At any time, there are hundreds of stocks on the Australian Securities Exchange (ASX) boasting a single-digit share price in cents; and it often follows that there is a tiny market capitalisation. In such cases, it can be difficult to invest a significant amount of money, given that the shares might not trade frequently, or in large dollops. And, in these cases, major transactions can move the share price — sometime, unfavourably.

Can there possibly be good buying down in these depths of the share market? Often, the stocks bearing the single-digit share price are not profitable, either. But they might be on a clear path to this state, for the investor that gets to grips with the “story” and the market opportunity.

I’ve been trawling through the ASX-listed population looking for this kind of situation, and here are two single-digit share prices that I think fit the bill. As it happens, both make software that is very highly regarded in their global fields, and are busy addressing large addressable markets.

1. Pureprofile (PPL, 3.3 cents)

Market capitalisation: $37 million

12-month total performance: –44.5%

Three-year total performance: 71.7% a year

Analysts’ consensus target price: 12 cents (Stock Doctor/Thomson Reuters, one analyst)

Data and insights company Pureprofile (PPL) works mainly in the field of online market research. It has more than one million “panellist” members worldwide, who are available to be asked questions, online or through the Pureprofile app, on their opinions and buying behaviour; and has access, through partnerships, to more than 20 million panellists worldwide. The panellists get paid for their answers, are highly engaged and demographically diverse: Pureprofile knows them well, and uses this knowledge to design market research surveys for brand owners and organisations to generate rich insights into human behaviour, opinions and preferences. For the company’s customers, understanding consumer habits and preferences helps them understand what customers like and what they are willing to spend money on; and following that, to target them better and boost their engagement with the brand.

Pureprofile can offer its customers any kind of survey from large-scale nationally representative samples, through to highly targeted, niche audiences. In this way, it has conducted studies in more than 100 countries. The company’s digital advertising division taps into these rich insights on behalf of advertisers and publishers to execute targeted digital marketing strategies. The company serves 770 clients, from nine offices around the world.

The bulk (80%) of revenue comes from online market research, but the company has four other businesses, including its software-as-a-service (SaaS) offering, AudienceBuilder, that it is building. More than half of revenue comes from the US market, but the company says growth trends in both Asia Pacific and Europe provide exciting opportunities for it to grow its presence in these regions

In FY22, revenue grew by 39%, to $41.7 million, while EBITDA (earnings before interest, tax, depreciation and amortisation) increased 28%, to $4 million. The net loss after tax was $2.2 million, but this has improved consistently from a $14.5 million loss in FY19. Pureprofile has not given a target year in terms of achieving net profit, but it said when delivering the FY22 result: “After a number of years of reinvestment to grow our revenue base we are focussing on moving towards net profitability. During FY23 we will focus on expanding margins to reduce net losses and move us closer to profitability.”

The most recent quarter, to 31 December 2022, was a record quarter of revenue, with $12.8 million, up 21% on the year-earlier quarter. EBITDA was $1.2 million for the quarter, which represented a 9% EBITDA margin, up from 8% EBITDA margin achieved in the September 2022 quarter.

Pureprofile has given guidance for full-year FY23 revenue within the range of $48 million—$52 million, with an EBITDA margin to be between 9%—10%. Revenue from repeat clients and annuity (recurring) revenue continue to grow, and all up, Pureprofile has virtually all its key numbers heading firmly in the right direction.

Pureprofile listed in July 2015 after raising $12.1 million issuing shares at 50 cents. By July 2016 the shares were trading at 43 cents, but it has been a long slide to the present price — however, from here, the business looks very well-poised for growth, and profitability.

2. Icetana (ICE, 3.5 cents)

Market capitalisation: $5 million

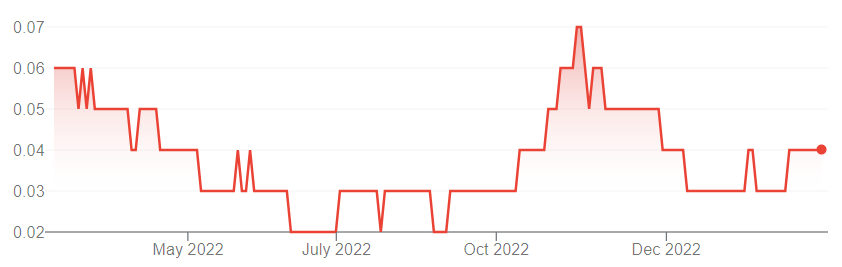

12-month total performance: –43.6%

Three-year total performance: –47% a year

Analysts’ consensus target price: n/a

Icetana (ICE) is a global software company providing artificial intelligence solutions to detect real-time anomalous events, and events and behaviour outside normal patterns, in the feed from video surveillance systems. The company was formed in 2009 to commercialise technology developed by researchers in the School of Electrical Engineering, Computing and Mathematical Sciences at Curtin University in Perth, and was floated in December 2019, at 20 cents a share, raising $5 million.

As with Pureprofile, while the subscribers to the initial public offering (IPO) would not be happy with where the shares sit, investors right now can turn that situation to their advantage.

The icetana software integrates with customers’ existing video management systems and IP cameras. Using artificial intelligence and machine learning techniques, it “learns” and filters-out routine motion, showing only anomalous or unusual behaviour: the company describes it as “looking for unusual things happening.” Where much of security monitoring involves people watching activity on cameras, icetana trains its product on the cameras. Each individual camera has its own model of activity, that has been created over a period of time: the icetana anomaly detection process interrogates that model in real-time, and “learns” what is normal and what is abnormal for that camera (not object or facial recognition). If it sees an unusual event according to that model, it alerts the security team – icetana says “problems are detected before they happen.” The company says its system allows security operators to move from reacting to situations to working proactively to prevent them.

The software is supplied mostly on a software-as-a-service (SaaS) basis, on a price per-camera, per-month basis. It has been implemented at more than 60 sites on five continents, with installations in Australia, North America, the Middle East, Japan and South America. About half of the installations are shopping centres, but icetana has also implemented systems in universities, prisons, casinos, resorts, schools and security companies. In the current financial year icetana is rolling-out its version 2 next-generation software, which has been designed to build on the historical learning gained from the original product. Version 2 compresses the “learning” period from 14 days to 24 hours.

In October 2022, Japanese technology company Macnica invested US$500,000 ($772,000) for a 14 per cent stake in icetana: as part of the agreement, Macnica received enhanced distribution rights for Japan, Brazil and Europe, and the company says Macnica “remains deeply engaged” in icetana’s product and commercialisation journey.

Icetana was hurt by the COVID pandemic, because crucial markets such as retail malls, casinos and universities were hit by COVID-19 restrictions. However, these markets are re-opening and starting to spend again. In FY22, icetana’s revenue rose 15% to $1.7 million, with receipts from customers up to $2.06 million, which includes future year prepayments. As icetana transitions to more SaaS customers, the key number becomes annualised recurring revenue (ARR): that figure grew by 11%, to $1.5 million. Recurring revenue increased from 63% of total revenue to 83%. Icetana finished FY22 in a reasonably strong financial position, with $2.01 million in cash at bank – this was before the share placement to Macnica – and no debt. As at 31 December 2022, cash at bank was $2.04 million.

It goes with the territory at this level of the share market that these are tiny numbers. But the scale of the market opportunity is huge. There are more than one billion security cameras around the world, and icetana says that market is growing at about 16% a year – which corresponds to about 160 million cameras being installed each year. There are certainly competitors, but icetana has a product that the market likes, and definitely has a runway for growth.

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.