This won’t surprise you but I’m expecting a better year for stocks than what we saw in 2023, though the December quarter was a ripper, as I expected. As with all years with stocks, there will be tailwinds and headwinds, but I suspect the former will outweigh the latter.

One big headwind from 2022 and 2023 was rising interest rates but this is set to turn into a tailwind. So, what central banks do with these big influencers on stock prices will be huge for optimistic share players.

Futures traders think there’s a 74% chance that the Fed will start easing its funds rate in March, but a week ago it was 88%. “Solid US jobs growth, cautious Fed minutes, and a still robust US economy raise doubts about markets’ aggressive Fed rate cut expectations,” said Christian Keller, head of economics research at Barclays. “Markets’ insistence of Fed cuts by March may turn out to be overly confident. The Fed minutes suggest that the FOMC members remain quite reluctant to reduce rates very soon.”

Even if the Fed doesn’t cut in March, US markets know that will happen and stock prices will be positively affected as a consequence.

Meanwhile last week the AFR reported: “Bond futures are fully priced for an RBA easing in September, from June, and ascribe an around 50 per cent chance of a follow-up move by December, from more than 100 per cent previously indicated last week. Financial markets give a 6 per cent chance only of an increase at the first 2024 policy meeting ending on February 6. Even so, nine economists, including NAB, out of 40 surveyed by The Australian Financial Review predict the central bank will lift borrowing costs to 4.6 per cent, because of sticky services inflation.”

Remember this: if the RBA raises again, it will be because the economy is doing better than expected and is keeping inflation higher than what the central bank wants. I’m betting rate rises are over and we will avoid a serious downturn, which would be great for stocks.

I always like history to reinforce my view on stocks and historically falling US interest rates have been good for stocks, especially cyclical stocks, and also the price of gold and commodities as the US dollar falls.

Also, in this AFR chart above, have a look at how our market has performed over the past nine years. We’ve had four negative years out of nine, but history says there’s usually two to three down years out of 10, so once again history is on the side of stock players.

Consequently, I like this from Goldman Sachs: “We expect S&P 500 firms in aggregate will beat analyst forecasts,” with the note predicting a gain of at least 5 per cent on stronger US economic growth, lower interest rates and a weaker US dollar.”

What do I worry about? The stickiness of services inflation? I suspect these concerns are overdone. I worry about unknowns such as Houthis raiding ships in the Red Sea and what happens in the Middle East. Russia in the Ukraine and OPEC and what it can do with oil prices. But history tells me that Western economies tend to soldier on through crises.

In the end, interest rates, economic growth, confidence, and company profits are the big determinants of stock prices. I think all these will work in the favour of investors.

But what should we invest in?

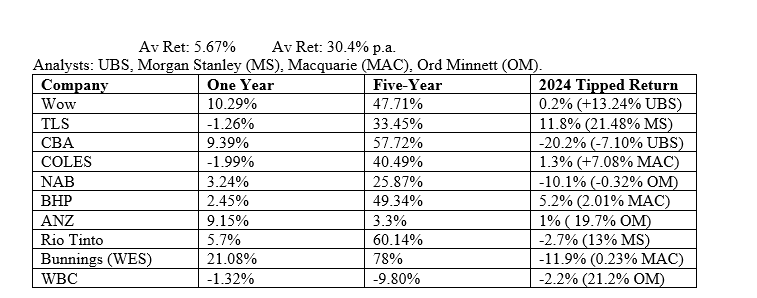

Below I look at classic core stocks that have been a mixed bag over the past year but have been largely great over five years. However, the consensus predicted returns from analysts on FNArena show these blue chip companies might disappoint in 2024. I have shown outlier analysts, who might be more positive on these solid companies, but as you can see, the general view is that these great businesses won’t star in 2024.

This year should be good for the re-loving of tech stocks, especially in the US, but our best tech companies such as Xero, Next DC and others should do well. I’m positioning for a mid-cap and small cap bounce-back this year and I expect interest rate sensitive businesses will do well.

Over the next few weeks, I’ll be scouring the best small- and mid-cap stocks to see what could star this year. From a portfolio point for view, I’ll keep the faith with core holdings but shoot for big returns from satellite or less-core stocks.

That said, while I won’t sell CBA because my capital gain is too great, I could easily sell the likes of NAB, ANZ and Westpac, to buy a small cap fund or ETFs such as VAS, VHY, IHVV, or even the thrillseeker play called GEAR.

By the way, if I sell a stock such as NAB, I could easily buy in again if its stock price falls, as my underlying strategy is always to buy good companies when the market takes a set against them.

Important information: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. For this reason, any individual should, before acting, consider the appropriateness of the information, having regard to the individual’s objectives, financial situation and needs and, if necessary, seek appropriate professional advice.