I’ve copped some flak lately for suggesting technology stocks have further to fall and that it is too early to reinvest in the tumbling global tech sector.

Fair enough. When you’ve written investment columns for as long as I have (30 years and counting), you take criticism in your stride. You also realise that investor “denial” is part of the process that creates bear markets – and opportunities for others.

Context is needed with tech investing. In a sector as large as global tech, it’s dangerous to generalise. There are big differences within tech: a software-as-a-service company with recurring, “sticky” income is different to a speculative fintech, for example.

A risky TAM stock (total addressable market), which is promoted on the size of its market opportunity, is completely different to a tech leader like Microsoft Corporation.

Caveats aside, tech and other long-duration growth stocks are relatively more affected by rising interest rates. Rates worldwide are just starting to rise, so more pain is ahead for tech stocks. Buying them now is akin to “catching a falling knife”.

I think of tech bear markets in three phases. The first is valuation. Rising rates reduce the present value of future cash flows. That’s bad for tech stocks with low or no earnings now. The result: analysts have to downgrade valuations for many tech stocks.

The second phase is earnings downgrades. As wage costs rise, labour-market shortages bite and companies defer tech projects, more tech companies will downgrade their earnings this year. Earnings downgrades in the tech sector have a long way to run.

The third phase is equity capital raising. Unprofitable tech companies live from one capital raising to the next. That fine’s when markets are rising. When conditions sour, raising capital is harder. Some loss-making companies can only raise capital at sharply lower prices, badly diluting shareholders. Other companies run out of money and die or are acquired at fire-sale prices.

That is when capitulation sets in – the point when some retail investors think tech will never recover. That’s the time to buy. There will be a time to pounce on beaten-up tech stocks, but it’s too early right now. Of course, there are always exceptions in every sector that offer value. My sense is to watch and wait for better value in tech.

Dividends in vogue

If I’m right, the Australian share market has a treacherous 12-18 months ahead. Of course, there will be relief rallies during this period – perhaps we will see one start this week. But we are at a major inflexion point as markets adjust to a cycle of rising inflation and rates – after decades of falling government bond yields.

None of this will end quickly or painlessly. We’re in for a tough time as household budgets are stretched by higher food, energy and home-loan interest costs. And as heightened geopolitical uncertainty and a slowing global economy hurt demand.

As I have consistently written this year, the best way to play rising inflation is through global bank stocks and hard and soft commodity producers.

Also, investors should have a higher portfolio equity allocation to maintain their real return as inflation rises – and a higher cash weighting (to provide the optionality to buy more shares during equity market sell-offs).

Yield is paramount. If the S&P/ASX 200 index provides a flat or negative return over the next 12 months, as I expect, every point of yield will be critical. Getting a 5-7% yield from quality companies (more after franking) will help offset flat capital returns.

The good news is that resource stocks and, to a lesser extent, global banks should return more cash through higher dividends or launching share buybacks. I wrote last month in the Switzer Report [1] about the appeal of Australia’s big miners (notably BHP Group) for income investors.

Still, I never understand why conservative income seekers invest directly in a handful of stocks (often the big-four banks and Telstra) and take company risk. A better approach is investing in an active income fund that provides diversification and reduces risks.

Why get a 5% yield on one stock when you can get 5% from a fund with dozens of stocks, and benefit from managers who invest for dividends every day?

I favour Listed Investment Companies (LICs) for yield. As closed-ended funds, LICs are better able to smooth dividend payouts and franking credits compared to open-ended unit trusts. The company structure of LICs is an asset for income investors. To my thinking, dividends and franking are the best selling points of the LIC sector.

Yes, LICs have their challenges. The biggest is the possibility that a LIC trades at a permanently large discount to its pre-tax Net Tangible Assets, frustrating its manager and the LIC’s shareholders. This can occur if the manager has a patchy performance record, poor dividend history, weak marketing or its asset class is out of favour. Liquidity is another issue for LICs that invest in small-cap companies.

However, a large LIC discount can also be an opportunity. The market gets it wrong with some LICs through an excessive NTA discount. Eagle-eyed investors might, for example, buy $1 worth of assets for 90 cents thanks to a 10% discount to NTA.

Again, every extra point of return in this market matters. If the discount in this LIC example narrowed (the 90-cent price moved towards $1), that could make all the difference in a flat market. A 5-7% yield would be even better.

LIC ideas

ASX data shows a long list of LICs trading at a discount to NTA at end-March 2022. The key, however, is not just looking at discounts in isolation, but rather over one, three and five years. LICs have a habit of reverting to their mean discount/premium over time.

Consider a LIC currently trading on a premium of 1% to NTA. Historically, it has averaged closer to a 5% premium. A longer-term view is needed.

Here are three LIC yield ideas for conservative income seekers. Patient investors should put quality LICs on their radar: the market sell-off will create opportunities for listed asset managers (and managers of unlisted managed funds, which I’ll cover in a later column).

1. Australian United Investment Company (AUI)

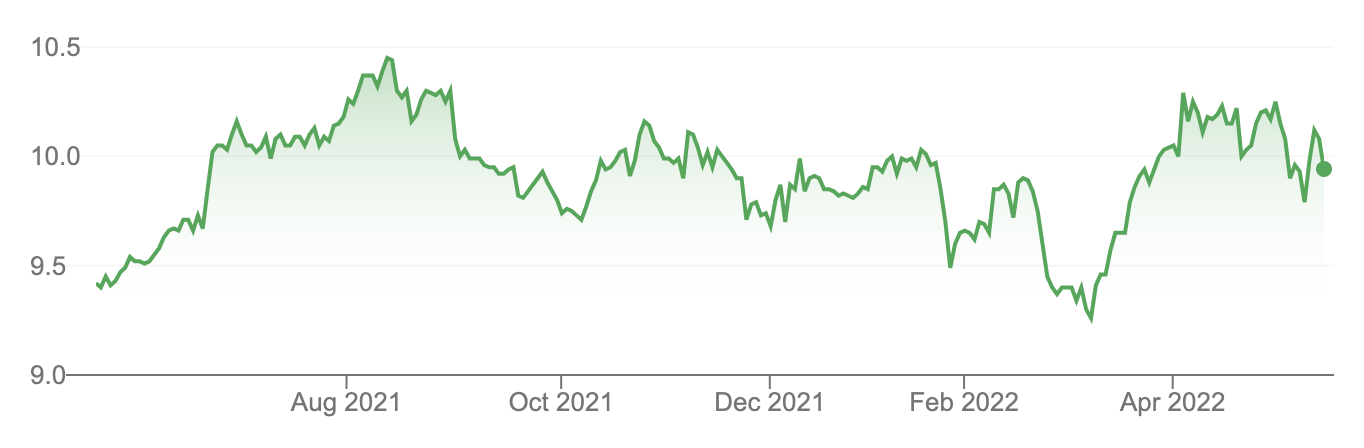

The investor in large-cap Australian equities traded at a 6.3% discount to NTA at end-April 2022, ASX data shows. According to Bell Potter’s excellent LIC research, AUI has had a discount/premium range of -8.7% (low) to 1.2% over five years.

Put another way, AUI is trading in the bottom quarter of its historic LIC discount/premium range. Its discount has averaged about 5% over the past five years. AUI yielded 3.55% before franking, ASX’s latest LIC data shows.

That’s not the best LIC yield available, but AUI has maintained or increased its dividend each year since 1984. Dividend reliability is even more precious in this market, and getting it from a long-established, well-run LIC makes sense.

Australian United Investment Company (AUI)

2. Clime Capital (CAM)

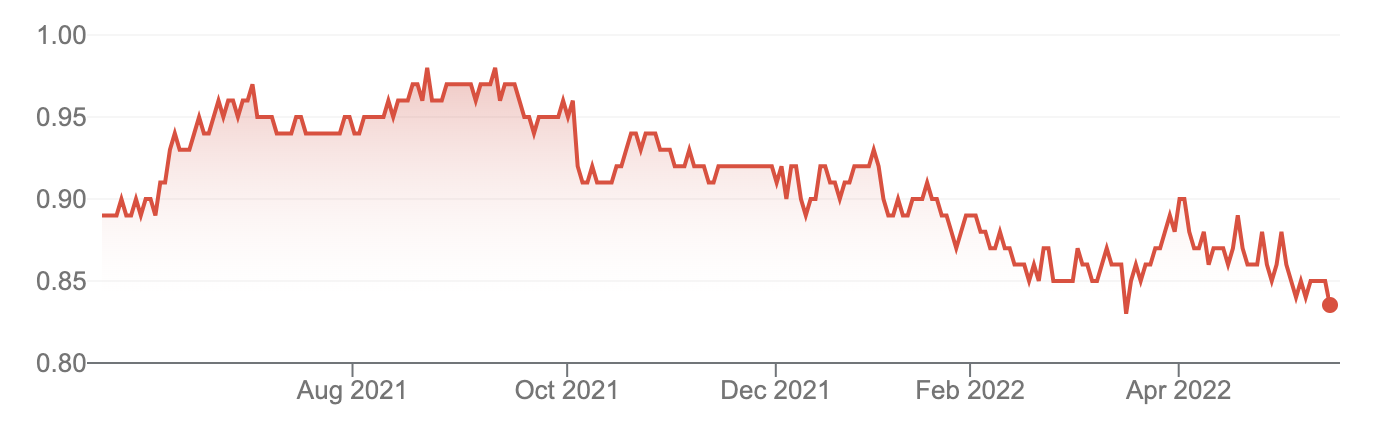

Clime Capital targets conservative income investors through quarterly dividends and its investment style that owns mostly large-cap, dividend-paying Australian shares. The LIC traded at an almost 4% discount to NTA at end-April 2022, ASX data shows.

That’s roughly in line with Clime’s 5-year average discount, using Bell Potter data. However, Clime’s trailing yield of almost 6% (before franking) appeals in this market.

Conservative investors might prefer larger LICs like Australian Foundation Investment Company (AFIC) or Argo Investments. Those LICs trade at premiums to NTA and have lower dividend yields than Clime, which has had improving performance in recent years, and whose value-investing style suits this market.

Clime Capital (CAM)

3. Future Generation Investment Company (FGX)

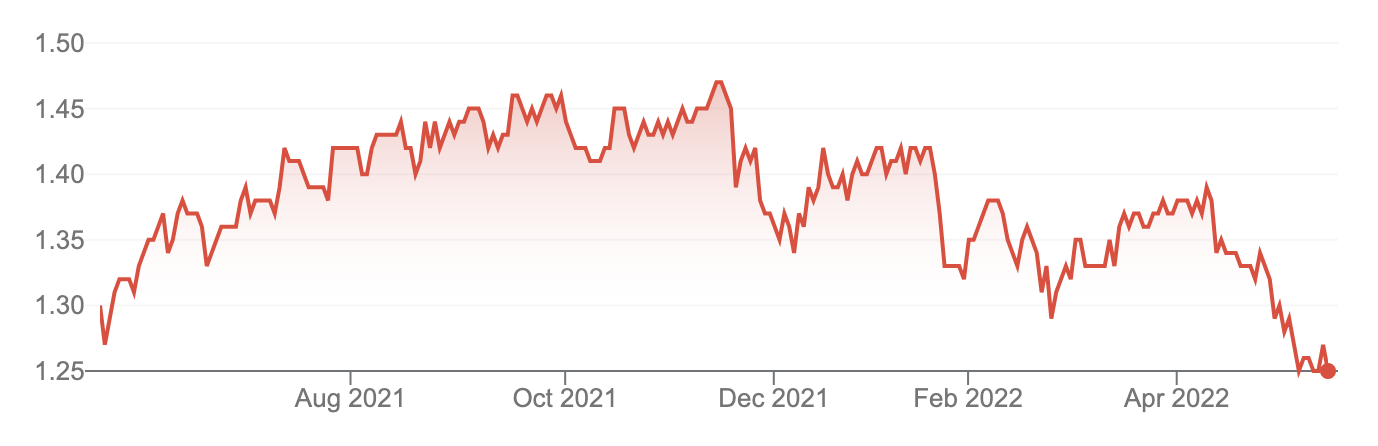

The philanthropy-focused LIC traded at an almost 7% discount to NTA at end-April 2022, ASX data shows. Future Generation’s trailing yield is 4.5% (before franking).

FGX has slightly outperformed the S&P/ASX 200 index over five years, yet trades at a decent discount to NTA. FGX has done better than its global version – Future Generation Global, which traded at a 9.3% discount to NTA at end-April 2022. The investment portfolios in both LICs have been less volatile than their underlying indices.

FGX’s other benefit is that it provides exposure to leading Australian and global asset managers, without paying management or performance fees. Since its September 2015 listing on ASX, FGX has made $52.9 million in social investment (to 2021). The well-run LIC’s innovative philanthropic focus is one of its best traits.

Future Generation Investment Company (FGX)

Tony Featherstone is a former managing editor of BRW, Shares and Personal Investor magazines. The information in this article should not be considered personal advice. It has been prepared without considering your objectives, financial situation or needs. Before acting on information in this article consider its appropriateness and accuracy, regarding your objectives, financial situation and needs. Do further research of your own and/or seek personal financial advice from a licensed adviser before making any financial or investment decisions based on this article. All prices and analysis at 18 May 2022.