I’ve run a small business for 14 years. Not once have I received a call from my bank about the business or its capital needs.

The closest contact I’ve had with my bank is a permanent note on its App saying I’m pre-approved for a line of business credit. Of course, the loan has high interest, requires collateral from a director and involves me doing the legwork. Occasionally, I get some bank marketing material that goes straight into my online bin.

Perhaps a bank algorithm has deduced I’m not a target customer. In fairness, I don’t have a business loan with this Sydney-based bank or am looking for one. But the lack of contact reinforces the perception that big banks neglect small businesses.

Small-business resentment towards banks is hardly new. I’ve written on this issue many times over the past three decades. What has changed is the emergence of online banks that specialise in lending to small and medium-sized enterprises (SMEs).

I’m not suggesting these online lenders will become a huge force in SME lending. But they can chip away at the big-four banks’ share of SME lending for years. The best online SME banks could have years of growth ahead if they exploit the opportunity.

Judo Capital Holdings is the pick of them for portfolio investors. Speculators could consider the micro-cap Prospa Group, which has underperformed the market in the past few years.

I like online SME lenders for four main reasons. The first is short-term (0-1 years): share market weakness in the past few months has weighed on the valuations of online lenders, creating a more attractive entry point for prospective investors.

The second is medium-term (1-3 years). Omicron, the spectre of rising inflation and interest rates, and probably a May Federal election are dark clouds for business confidence. But beneath the gloom is a recovering economy with excellent medium-term prospects. That’s good for SME credit growth when the Covid handbrake is finally released.

The third factor is long-term (at least 3-5 years). As mentioned earlier, online SME lenders have a huge market to grow into. They could quadruple the collective size of their loan books and still have a tiny share of the overall SME lending market.

Then there’s fintech adoption. As in other industries, Covid has condensed a decade of fintech change into a few years. We’ve had to do more things online, including aspects of banking that traditionally required a human banker. That’s good for online lenders that don’t have the costly infrastructure of bank incumbents.

Here is a snapshot of Judo and Prospa:

1. Judo Capital Holdings (JDO)

In November 2021, Judo raised $657 million through an Initial Public Offering (IPO) on the ASX that valued it at $2.3bn on listing. The Melbourne-based Judo was one of last year’s largest floats and a welcome addition to the listed fintech sector.

The offer was reportedly oversubscribed by almost three times, such was the demand for Judo from institutions. In a hot IPO market, Judo’s valuation looked more reasonable – and realistic – than many floats.

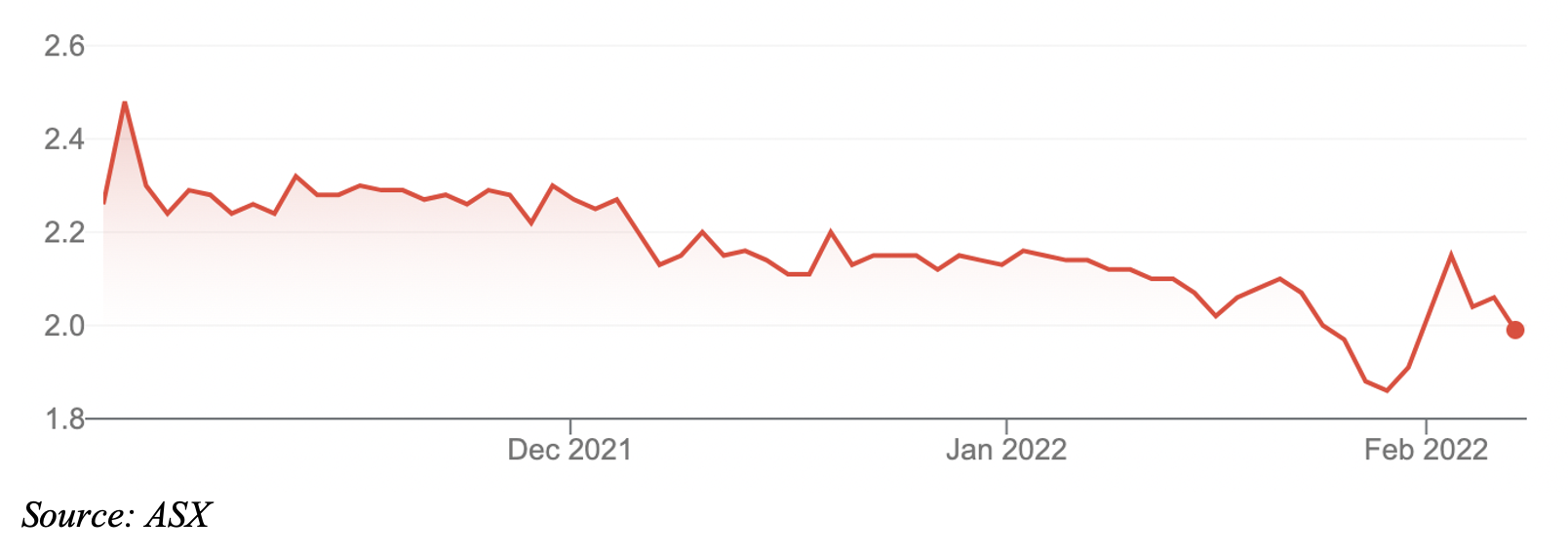

Judo has so far marginally disappointed investors, albeit in a falling share market. The company’s $2.10 issued shares peaked at $2.55 soon after listing but now trade at $1.90. They hit $1.81 in late January as global equity markets tumbled.

Operationally, Judo is performing well. Its monthly loan book at end-January 2022 was $4.96bn, up from $3.52bn at end-June 2021. That equates to 40.9% growth in Judo’s loan book in seven months – a stellar effort in a Covid-affected economy.

At its current growth rate, Judo should reach its $6bn loan-book target by the end of FY22. Judo is adding roughly $200 million a month to its loan book (excluding January), although loan growth can be lumpy.

Judo has attractive traits. The company has grown quickly since its 2016 launch and has been remarkably consistent. Judo’s strategy at launch – take share from the big banks through a dedicated SME offering – has barely changed.

Another attraction is Judo’s status as an APRA-regulated bank. Getting a banking licence from the Australian Prudential Regulation Authority is a big task.

Prospective investors should have more confidence knowing APRA has run the rule over Judo’s systems, processes and financials. Compared to many IPOs that promote cobbled-together pro-forma accounts that portray the company in the best light (to maximise the valuation), Judo’s prospectus has more substance.

Management is another factor. Judo is well run and governed. You don’t go from a start-up in 2016 to become the first new Australian bank to list on ASX in 25 years without doing something right. So far, Judo is doing everything management said it would. Judo listed on the ASX a couple of years earlier than expected, such was its growth.

This column’s readers know one of my preferred ideas is banking stocks. Judo is a different proposition to bigger banks that have lower funding costs. But I like the idea of buying a quality company that was hard to get stock in (for most retail investors) during its IPO, at a discount to the offer price.

One issue to watch is Judo’s escrow in August 2022. That’s the date when some of Judo’s longstanding institutional investors can sell their restricted securities. They might decide to hold, given the modest value in Judo at the current price.

However, the prospect of some institutions (which own most of Judo) selling could create an ‘overhang’ that weighs on the share price for the next few months.

Conversely, a few early investors selling could also bring new investors to the share register, boost Judo’s liquidity and its eligibility for index inclusion, which means buying from Exchange Traded Funds.

Either way, Judo is a stock to watch over the next few months.

Judo Capital Holdings (JDO)

2. Prospa Group (PGL)

Unlike Judo, Prospa Group came to market at a much earlier stage. It listed on the ASX in June 2019 after raising $109 million through an IPO. Prospa was valued at $610 million on listing, but like so many small-cap companies, arguably listed too early.

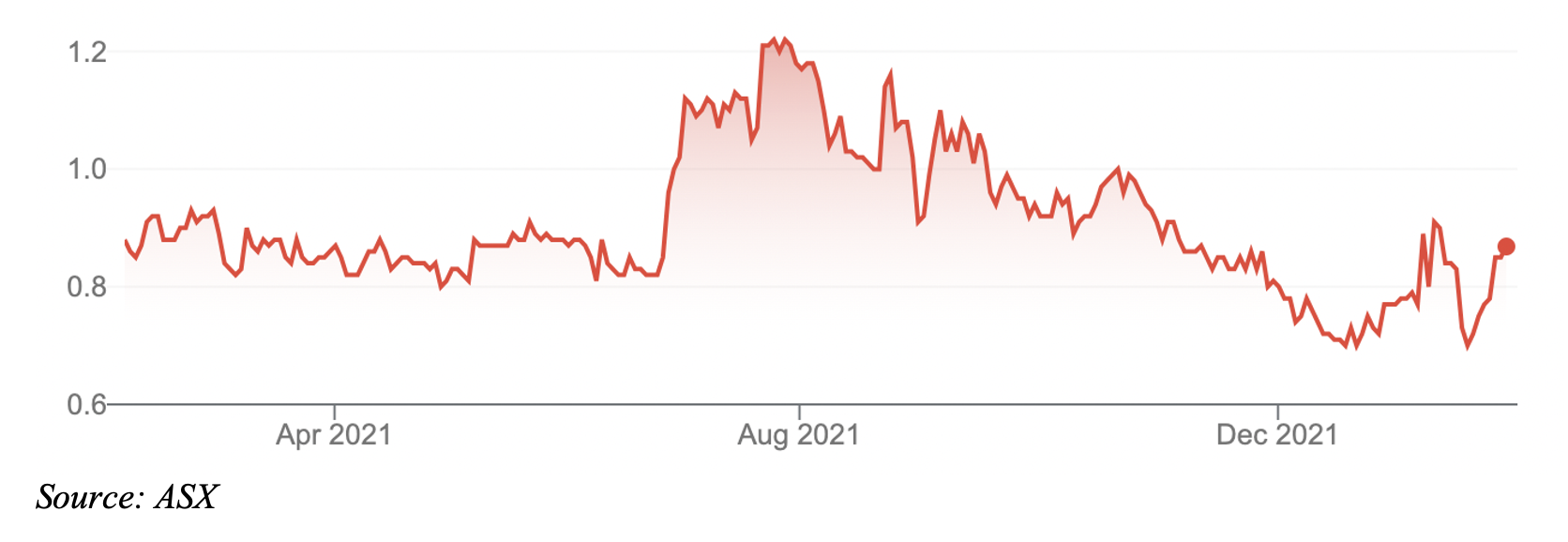

To recap, Prospa shares were offered at $3.78 in the IPO. They soared to $5.09 as the market embraced the potential of online loans for small businesses. Prospa crashed to 40 cents in early 2020 as the market feared a boom in bad debts during Covid.

I identified Prospa for this report in June 2020 (“Three B2B stocks that will benefit from Australia’s recovery”) at $1.06. Prospa hit $1.25 in July 2021 but has since drifted to 90 cents, amid broader market weakness.

Prospa’s latest trading update showed record loan originations of $186 million for the quarter to end-December 2021. That was up 85% on the prior quarter. The gross loan book rose 16.4% on the prior quarter to $515 million.

The company said its financial performance in the first half of FY22 was ahead of expectations. Prospa’s not racing ahead but half-year underlying earnings (EBITDA) of about $9 million is a good effort given Covid headwind. If you annualise those earnings, Prospa’s valuation looks undemanding at the current price.

Yes, contrarian investing in micro-cap recovery plays is high risk. Much can go wrong and often does. Any investment in Prospa should be considered speculative. The company has a lot of work ahead to restore market confidence.

But over the years, I’ve watched investors forget about micro-cap IPOs that disappoint after listing. Analysts and the media stop covering them. Fund managers take their losses and move on. Opportunities emerge because good news is overlooked.

So often, the best time to buy a hot IPO is at least a year or two after listing when there is more history as a listed company. By then, the IPO hoopla has faded and, in many cases, the valuation is far more realistic. That could be the case with Prospa.

More will be known when Prospa reports its half-year results on 16 February 2022.

Prospa Group (PGL)

Tony Featherstone is a former managing editor of BRW, Shares and Personal Investor magazines. The information in this article should not be considered personal advice. It has been prepared without considering your objectives, financial situation or needs. Before acting on information in this article consider its appropriateness and accuracy, regarding your objectives, financial situation and needs. Do further research of your own and/or seek personal financial advice from a licensed adviser before making any financial or investment decisions based on this article. All prices and analysis at 9 February 2022.