There are two ways you play this Coronavirus threat to your wealth — either you cash out now and sit on the sidelines, possibly copping the capital gains implications (if you have any), or you sit this out and let the market recover from the over-the-top reactions of stock markets.

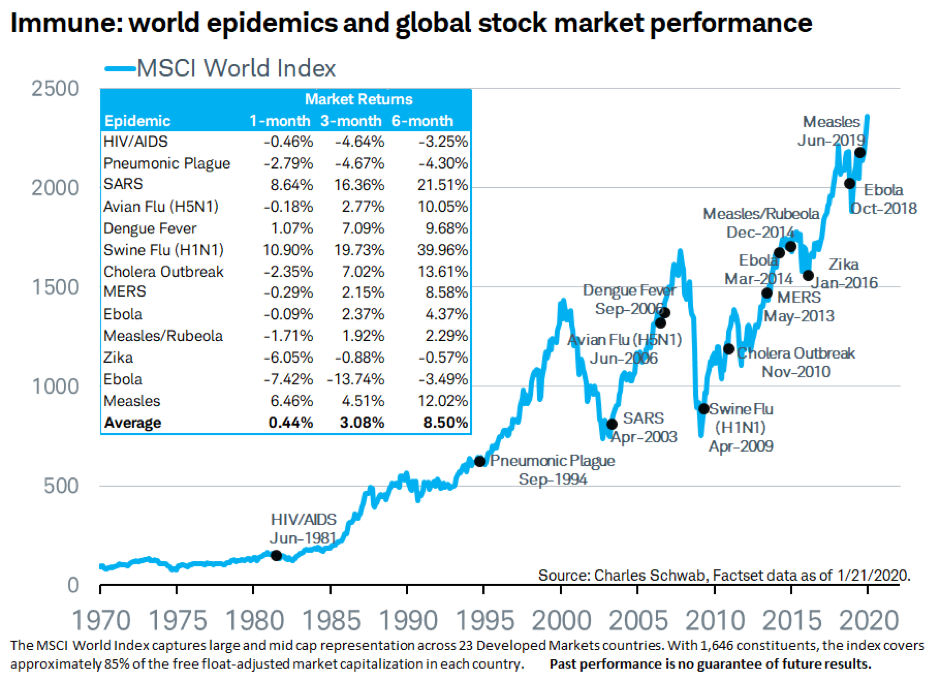

I keep using this chart to show you what history has taught me:

After every disaster the market has rebounded, with some stronger than others but the magnitude of the sell off, ultimately, will determine the magnitude of the rebound.

What’s interesting is that in none of these medical emergency cases (in the chart above) has the tragedy resulted in a bear market. And sometimes the fall looks so small because the rebound that follows is so big.

In case you missed it, SARS took 6% off the stock market, and then the S&P 500 posted a gain of more than 20% in the three months after the World Health Organization said it was investigating the SARS outbreak in March 2003. But history shows that other things can affect the overall market reaction.

“We believe SARS was largely overshadowed by the U.S. invasion of Iraq on Mar.19, the fall of Baghdad on Apr.10 and end of major operations on May.1,” said Cowen equity research analyst Kevin Kopelman. “When the SARS outbreak began, the economy was also in early stages of an expansion phase and the S&P traded at 15 times price to earnings.”

On the other hand, Ebola hit stocks by 13% overall over different lengths of time but, once again, there was a solid rebound once medical authorities played down the global threat.

That’s what I’m waiting for before I go back into new stock purchases.

History shows me that Wall Street’s reaction to such epidemics and fast-moving diseases is often short-lived, so I’m hoping history is our best guide.

And history gives us a reason to be optimistic. Optimism is even being preached by none other than Professor Steve Keen — Dr. Doom — who thinks rate cuts won’t do much to help the stock market, but a big budget stimulus package, akin to the Kevin Rudd/Wayne Swan one that saved us from recession, could help lift GDP, confidence and stock prices. Steve will be on tonight’s programme — go to YouTube & Switzer Financial Group after 7pm to see my interview with him, Chris Joye, as well as Charlie Aitken and Paul Rickard. The show will focus on how we play the Coronavirus.

Tomorrow, the RBA has to cut rates or it will disappoint the stock market, but the ball will firmly be in Scott Morrison’s and Josh Frydenberg’s court to come up with spending initiatives and probably tax cuts to ensure that the loss of Chinese export demand, such as tourists, will not push the economy deep into recession.

The calibre of the medical and economic responses by our government and global governments will determine how far stocks fall, and how quickly they rebound.

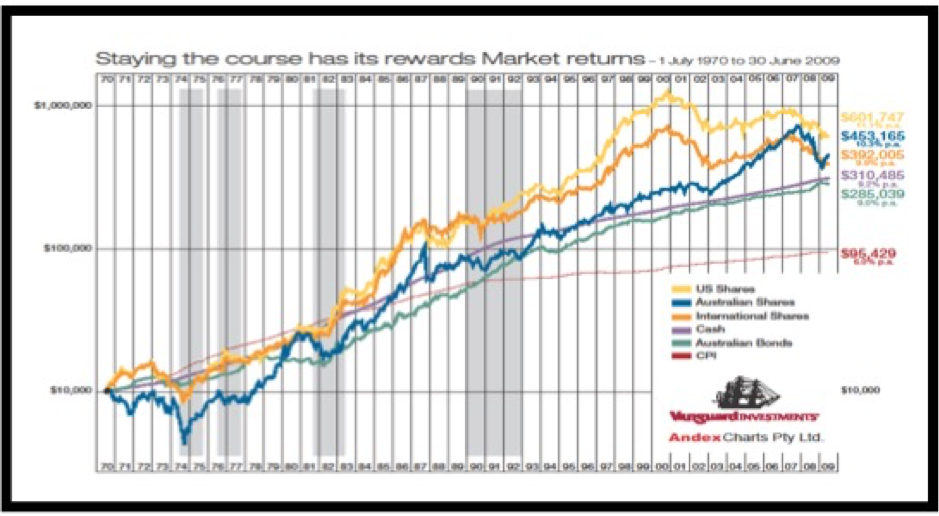

And this chart should help you keep the faith about stocks:

Every dip in the blue line was quickly offset by a big rebound in stocks. Between 1970 and 2009, one year after the GFC when the market fell over 50%, $10,000 became $453,166.

I hate the downs of the stock market, but I love the long-run ups. That’s why I keep the faith and it’s why I tell you to buy the dips, but I wouldn’t buy just yet.

Watch this space.

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.