As I write this column, New Zealand has announced 15 new Covid cases in the Auckland region, down from 59 cases a week ago. Let’s hope NZ quickly gets on top of its outbreak.

Let’s also hope the NZ-Australian travel bubble can resume this year, although that seems less likely given the extent of cases in New South Wales and Victoria. Like many, I’d love a holiday in NZ or anywhere for that matter with our international and State borders shut.

Which brings me to NZ travel-related stocks, principally Air New Zealand (AIZ), Auckland International Airport (AIA) and casino operator SkyCity Entertainment Group (SKC).

Buying NZ travel stocks during a NZ lockdown seems foolhardy. But the stocks are re-opener beneficiaries and look modestly undervalued at the current price.

To be clear, prospective investors who buy NZ-related travel stocks (or those in Australia) need a long-term horizon (at least 3-5 years) and higher risk tolerance. International travel will take years to get back to its past high and much can go wrong if the virus mutates.

I suspect the market is underestimating the challenges of Covid recovery. There’s no quick fix: many consumers will remain hesitant even when 80% of the population is fully vaccinated, particularly if Covid case numbers jump after lockdowns end.

Still, I can’t help thinking the big dual-listed NZ travel-related stocks offer value for long-term investors who can look through the current doom and focus on valuation. When life eventually returns to normal, the NZ tourism industry is ideally placed for recovery.

I covered SkyCity Entertainment Group in July for The Switzer Report (‘Casino stocks an attractive long-term bet’), so won’t go into it in detail here. SkyCity is up from about A$3.05 to A$3.28 after delivering an okay FY21 result, given the circumstances.

The evidence in overseas markets is clear: casinos had a strong bounce back in activity when lockdown restrictions eased. Nevada, for example, broke records in gaming activity. SkyCity looks well positioned to benefit from a market craving entertainment.

My focus this week shifts to air travel: Air New Zealand and Auckland International Airport. I outlined a favorable view last year on Qantas Airways (QAN) – again as a medium-term play on lockdown restrictions easing and international travel resuming.

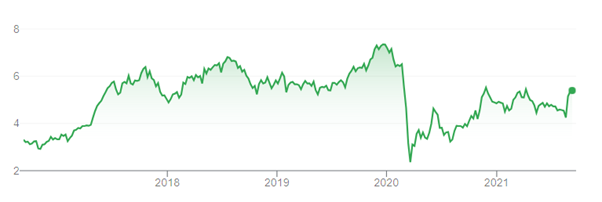

Qantas has a one-year total return (including dividends) of 32%. But over three years, its total return is almost zero. Nevertheless, Qantas’s recent share-price gains show the benefit of buying quality companies when news is grim.

Chart 1: Qantas (QAN)

Source: ASX

Auckland International Airport (AIA)

Like Sydney Airport, Auckland International Airport has a strong position in transport infrastructure. AIA gets about 75% of all international visitors to NZ. That makes it one of the biggest losers from travel restrictions (and winners when things open up).

Released in mid-August, AIA’s FY21 earnings tumbled due to the lockdowns. The airport reported the first loss in its history as passenger numbers slumped 58%. Underlying profit fell by $230.3 million to a $41.8-million loss. Revenue halved and no dividend was paid.

As expected, international travel volumes at the airport tanked, down 93% year-on-year.

That’s the bad news. The good news was an unfolding recovery in domestic travel in FY21 before the latest lockdown. Domestic passenger numbers fell 17% year-on-year, but the trend improved.

My interest in AIA is threefold. First, it is a play on international borders finally re-opening and international travel volumes to NZ recovering over the next few years.

Two, before Covid erupted in early 2020, AIA had begun delivering on more than $2 billion in aeronautical infrastructure projects. Overall capital investment at AIA is expected to be $250-$300 million in FY22.

In August, AIA announced plans to further strengthen its retail shopping precinct through the development of a 23,000 square-metre retail outlet centre. AIA will be in good shape over the next few years as more passengers take advantage of its new or upgraded facilities.

The third factor is valuation. Price Earnings (PE) comparisons are hard with so much uncertainty about airport earnings due to Covid lockdowns. What is clear is that private equity is paying more for airports than public equity (witness the takeover bid for Sydney Airport (SYD)).

Clearly, the smart money – giant pension funds seeking reliable income from infrastructure assets, and private-equity firms – see untapped value in key airports at current valuations.

AIA has much land that can be developed, a favourable regulatory environment, and is superbly positioned to capitalise on long-term growth in Asian tourism to NZ. My sense is NZ tourism will be in even more demand after Covid as tourists look for safer, cleaner environments to visit.

Either way, AIA looks like reasonable value for long-term investors who can ride out Covid uncertainty and benefit over the next few years as international travel slowly recovers.

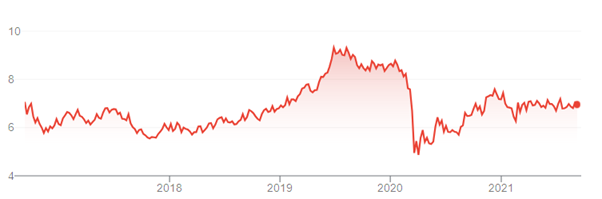

Chart 2: Auckland International Airport (AIA)

Source: ASX

Air New Zealand (AIZ)

My comments about AIA apply equally to Air New Zealand. Like AIA and all international airlines, Air New Zealand is suffering from border closures and little international travel.

In August, Air New Zealand reported a 48% drop in revenue to $2.5 billion in FY21. The business lost $440 million (before tax and significant items) and continued to suspend its dividend. That was a substantial deterioration on the previous year ($87 million). Within that, Air New Zealand’s domestic business performed well due to demand from leisure and business travelers that was near pre-Covid levels. Strong growth in cargo revenue was another highlight, buoyed by government airfreight support schemes and booming e-commerce demand as consumers bought goods online during lockdowns.

Analysts are extending their timing for a recovery in overall passenger numbers with Auckland in lockdown. Morningstar expects a gradual recovery in international travel to NZ. It could take until 2024 for international passenger volumes to return to pre-Covid levels.

That timetable seems reasonable. Assuming NZ, like Australia, has a sufficient vaccination rate by year’s end, it will still take time for international travel volumes to recover. Air NZ might not be profitable again until FY23 (it has not issued earnings guidance due to the uncertainty).

Morningstar’s fair value of A$1.80 a share for Air New Zealand compares to the current share price of $1.44. The stock is no screaming buy, but there’s a sufficient margin of safety for prospective investors who understand the risks of airline stocks.

As with Qantas and Auckland International Airport, it’s a waiting game with Air New Zealand. Do you buy now when Air New Zealand is trading at half its pre-Covid share price, or wait until there is more certainty on lockdowns ending and international travel resuming?

I prefer to go early but accept that Air New Zealand’s share price could keep trading sideways – or find a new low if the outbreak takes longer than expected to contain.

For all the short-term risks, Air New Zealand has a dominant position in NZ domestic travel in a country that has so far had far less community transmission of Covid. With a three-year annualised total return of minus 12.6%, Air New Zealand’s worst days should be behind it. That might seem hard to picture now with Auckland in lockdown. But the market always looks forward and NZ travel still has excellent long-term prospects.

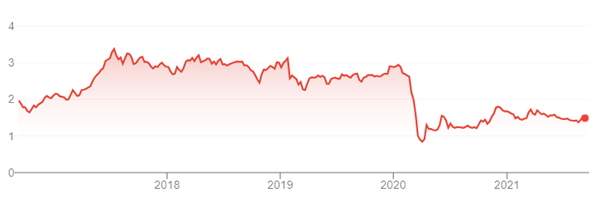

Chart 3: Air New Zealand (AIZ)

Source: ASX

Tony Featherstone is a former managing editor of BRW, Shares and Personal Investor magazines. The information in this article should not be considered personal advice. It has been prepared without considering your objectives, financial situation or needs. Before acting on information in this article consider its appropriateness and accuracy, regarding your objectives, financial situation and needs. Do further research of your own and/or seek personal financial advice from a licensed adviser before making any financial or investment decisions based on this article. All prices and analysis at 8 September 2021.