Welcome back to another year with the Switzer Report! In case your holidaying has distracted you, Thursday stock trading on Wall Street hit all-time highs, with the Dow and S&P 500 closing above 31,000 and 3,800 respectively. Meanwhile, the Nasdaq Composite index beat the 13,000 level for the first time ever, which was pretty good, given tech stocks are (relatively speaking) on the outer.

All this positive action for stocks in the US and here locally (where we’ve had an historically great start) makes me think about how important January can be for anyone wanting to be long shares.

There’s an old market maxim that as January goes, so goes the rest of the year, and so far this January is looking really impressive. But it often does as the so-called January Effect suggests.

The “January Effect” has some form, as Investopedia pointed out: “One study, analyzing data from 1904 to 1974, concluded that the average return for stocks during the month of January was five times greater than any other month during the year, particularly noting this trend existed in small-capitalization stocks.”

And what about January as an indicator for the rest of the year? Arian Tout of Tradethetape.com.au put this into historical perspective: “… a gain in January has foretold an annual gain 87% of the time with only 9 major errors going back to 1950, according to the Stock Trader’s Almanac.”

That said, other factors can get in the way. I don’t like investing on rules of thumb but I do like it when I think history suggests that markets do well in some months and years and this coincides with other factors that will drive stocks higher in the months ahead. Be clear on this: a lot of really smart investment experts think stocks will kill them this year! And it’s not simply because of what January is telling them so far.

Earlier this week, Bloomberg did its annual survey of the world’s biggest investment banks, banks, brokers and asset management operations, which covered over 50 assessments. The bottom line conclusion was to be long stocks!

The consensus was that the combined mega-hit of huge fiscal stimulus, record low interest rates and vaccinations will conspire to make stocks the assets worth chasing. And it’s our job at the Switzer Report to pinpoint the stocks worthy of your attention and investment.

Goldman Sachs thinks the S&P 500 will end 2021 at 4,300, which would be a 13% gain. But this was before the Democrats took the Senate. Bigger spending will probably see the investment banks pump up its index guess. On the more confident side, Wells Fargo and LPL think company earnings will surge 30%!

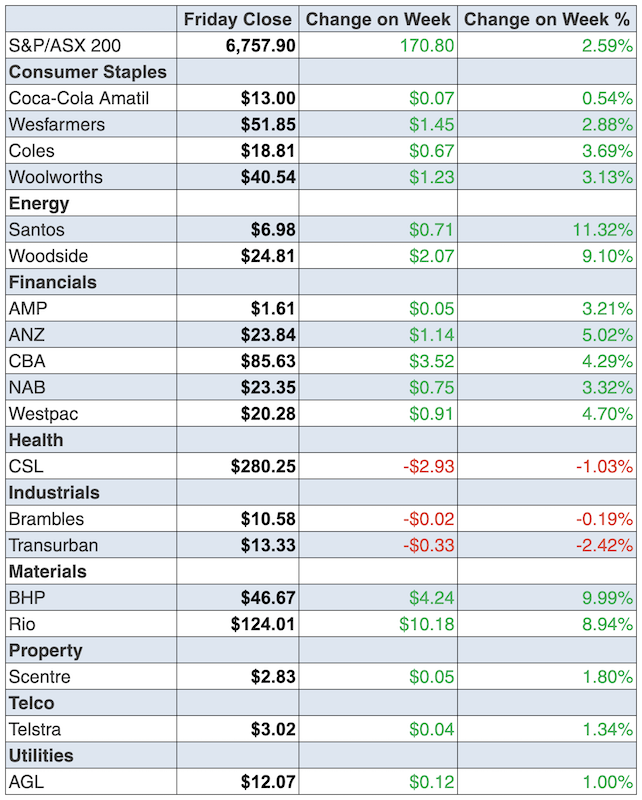

On Friday, our S&P/ASX 200 ended up 45.9 points (or 0.7%), finishing at 6757.9, which made it a 2.6% gain for the week, after starting Monday with the best first day gain for 20 years.

The Democrats win has led to Wall Street positivity that some experts thought was unimaginable but their potential bigger spending has been seen as a plus for the US economy, company profits and share prices.

Despite this, US stocks were in and out of negative territory on Friday but it wasn’t anything dramatic. It could’ve been very negative, with the Yanks losing jobs in December. Some 140,000 jobs were lost, which was a big miss, given economists expected a 50,000 gain.

But why would this surprise anyone, with 21.5 million Coronavirus cases in the States right now? Typical of Wall Street, the coincidence of bigger-than-expected job losses, more virus-related restrictions on business and the Democrats now set to run the Senate has raised expectations of greater stimulus cheques to result. Under a Republican-controlled Senate, $600 payments were on track but some experts think it could be pushed to $2,000! Of course, that would not only lead to greater economic growth and better stock prices, it would lead to a lower greenback and a higher Aussie dollar, which we’ve been tipping for at least six months.

The Oz dollar was 77.33 US cents at the time of writing and is going higher, thanks to how the state of Georgia rejected the Republicans in the Senate vote rerun this week. “Biden’s team was already going to be pushing for increased fiscal stimulus and the December report provides them with even more ammunition to make their case…” wrote Adam Crisafulli from Vital Knowledge. (CNBC)

Right now, tech stocks have been copping it, as cyclical stocks like miners and banks win friends. Woodside Petroleum advanced 9.1% to $24.81! Meanwhile, as the AFR reported: “Commonwealth Bank advanced 4.3 per cent to $85.63, Westpac firmed 4.7 per cent to $20.28, NAB added 3.3 per cent to $23.35 and ANZ rose 5 per cent to $23.84.”

However, there will be buying opportunities ahead, as short-term investors take profit and create bargains for long-term players. For example, CSL under $280 this week brought in the smarties, and there’ll be many good buys in coming weeks.

Currently, we’re looking at a rotation out of growth stocks (like our tech favourites) into value stocks, but eventually vaccinations and faster economic growth from the huge stimulus programs will help growth stocks.

What I liked

I’ll start this in earnest next week as the data deliverers get back to work, but here’s a quick summary of the past three weeks from Shane Oliver of AMP Capital: “Australian economic data releases over the past three weeks have generally been solid with another surge in November retail sales (up 7% month on month as Victoria reopened), further gains in building approvals, another strong rise in job ads (which are now actually up 5% year on year) and a strong rise in imports and another strong rise in home prices in December leaving them up 2% through 2020. Credit growth remained soft but looks like it might be bottoming and APRA data showed that the share by value of housing loans in deferral had fallen to just 2.8% from 11% in May, suggesting that the winddown of bank payment holidays won’t pose a major problem for the property market.”

And on that subject, you have to be buoyed by the latest house price data out this week. According to CoreLogic, Australian capital city average dwelling prices rose 0.9% in December and by 2% through 2020, which, considering the year brought the worst recession since the Great Depression, was a pretty good effort.

What I didn’t like

Again, Shane has pinpointed a big watch issue that I really wish I didn’t have to report on: “Of course, this [good] data [above] was all before the latest coronavirus scare in NSW. While new cases now look like they’re coming under control again, the scare, compounded by partial lockdowns and a return to border closures, will weigh a bit on confidence, which may not be enough to stop the recovery but it could slow it. Along with the reality that we still have a long way to go to get to full employment and the continuing surge in the value of the $A, this will act as a dampener on the recovery and will all likely see the RBA remain under pressure to maintain easy money. A rate hike remains several years away and the RBA is still likely to extend its QE program beyond April to match other central banks QE programs in order to help slow the rise in the $A.”

And I’m watching virus infections in the US and Europe, which have seen rising trends resume, with the UK seeing new cases almost quadruple to over 60,000 a day over the last month, thanks to a new 70% more contagious strain! The trend also remains up in Canada and Japan with a new rising trend in South Africa also based on a new strain, which could lead to some surprising, temporary lockdowns, such as we saw in Queensland late this week. Brisbane faces a three-day lockdown to stop the spread of this mutant COVID strain. This could lead to some government restriction decisions that could surprise us all.

The game changer ahead

Vaccinations and the success of these jabs will be the game changer for the Oz economy, the world economy and stock prices in 2021. As a consequence, I really liked the SMH news story this week, which was headlined: “COVID-19 vaccination on track to start in February: Scott Morrison.”

As the top investment experts have predicted, 2021 will be great for stocks, even if it takes time, because vaccinations plus big budget deficits and unbelievably low interest rates will drive economic growth and stocks prices.

And I’ll be a big buyer of overall market dips or sell-offs of companies I really like, in what should be a stock player’s paradise over 2021. I’ll also be positioning myself to gain from companies that will do better as the reopening of economies progresses because of vaccination success, when it comes.

What companies will they be? Watch this space, as this is what we do.

Top Stocks – how they fared:

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.