The fact of biotech investing is that the share prices are at the mercy of news flow from drug trial results, partnerships with bigger companies, regulatory interactions and a wide range of other events that can point to the increased – or decreased – likelihood of the drug, medical device or diagnostic test ever reaching the market. The share price rises –and falls! –can be huge, and investors in this area need to have the nerves for that, and a great deal of patience, to ride the fluctuations, hopefully in an increasing trajectory through to payday.

Here are four members of the ASX life sciences cohort expecting significant news this year – and these are all situations where investors can be reasonably confident that the news should be positive.

1. Cyclopharm (CYC, $1.50)

Market capitalisation: $140 million12-month total performance: —8.5%Three-year total performance: 13% a yearAnalysts’ consensus target price: $1.70 (Stock Doctor/Thomson Reuters, one analyst)arket capitalisation: $938 million

Cyclopharm is a diagnostic imaging company specialising in lung health, with its flagship medical device being Technegas, a lung ventilation imaging agent contained in a gas. Technegas is a nuclear medicine product: it is an ultra-fine dispersion of radioactive labelled carbon. The patient inhales the gas during a medical imaging procedure, and the labelled carbon helps to produce images that accurately demonstrate lung function. Technegas has mostly been used to diagnose pulmonary embolisms – a life-threatening condition that occurs when a blood clot blocks an artery in the lungs – but may help diagnose other respiratory complaints, including asthma, chronic obstructive pulmonary disease (COPD) and Long COVID.

Cyclopharm sells Technegas in 64 countries around the world, with more than 1,500 nuclear medicine departments using the more than 1,600 Technegas generators that the company has sold globally. The units have conducted more than 4.6 million patient procedures in almost 30 years. In its most recent full-year financial report – for calendar 2021 – Cyclopharm reported $17.7 million in revenue, a lift of 20%: although it made a net loss of $5 million, the company paid a one-cent dividend for the year. Two-thirds of revenue comes from Europe.

But it has not yet cracked the US market. in May 2020, the FDA gave its approval to file a new drug application (NDA), kicking-off a review stage that involved a ten-month qualitative review in which the US Food and Drug Administration (FDA) assessed the safety and efficacy of Technegas. But in June 2021, the FDA effectively declined to immediately approve Technegas, issuing what’s known as a complete response letter, raising questions about the characteristics, production and delivery of Technegas particles. Investors did not like this news, with Cyclopharm shares plunging more than 40 per cent.

But that was not complete rejection, and Cyclopharm has been working with the FDA ever since to satisfy the regulator. It held a Type B meeting with the FDA in January 2022

Cyclopharm has told the ASX it expects FDA approval in mid-2023.

At the end of 2022, Cyclopharm had $6.7 million in cash.

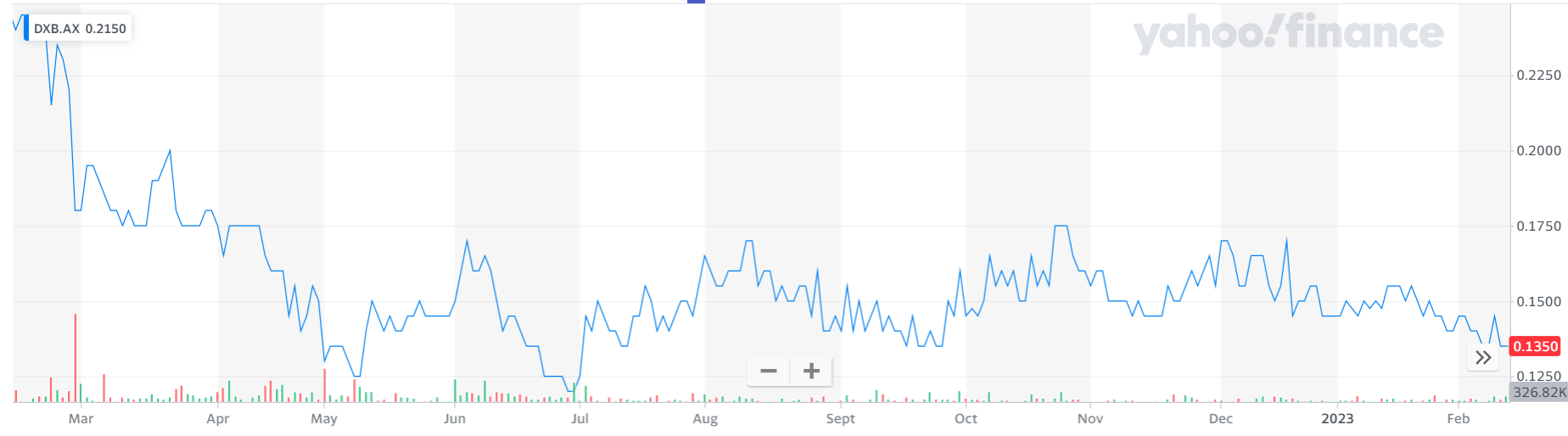

2. Dimerix (DXB, 13.5 cents)

Market capitalisation: $43 million

12-month total performance: –46%

Three-year total performance: –3.4% a year

Analysts’ consensus target price: n/a

The Melbourne-based Dimerix works on developing new therapies to treat inflammatory causes of kidney and respiratory diseases and has multiple late-stage clinical programs in both. Dimerix’s lead drug candidate, DMX-200, is in Phase 3 trials for the treatment of Focal Segmental Glomerulosclerosis (FSGS), which is a rare kidney disease with no approved treatment anywhere in the world.

FSGS is a particularly cruel disease, with half of all children who acquire it likely to endure kidney failure within five years. The disease, in which scar tissue develops in the glomeruli – the capillary networks that work as the microscopic filtration units in the kidney – and degrades their effectiveness, has no treatment approved anywhere in the world. For this reason, DMX-200 has been designated an “orphan drug” for FSGS by the US Food & Drug Administration (FDA), the European Medicines Agency (EMA) and the UK Medicines and Healthcare Products Regulatory Agency (MHRA).

An orphan drug is a drug developed to treat medical conditions which, because they are so rare, would not be profitable to produce without government assistance. Governments provide special incentives and fast-tracked approvals to orphan drugs, trying to bring cures or treatments to the market as quickly as possible. Orphan drug designation qualifies the sponsor of the drug for seven years of marketing exclusivity in the US and ten years in the EU following approval, as well as other development incentives.

The global Phase 3 FSGS trial, named ACTION3, is being performed across 75 sites, in 96 volunteer patients, with interim (part one) data outcome expected to be known in the second half of 2023. That will give a good indication as to whether DMX-200 is on track to be brought to the global FSGS market, which was valued at US$12.6 billion ($18.3 billion) in 2022, and growing at 8.2%.

At the end of 2022, Dimerix had $6.7 million in cash.

3. Pharmaxis (PXS, 5.5 cents)

Market capitalisation: $40 million

12-month total performance: –47.6%

Three-year total performance: –20.6% a year

Analysts’ consensus target price: 25 cents (Stock Doctor/Thomson Reuters, two analysts); 24 cents (FN Arena, one analyst)

Sydney-based Pharmaxis is expecting important trial results this year for both its lead drug candidate, PXS-5505, for the rare bone marrow cancer myelofibrosis, and its PXS-6302 topical drug for skin scarring.

PXS‐5505 is currently in a Phase 1/2a trial for the treatment of myelofibrosis, and is also in pre-clinical testing for glioblastoma (GBM), the most common form of brain cancer. Both are nasty conditions.

Myelofibrosis, a rare bone cancer suffered by one in 500,000 citizens, is a scarring of the bone marrow that interrupts the body’s normal production of white and red blood cells and platelets. This leads to fatigue, reduced immunity, clotting and bruising and bleeding. Myelofibrosis sufferers typically are aged 50 to 80 years, and can expect to live an average of only five years after diagnosis: about 10% typically go on to develop leukaemia. In July 2020 the FDA granted Pharmaxis “orphan drug” designation for PXS‐5505 for myelofibrosis.

Glioblastoma, for its part, is the most common form of brain cancer, with an average survival of just 15 months from diagnosis.

PXS‐5505 works by inhibiting the lysyl oxidase (LOX) family of enzymes, which play a crucial role in the development of severe fibrosis, as well as cancers to which fibrosis contributes. The company is a global leader in the LOX field. Pharmaxis is hoping that the drug can make it a global leader in myelofibrosis, and flowing from that, to develop PXS‐5505’s potential in several other cancers, including liver and pancreatic cancers. Interim data from the myelofibrosis was positive, and a significant data update is expected in the middle of this year.

A Phase 1/2 trial of PXS‐5505 as a first-line treatment for liver cancer, added to existing to chemotherapy, is in the patient recruitment phase, and Pharmaxis has also received FDA approval to conduct a clinical trial of PXS-5505 in the liver cancer known as hepatocellular carcinoma, or HCC: that study will yield first results in 2024. HCC is potentially the biggest addressable market that Pharmaxis is targeting, at US$7 billion ($10.1 billion).

The company is also expecting data by mid-year from its Phase 1 trial of PXS-6302, which has shown the potential to improve scar appearance and elasticity without reducing tissue strength. The trial has reported positive interim results, with patients demonstrating good tolerability. The trial is being led by Professor Fiona Wood, a renowned Aussie surgeon and the inventor of spray-on-skin for burn victims, a process now being commercialised by AVITA Medical, Inc. (ASX: AVH). Complete Phase 1c trial results are expected by June 2023, and are likely to attract global interest in the drug. An additional trial of PXS-6302 in scar prevention is expected to start recruiting patients in the first half of this year.

Pharmaxis also has a neuro-inflammation drug, PXS-4728, which is heading into a Phase 2 trial of patients with severe sleep disorder that can lead to neuro-degenerative diseases, for example Parkinson’s disease.

Pharmaxis also earns revenue by making and selling two products that it put through clinical trials for sale

- Bronchitol is approved for the treatment of cystic fibrosis to help patients clear mucus from their lungs. It is a precision spray-dried form of mannitol, delivered to the lungs by a specially designed, portable inhaler. Bronchitol works by rehydrating the airway/lung surface and promoting a productive cough. It is sold in Australia, the US, Europe and Russia.

- Aridol, a lung function test for asthma, sold in Australia, the US, Europe and Asia.

In the year to 30 June 2022, Pharmaxis earned $7.4 million from selling these products, up from $6.7 million in FY21.

At the end of 2022, Pharmaxis had $16.45 million in cash.

4. Neuren Pharmaceuticals (NEU, $7.27)

Market capitalisation: $938 million

12-month total performance: 68.7%

Three-year total performance: 35.1% a year

Analysts’ consensus target price: $8.60 (Stock Doctor/Thomson Reuters, three analysts)

Neuren Pharmaceuticals is quite simply one of the great stories in Australian biotech. The company has two drugs in development, with six programs in total, all aimed at serious neurological disorders, and all at Phase 2 stage or later. Five of the programs are expected to report news this year.

Trofinetide is targeting the rare neurological conditions known as Rett Syndrome and Fragile X Syndrome and is also being investigated as a treatment for traumatic brain injury.

Rett Syndrome is a form of autism that affects about one in 10,000 females, and is characterised by intellectual disability, loss of motor control and muscle rigidity. Fragile X is an inherited chromosome mutation known as a cause of autism, which according to Neuren’s 2018 Annual Report and research cited by the Royal Australian College of General Practitioners affects about one in 4,000 males and one in 6,000 females globally.

NDA for trofinetide to treat Rett syndrome was accepted by the FDA for Priority Review, with a Prescription Drug User Fee Act (PDUFA) date set for 12 March 2023. Once the FDA accepts a filing for the approval of a drug, the agency must complete its review process within ten months in most cases. The date at the end of the review period is referred to as the PDUFA date. Neuren’s North American partner for trofinetide, ACADIA Pharmaceuticals, has estimated the potential revenue for the drug in 2023 for Rett syndrome in the US alone at US$73 million (A$112 million), plus double-digit percentage royalties.

Neuren is also developing its NNZ-2591 drug for four serious neurological disorders — Prader-Willi, Phelan-McDermid, Angelman and Pitt-Hopkins syndromes — which each emerge in early childhood. None of these diseases have an approved treatment: all four programs have been granted orphan drug designation by the FDA. Common to all of these disorders is impaired communication between nerve cells, leading to disrupted brain function that significantly influences daily life.

Neuren expects results from Phase 2 trials of NNZ-2591 in Phelan-McDermid, Angelman and Pitt-Hopkins syndromes in the first half of 2023; last month, the FDA gave Neuren the green light to go ahead with a Phase 2 trial testing NNZ-2591 on children with Prader-Willi syndrome (PWS), and those results are expected in the second half of the year.

Trofinetide and NNZ-2591 provide an opportunity potentially to be the first approved therapy for one or more of these important indications. The FDA and the European Medicines Agency (EMA) have both granted orphan drug designation for trofinetide in Rett and Fragile X syndromes and for NNZ-2591 in each of Phelan-McDermid, Angelman and Pitt Hopkins syndromes; the FDA has also granted orphan drug designation for Prader-Willi syndrome.

In addition, the FDA has granted “Fast Track” designation for trofinetide in Rett syndrome and Fragile X syndrome. Fast Track designation provides for early and frequent communication with the FDA, ensuring that questions and issues are resolved quickly, to expedite the development and approval of therapeutically important drugs.

At the end of 2022, Neuren had $40.2 million in cash.

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.