Everyone likes the occasional ‘punt’ on the share market – so I have scoured the ASX for three potential high-reward stocks for 2023 (and longer-term than that). Quite obviously, the risks are high too. But in each case, there’s a sound base for optimism on the “story” for investors who can tolerate the risk. Buyer beware – none of these should be the only stock in your portfolio, but if you have a solid core of high-quality holdings – maybe you could have a dabble on one or two of these.

1. Genmin (GEN, 25 cents)

Market capitalisation: $101 million

12-month total return: 47.1%

Three-year total return: N/A (listed March 2021, at 34 cents a share)

Analysts’ consensus price target: 61.9 cents (Stock Doctor/Thomson Reuters, two analysts)

African iron ore play Genmin is developing its flagship Baniaka iron ore project in the west African country of Gabon. At the wholly owned Baniaka, Genmin has identified an indicated resource of 168 million tonnes, within a total resource estimate of 760 million tonnes: however, this represents only 15 kilometres (18%) of the interpreted 85 kilometres of strike extent, so it is very likely to be enlarged.

Last month Genmin released the results a detailed pre-feasibility study (PFS) on the Stage 1 development of Baniaka. The PFS outlines a conventional open-pit mine working through five million tonnes of ore a year, over an initial ten-year mine life – a timeframe that is very likely to be extended. Some of the analysts that have looked at the Baniaka numbers expect that throughput will be easily doubled to ten million tonnes of ore a year, within five years.

The PFS gave a cash production cost estimate of US$59 a tonne, and an all-in sustaining cost (AISC) — a figure that incorporates not only the “cash cost” of production, but all the costs that allow production to be sustained — which compares to an iron ore cost that is estimated to average about US$97 a tonne. And that is for 62% iron “fines”: the Baniaka fines product is up to 64% iron, and will garner a significant premium. The PFS projected an initial capital cost of US$200 million. post-tax net present value (NPV) of the Baniaka project of $601 million — which looks very good next to Genmin’s current market capitalisation of $101 million.

The final investment decision for the project is expected in the second quarter of 2023, although pre-development works have commenced with Bond Equipment awarded a US$500,000 (A$740,000) first stage detailed design and engineering contract for the processing facility. Final investment decision (FID) should come in 2023, and if the green light is pushed, the company is targeting first production in mid-2024.

In July, Genmin struck a royalty deal with mining heavyweight Anglo-American on revenue from the sale of the first 75 million tonnes of iron ore from Baniaka, and payments commenced with a US$10 million cheque in July. The underpinning of the Anglo-American deal should be a great help with the finalising of the project funding, which should happen in the first half of 2023.

The project is favourably situated with respect to existing and operating bulk commodity transport, port access and renewable energy infrastructure: Baniaka will have strong ESG credentials, given that it will not have a tailings dam, will be powered by renewable energy (hydropower from the Grand Poubara Hydroelectric Power Station), and will produce a greener, high value-in-use (VIU) lump product.

Genmin has two other projects in Gabon: Bakoumba (advanced exploration stage); and Minvoul/Bitam (early exploration stage). But Baniaka is where all the action is. The developments late in 2022 have Genmin poised very attractively — and given that investors are buying for less than the IPO price, it looks to be excellent buying at these levels.

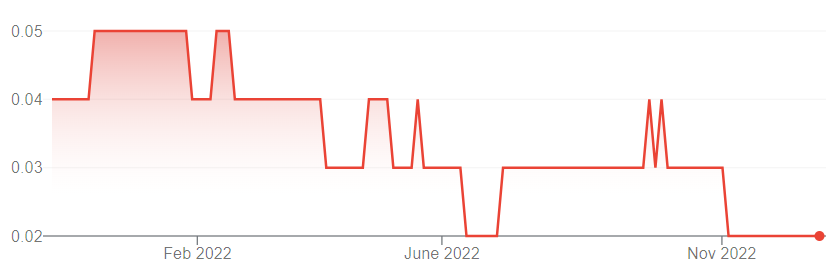

2. Carly Holdings Limited (CL8, 2 cents)

Market capitalisation: $4 million

12-month total return: —53.7%

Three-year total return: —58.6% a year

Analysts’ consensus price target: 61.9 cents (Stock Doctor/Thomson Reuters, two analysts)

Carly is an Australian online technology company that is leading the growth of the car subscription industry in Australia and New Zealand. The company launched the eponymous flexible car subscription service in March 2019, and secured automotive industry leaders SG Fleet (ASX:SGF) and Turners Automotive (ASX:TRA) as significant shareholders. Subsequently, the RACV came on-board as a major shareholder, too.

How Carly works is that it provides a flexible alternative to finance or purchase of a vehicle: Carly car subscription offers the use of a car without the long-term burden of debt or ownership, providing individuals and businesses with a more flexible and low-risk alternative to financing a vehicle or buying it outright.

Subscription is for a minimum of 30 days, and tends to go for two years at the maximum end. A monthly recurring payment covers all expenses other than fuel and tolls. People and businesses can get access to new or used cars at short notice, and can change the vehicle to suit changing needs. There is no break fee or upfront deposit: the subscription is not a debt. The company says its average subscription period is 5.6 months. Carly is the only car subscription service to have secured tax deductibility status as confirmed by the Australian Taxation Office (ATO). Carly subscribers using cars for business or work purposes can claim tax deductions: Carly is the only car subscription offering that can currently provide certainty of tax deductibility on car subscription payments.

Carly says car subscriptions is a large and growing opportunity, sitting between car rental, in which the longest period is about 14 days, and outright purchase and long-term finance. The company cites studies that show that 38% of Australians would consider subscribing to a car rather than purchasing or leasing; while 69% of Generation Z and 50% of Millennials indicate a preference for car subscription. (According to Pew Research Centre, anyone born between 1981 and 1996 is considered a Millennial, and anyone born between 1997 and 2012 is considered to be Generation Z.) Moreover, 47% of Australians would consider subscribing to, rather than buying, their next car; according to the Boston Consulting Group, globally this proportion runs at 52%.

These generations value access to items that meet their needs at particular times, and cars are no different; Carly says they will subscribe to everything from mobile phones to streaming on-demand movies and food, so why not cars? For the broader market, the company says individuals and businesses of all sizes are seeking a range of mobility solutions to match their lifestyle or commercial requirements, which can vary hourly, daily or monthly.

Also, in situations where vehicle leases are expiring however replacement vehicles are not always available; or customers are waiting for up to twelve months for dealers to deliver new vehicles; or customers are delaying vehicle upgrades as used vehicles are currently more expensive, Carly is working with dealers and lessors to support their customers to fill the gaps with subscription vehicles.

COVID lockdowns and vehicle supply shortages have caused problems for the business for much of its operating life, but despite this, growth has been strong: In the June 2022 quarter, compared to June 2021, subscription transaction value increased by 47%, while subscription revenue surged 112%. The company operates under two models, the “asset heavy” owned fleet model, where it owns or leases cars that it can supply to specific market opportunities; and the “asset light” model, which “monetises” excess vehicles in the market, without the need to buy or lease. With its second-largest shareholder being fleet management and leasing heavyweight SG Fleet, which manages more than 250,000 vehicles and supplies Carly with vehicles.

Carly secures vehicles under either model, depending on which is more favourable in the prevailing market conditions. It says the addition of the “asset heavy” model has given it greater control over vehicle supply and has helped subscription revenue as a proportion of transaction value to increase from 36% to 51%. Average gross profit per subscription jumped by 42%, to $329.

The collaboration with SG Fleet enables it to offer subscription services to its customers and derive a new revenue stream, while providing Carly with access to business and government demand channels. Carly also has a strategic partnership with its third-largest shareholder. Turners Automotive New Zealand, which launched “Turners Subscription powered by Carly” in September 2020; and with Hyundai Australia, the third largest car brand in Australia, which works with Carly to offer a co-branded subscription

offering for its vehicle range, supported by a Hyundai-funded marketing campaign. This provides a new way for consumers to access Hyundai vehicles, and generates both supply and demand for Carly.

Carly is tiny, and not profitable, but it is showing very promising signs in a market that is worth $55 billion a year in sales of new and used cars. The subscription model is only in its infancy, but the long-term use-case looks very compelling in terms of its flexibility and how it fits the changes in way that people want to gain access to cars.

3. Nyrada Inc. (NYR, 14 cents)

Market capitalisation: $20 million

12-month total return: —43.2%

Three-year total return: n/a (listed January 2020, at 20 cents)

Analysts’ consensus price target: n/a

Nyrada is an early-stage drug company that specialises in discovering and developing novel small-molecule treatments for cardiovascular, neurological and chronic inflammatory diseases. The company has two lead candidates, a cardiovascular drug candidate, PCSK9, which is a cholesterol inhibitor, and a brain injury drug candidate, NYR-BI02. Both target diseases with substantial market size and unmet patient need.

PCSK9 has been in pre-clinical trials to determine if it can reduce inflammation in vascular cells in the early phases of atherosclerosis, which is more commonly called “thickening” or “hardening” of the arteries. It is caused by a build-up of plaque — fats, cholesterol and other substances — in the inner lining of an artery. Atherosclerosis often has no symptoms until a plaque ruptures or the build-up is severe enough to block blood flow.

PCSK9 is known to play a role in regulating LDL-cholesterol metabolism in the liver, but in June, Nyrada reported that a study run by Duke University researchers using select candidates from the PCSK9 family of inhibitor compounds had shown success in blocking the early stages of the atherosclerotic plaque progression. The objective of the study was to determine if the inhibitors reduced inflammation in vascular cells in the early phases of atherosclerosis, in a human tissue-engineered blood vessel model of the disease developed at Duke.

The Duke trial showed successful results, but in the careful language of the life sciences, Nyrada says it “attenuated” — as in, “reduce the force or effect of” — the early stages of atherosclerosis. But, given that atherosclerotic plaque build-up is a major cause of cardiovascular disease, the opportunity for Nyrada to therapeutically target this disease in its early stages is highly encouraging.

According to the World Health Organisation (WHO), cardiovascular disease is the largest cause of death globally, taking the lives of an estimated 17.9 million people every year. One of the major causes of the disease is a build-up of LDL cholesterol in arteries, which can cause heart attack and stroke. Nyrada is aiming to prove that its PCSK9i inhibitor, which is taken orally, lowers LDL cholesterol levels.

Being an oral drug candidate, Nyrada’s drug has the potential to provide a valuable alternative to expensive and inconvenient injectable PCSK9 inhibitor drugs. Also, the drug would be an ideal alternative for patients who respond poorly to statins.

At the moment, Nyrada is working on the trial design for a Phase I first-in-human study of PCSK9, which is scheduled to commence in the first half of 2023.

The other candidate, NYR-BI02, is a first-in-class “neuroprotectant” drug to prevent secondary brain injury. This is the injury that occurs in the hours and days following the primary injury, and it is the secondary brain injury that leads to long term permanent brain damage and disability.

Each year, globally, more than 60 million people suffer a concussion or moderate to severe traumatic brain injury (TBI) yet no US Food & Drug Administration (FDA)-approved treatment for secondary brain injury exists. Every year there are 4.1 million TBIs in the United States, United Kingdom, Europe and Japan alone.

For stroke the need is similar, with only limited treatment options available. NYR-BI02 offers the potential to reduce the secondary injury, and therefore reduce patient mortality and disability and improve quality of life.

Nyrada is working with the Walter Reed National Military Medical Center (sic) in Washington, DC — one of the most prominent US military medical research facilities — on NYR-BI02. As part of this collaboration, Nyrada will initially test the efficacy of NYR-BI02 molecule at Walter Reed in a model of TBI, with an ongoing pre-clinical stroke model study to be completed by the end of 2022, and a Phase I first-in-human study on track to commence in the first half of 2023. Nyrada is well-funded for the Phase I clinical development work it has planned for 2023, with a cash balance of $9.9 million at present.

As with all life sciences technology situations, Nyrada is a very speculative investment, but one that could be highly rewarding if clinical trials go well, because it is targeting some major disease problems, where the medical world is looking for improved treatment options. Again, you are potentially benefiting from the fact that you are buying at below what IPO subscribers paid.

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.