Over the years, I’ve learned a few things about megatrend investing. The key one is investors confusing megatrend investing with active investing and portfolio tilts.

Novice investors get bored with well-known megatrends, believing their best returns are over. Instead, they chase the latest fad or hot trend. They follow the herd, even though that’s a sure-fire way to destroy capital in the long run.

In late 2021, I warned about the dangers of thematic investing using Exchange Traded Funds (ETFs), in a feature for a national newspaper. Predictably, a trend captures investor imagination, ETF issuers launch a thematic ETF and investors buy at the top.

I noted a 2021 US study, “Competition for Attention in the ETF Space,” that found specialised (thematic)ETFs overseas lose about 30% in risk-adjusted terms over the first five years after launch, on average. That’s the danger in chasing trends too late.

Another insight is investors underestimating the strength and duration of genuine megatrends. Consider the greatest megatrend of them all: the ageing population. This trend has been known for decades, yet we don’t hear much nearly as much about thematic investing in ageing compared to tech and other trends.

Investors, it seems, would rather punt on artificial intelligence, esports, crypto and other trends. Some themes, of course, will reward investors. But the most powerful trends – ageing, health, Asian middle-class consumption – are a better long-term bet.

Healthcare is an example. Global healthcare equities should have an allocation in most long-term growth portfolios. Over the past 15 years in this column, I have highlighted the benefits of adding healthcare exposure to portfolios. I stand by that view.

My “go-to” exposure – the iShares Global Healthcare ETF (ASX: IJX) – has a 10-year averaged annualised return of 14.2% to end-May 2023.

I like healthcare for three main reasons. First, healthcare is traditionally a defensive sector less affected by economic slowdowns. We still need to see a doctor, take medicine and get tests if we are sick, regardless of economic conditions.

Yes, some parts of the healthcare sector are more cyclical than others. Medical devices are more affected by a slowing economy. Other parts of the healthcare sector are more speculative, such as telemedicine and digital health. But the big global healthcare companies are generally more defensive and less cyclical.

The healthcare sector’s defensive qualities stand out as the world – and possibly Australia – heads towards recession this year. BlackRock notes that the global healthcare sector has outperformed broad markets by an average of 10% over the last several recessionary periods.

Healthcare’s second attraction is its growth prospects. As BlackRock notes in its 2023 Sector Outlook (healthcare) report: “… The number of persons aged 80 years or over is projected to triple from 143 million in 2019 to 426 million in 2050 (source: Our World in Data 2022). These changing demographics provide potential for long-term secular demand and growth for healthcare products and services for decades to come.”

The third factor is valuation. The iShares Global Healthcare ETF is on an average Price Earnings (P/E) multiple of 22 times (at end-May 2022). That’s broadly in line with the S&P 500 Index in the US. Healthcare historically trades at a slight premium.

Investors who want healthcare exposure should look offshore. Choice in local large healthcare stocks is limited and they often look expensive against global peers.

An ETF is a convenient, low-cost way to gain exposure to global healthcare stocks via ASX. Australia also has some excellent active funds in this space (more on them below).

Here are three global healthcare funds to consider:

- iShares Global Healthcare ETF (IXJ)

As mentioned, IXJ has been my preferred healthcare exposure for long-term investors. IXJ tracks the S&P Global 1200 Healthcare Sector Index, thus providing instant diversification by country and healthcare sub-sector.

About 70% of IXJ is invested in the US. By sub-sector, the ETF invests across global biotechnology, pharmaceutical, healthcare and medical-device companies. Its largest holdings feature the world’s best-known healthcare companies.

IXJ is a simple way to get global exposure to healthcare, without having to pick healthcare sub-sectors or company winners. IXJ is unhedged, so investors need a view on the direction of the Australian dollar against the Greenback. IXJ’s annual fee is 0.4%.

Investors who want to eliminate currency risk – and seek pure healthcare exposure – could consider the BetaShares Global Healthcare ETF (ASX: DRUG) (Currency hedged). It includes 59 healthcare stocks, so is more concentrated than IXJ.

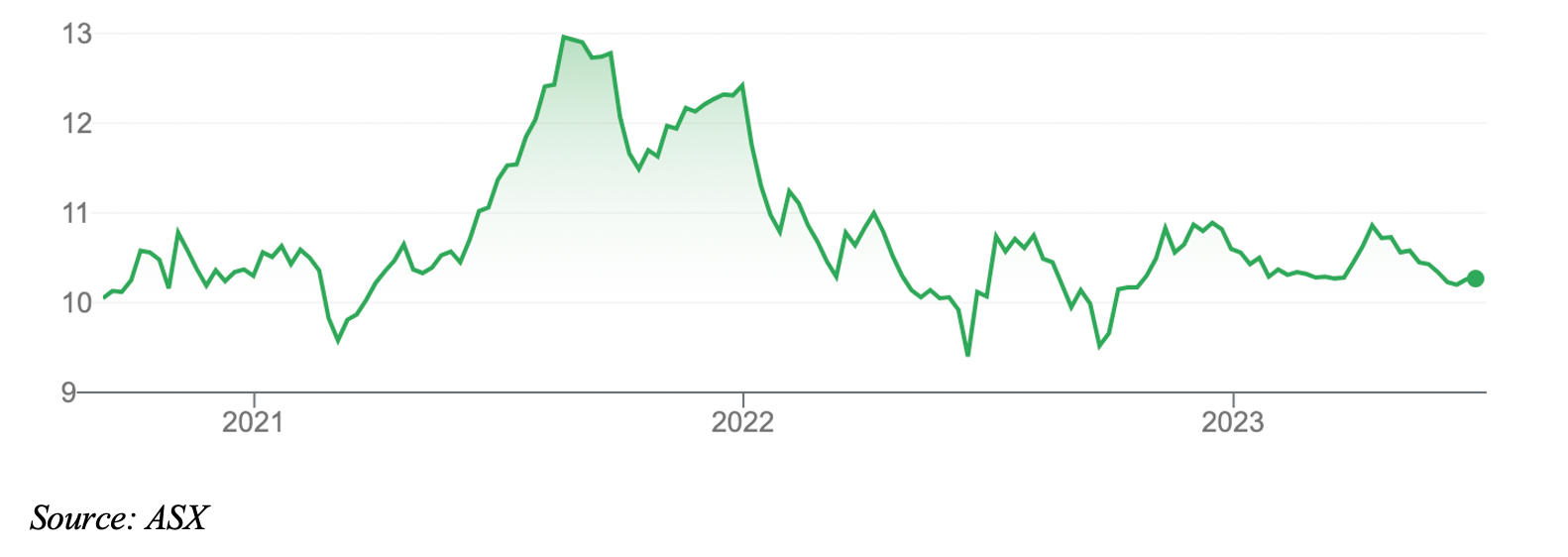

Chart 1: iShares Global Healthcare ETF

- VanEck Global Healthcare Leaders ETF (ASX: HLTH)

HLTH is a ‘smart-beta’ ETF that uses rules to invest in a diversified portfolio of global healthcare companies in developed markets (excluding Australia).

HLTH tries to identify healthcare companies with the best GARP (Growth at a Reasonable Price) attributes. Stocks in HLTH’s underlying fund are chosen based on four factor categories: growth, value, profitability and cash.

HLTH holds 50 stocks, but many of its largest holdings would not be well known to Australian investors. The ETF returned 2.54% over one year to end-May 2023.

It’s early days for HLTH, which listed on ASX in September 2020. Smart-beta ETFs have their place and I see the benefits of using factors to identify the best healthcare companies and not overpay for them (as can happen with capitalisation-weighted indices). But I still prefer a broad-based approach through IXJ.

Chart 2: VanEck Global Healthcare Leaders ETF

- Platinum International Health Care Fund

I mentioned earlier that Australia has some terrific actively managed global healthcare funds. Unlike ETFs, active funds seek to outperform their benchmark index.

The Platinum International Health Care Fund stands out. I’ve followed this unit trust for years and rate its investment team among the best in their field. The fund’s top-10 positions include some of the world’s most promising healthcare companies.

The fund has an average annualised return of almost 13% over 10 years to end-May 2023, slightly below its index. Over one year, the fund is up almost 30%, or about three times more than its benchmark. After a tough few years, the fund’s investment strategy is outperforming.

Long-term investors will note IXJ has a slightly higher annualised 10-year return than the Platinum Fund (after fees). But this is a good time for active funds management, particularly in the healthcare space as new technologies revolutionise the sector. Investors need active managers who can spot emerging biotechnology companies before they can into indices – and protect their capital in volatile equity markets.

Conservative long-term investors who want low-cost healthcare exposure should stick to IXJ. Those with more of a medium-term view, and a desire for active management in healthcare, could consider the Platinum International Health Care Fund.

About 60% of the Platinum Fund is invested in biotechnology companies, there is currency risk and the fund can be concentrated (it can hold 30-100 stocks). With that comes higher risk, but also potential for higher returns from global healthcare equities.

Tony Featherstone is a former managing editor of BRW, Shares and Personal Investor magazines. The information in this article should not be considered personal advice. It has been prepared without considering your objectives, financial situation or needs. Before acting on information in this article consider its appropriateness and accuracy, regarding your objectives, financial situation and needs. Do further research of your own and/or seek personal financial advice from a licensed adviser before making any financial or investment decisions based on this article. All prices and analysis at 28 June 2023.