If you can’t stand losing money, the next couple of months could be challenging. The stock market will be processing the data drops trying to work out whether inflation will fall fast enough to stop the Fed from raising too many times and risk putting the US economy into a recession.

It’s the ongoing battle between bulls and bears and the early win for the bulls in January has given way to small wins for the bears in the strength of a stronger US economy than was expected, which implies that high prices will be stickier for longer.

On the plus side, the AMP Pipeline Inflation Indicator is telling us that US inflation is on the slide, but it’s more goods inflation rather than services inflation. That will be the big watch for the next couple of months.

My mate Percy Allan has beaten his Covid challenges and is back to writing and this is how he sees the current battle between optimists and pessimists.

“Since the USA accounts for 60% of global stocks by value, it sets the tone for other share markets including our own,” he points out. “Bulls say that notwithstanding the Federal Reserve aggressively hiking its funds (cash) rate, America will have an “immaculate” economic soft landing or no landing at all. Yet inflation should quickly fall from hereon because its underlying causes – an abnormal demand for goods and services and a shortage of goods and labour – will end as life returns to normal from pandemic lockdowns and restrictions.”

But wait there’s more.

“Cash and bond rates won’t go back to zero but will settle around 2.5% and 3.5% respectively. Most households and businesses will adjust to that. Hence company earnings will hold up and stocks won’t crash.”

And this is Percy’s take on what the bears think is happening for stocks, and it’s hard to read: “Bears say the Fed will not only raise rates further, but also keep them high to force a recession to lock in low inflation. An economic slump will decimate company earnings that are inflated by historic standards. Investors will be “mugged by reality” as high rates continue to downgrade the value of their assets. Only after a recession and stock market crash will the Fed relent and start reducing rates. Zombie companies (unable to service their debts) will disappear and many homeowners who bought at the height of the property boom will default on their mortgages.”

Happily, Percy says there is agreement on a subject that we Aussie investors will be chuffed to hear: “Both bulls and bears seem to agree on one thing – Australia’s prospects look better than America’s because we don’t yet have a prices/wages spiral, a surge in immigration will alleviate our labour and skills shortages, our monetary policy is more effective (because mortgage rates are largely variable not fixed for 30 years as in America) and exports stand to benefit from China’s reopening after abandoning Zero-Covid and its improved relations with Canberra.”

So in that context I’ve gone hunting for three stocks that analysts like and which I often get questions about.

- Santos (STO)

The first is Santos (STO), which has been fighting gravity while Woodside has been flying relatively higher. The analysts surveyed by FNArena give the company a big thumbs up, which the market continues to ignore.

The average consensus rise is 33.4% but Macquarie is a huge fan, with a price target that is nearly 50% higher than the current price of $7.01. This table shows how supportive the experts are for this company.

Last week, Federal Climate and Energy Minister, Chris Bowen admitted that natural gas had a key role in the future as we transition to renewable sources of power. That should have been good news for Santos and its share price did rise by more than 1% on Friday.

- Pilbara Minerals (PLS)

The next company that has analysts divided is Pilbara Minerals (PLS) and once again Macquarie is the front of the supporter squad. It sees nearly a 70% higher share price. But Credit Suisse’s team takes an opposite stance with a negative 31% call against the stock’s price!

Macquarie likes the company’s recent strong earnings, year-on-year, but Credit Suisse thinks the good news for the business is already baked into its share price.

- Dicker Data (DDR)

The final one is an interesting company called Dicker Data (DDR). While only two analysts are surveyed, they’re both wildly positive about Dave Dicker’s business. Morgan Stanley sees a 57% share price rise ahead, while Ord Minnett tips a 38% gain over the year.

The business supplies products to the ICT industry and when I asked Dave a couple of years ago why he’s been so successful, he basically said he beats the pants of his foreign rivals because he understands his Aussie customers.

Dicker Data (DDR)

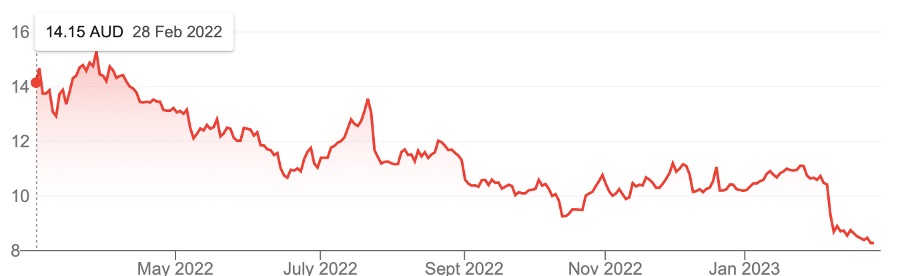

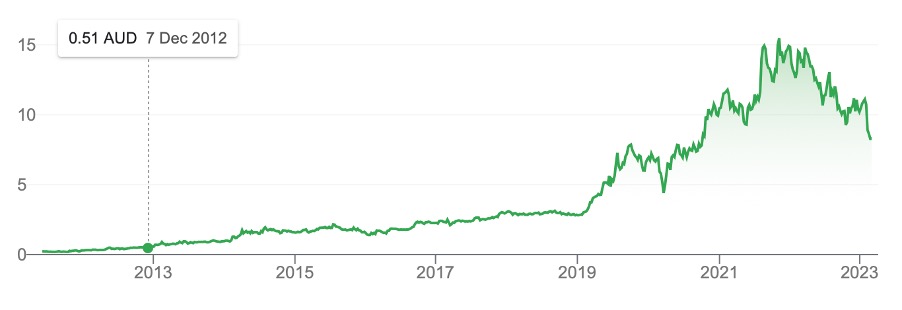

There is the argument that the 41% fall over the past year was due to the tech sector sell-off. Looking at the long-term chart for the company, you might give Dave and DDR the benefit of the doubt.

DDR

I’ll be interviewing Dave for my Switzer Investing program today, so make sure you catch it. This guy is one of the most laid back CEOs of a listed company that I’ve ever met!

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances