Steers who manage around US$70bn on behalf of institutional clients and sovereign wealth funds, about 36% of the fund is invested in electric assets, 13% in communications, 11% in railways and 8% in toll roads. 56% of companies are domiciled in USA, with Europe next at 11%.

Performance has been satisfactory, marginally outperforming its benchmark. Since inception in 2015, it has returned 7.7% pa after fees and expenses compared to its benchmark of 7.2% pa (the S&P/ASX 200 accumulation index return over this period is 8.3%). It is unhedged. Management fees for the $342m LIC are 1.2%.

On 30 April, ALI closed on the ASX at $2.18, a 5.2% discount to its NTA of $2.30. It provides a weekly NTA estimate and on 14 May, this was $2.29 compared to a share price of $2.12 (a discount of 7.4%). A new NTA should be posted tomorrow (Tuesday).

3. International equities – WCM Global Growth Ltd (WQG) – Buy

For disclosure, I am a Non-Executive Director of WCM Global Growth (WQG). But notwithstanding that conflict, I still think this is a LIC you should consider.

This $295m LIC is managed by WCM Investment Management, a California-based asset management firm specialising in active global and emerging market equities.

WQG comprises investments in about 30 global mid-market companies. They need to meet two key criteria: a rising competitive advantage(or expanding economic moat) and a corporate culture that supports the expansion of the moat. About 24% of the fund is invested in IT companies; 19% in health care, 18% in consumer discretionary and 10% in financials, with the Americas accounting for 65% of the companies.

Portfolio performance overall has been outstanding. Although it has been more difficult to outperform over the last few months with the rotation out of tech, it is still comfortably ahead over the last 12 months with a return after fees of 28.1%, 4.3% ahead of the benchmark. Since inception, it has delivered an annualised return to 30 April of 20.0% pa, 6.7% pa ahead of its benchmark’s 13.3% pa.

The management fee is 1.25% plus a performance fee. It is unhedged.

The discount on NTA for WQG has closed considerably, and on 30 April was down to 5.2%. WQG provides a weekly NTA estimate and on 14 May, this was $1.63. With a share price of $1.575, this represented a discount of 3.4%. A new NTA should be posted tomorrow (Tuesday). WQG closed on Friday at $1.565.

4. Australian equities – Australian Foundation Investment Company (AFI) – Sell, potentially Buy Djerriwarrh

Australian Foundation Investment Company (AFI) is Australia’s largest listed investment company with an $8.6bn portfolio. It invests in a broad based portfolio of shares, and aims to provide shareholders with attractive investment returns through access to a growing stream of fully franked dividends and an enhancement of capital invested over the medium to long term.

Internally managed, the management cost of 0.13% pa is very low.

However, its performance largely mimics the benchmark indices. Of the major broad based LICs (which also include Argo (ARG) and Milton Corporation (MLT)), it has probably done the best. Over the last 12 months, it has returned 34.7% compared to a franking adjusted return for the index of 32.0%, and over 5 years, it is just marginally behind with a franking adjusted return of 11.4% pa compared to the index’s 11.8% pa.

So the sell recommendation has nothing to do with performance. It just that it is trading at a premium, and I can never understand why you would pay $1.06 for an asset that is worth $1.00 – particularly when there are easy alternatives.

At the end of April, it was trading at a premium of 6.0% to its pre-tax NTA of $7.06. It closed on Friday at $7.51, putting it on an estimated premium of 5.9%.

What are the alternatives if you want to stay invested in the market?

One option is to buy a low cost index tracking ETF such as IOZ from iShares (which tracks the S&P/ASX 200) or VAS from Vanguard (which tracks the S&P/ASX 300). Guaranteed to get a return equivalent to the index, less a fraction (their management fee). A second option is to invest in FGX above.

A third option is to stay with the same manager and invest in another of their LICs, the $782m Djerriwarrh Investments Limited (DJW). Its investment objective is to “pay a higher level of fully franked dividend than is available from the S&P/ASX 200 and to provide capital growth over the medium term”. To do this, it holds a portfolio of stocks much like AFI, but in addition, generates additional income by writing call options over some of the stocks.

It hasn’t performed as well as AFI (32.6% over 1 year vs 34.7%, and 9.0% pa for 5 years vs 11.4% pa for AFI – all adjusted for franking), but it is trading at significant discount to NTA. On 30 April, this 9.5%. On Friday, DJW closed at $2.93, a 9.3% discount to our estimated NTA of $3.16.

5. Australian equities – WAM Capital Limited (WAM) – Sell

There is no argument with the “since inception” investment performance of Geoff Wilson’s flagship LIC, the $2.05bn WAM Capital, but over 5 years, it is “good” rather than “great”. WAM benchmarks to a 50/50 split between the All Ordinaries and the Small Ordinaries Indices – and against the former, it is 1.8% pa ahead and against the latter, it is 1.4% pa ahead. But WAM’s performance is reported before management fees and expenses – unlike most other LIC Mangers – so once an allowance is made for this, it is only a little bit in front.

But the real issue is the premium to NTA, which was 19.1% on 30 April. Why pay $1.20 for something that is worth $1.00? WAM has a market capitalisation of $2,037m against gross assets of $1,737m.

WAM pays a very attractive fully franked dividend of 6.7%. But the share prices has gone sideways over the last 5 years.

WAM Capital (WAM) – 5/16 to 5/21

WAM has a huge fan base, so I am not expecting the premium to fade quickly. But I do think there are better opportunities available.

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.