Picture this: a twentysomething employee works for two years in a job he hates. The boss demands he take on more work and responsibility, for no extra pay.

Unable to travel, the young employee grows his savings. He starts to rethink his life goals and whether a boring nine-to-five job in an office tower is for him.

Does he quit his job and travel, backing himself to get a job in the Gig Economy when he returns? Or work remotely, hopeful of the strength of the labour market?

Welcome to the Great Resignation. The talk about a supposed mass exodus from the workforce in 2022 began overseas a few months ago. Australian newspapers, too, have picked up on the trend. Forecasts of up to 40% of employees considering quitting their jobs is good clickbait.

Proponents of the Great Resignation argue the pandemic will encourage people to rethink their career and life goals. Having had a taste of remote working, they are reluctant to return to the office. They want flexibility, greater control and purpose in their work.

That’s the theory. My hunch is there are three main trends at play. First, some people who shelved their “gap year” or extended overseas holiday are desperate for adventure. Those who managed to grow their savings during the pandemic feel empowered to quit their job.

Second, many workers probably feel jaded and burnt out after taking on extra work tasks and responsibilities during the pandemic. Then, juggling that with homeschooling and other life complications. They know the labour market will be strong next year, so back themselves to find something better.

The third issue is the trend itself. As people read about the Great Resignation and watch their friends quit, the trend starts to feed on itself. Lately, a few people I work with have resigned. They’re taking time out before looking for another job. There will be more of this.

Whether you believe the trend or not (I think the Great Resignation is overhyped), the reality is there will be a higher labour-market turnover than usual in 2022. Just as there is pent-up demand to travel, so, too, will there be pent-up demand to change employers or careers.

That’s good for human resources (HR) stocks on the ASX. Even if the Great Resignation is only half as pronounced as forecasts predict (say, 20% staff turnover), companies will have to work harder than ever to attract and keep top talent. Some employers will offer more money, or greater flexibility, such as remote working or extra holiday time to travel. Or both.

I expect rising demand for HR companies that help corporates navigate these trends. That includes companies that advertise job vacancies (such as Seek), those that recruit staff, develop payroll and other HR technologies, and firms that check resumes.

There’s not a lot of choice in ASX-listed HR stocks. Most are speculative micro-caps that suit experienced investors who understand the features, benefits and risks of this form of investing. Here are two HR-related stocks that should get a boost in 2022.

1. Xref (XF1)

Xref has developed a clever platform for online pre-employment verification. Simply, lots of people changing jobs in 2022 means more resumes will have to be checked. Hiring a manager who claims to have an MBA but only finished the first two subjects can be costly.

Founded in 2010, Xref listed on the ASX in 2016. The company acquired its identity-verification platform (RapidID) in 2019. The business now has 60 staff and is capitalised at $113 million.

Xref’s main customer proposition is automated reference checks (65% of revenue). Employers can request one or multiple reference checks and Xref completes the task within 24 hours. That’s a handy service for large Australian employers that use Xref.

After two years of flat growth in usage and sales (due to Covid), Xref expects to grow much faster in 2022. In early October, Xref reported 126% sales growth for the September quarter and attracted a number of new clients to its service.

Xref noted: “Companies are starting to witness the effects of what has been coined ‘The Great Resignation’. Millions of workers around the globe calling time on their employers. Sector, geographical and role changes are contributing to what is sure to be one of the biggest migrations of talent ever seen. We are witnessing this through record lead flow, which is, in turn, feeding growth in new client acquisition.”

Xref has rallied from 30 cents in June to 62 cents. That’s taken the share price back to pre-pandemic levels, but Xref has come a long way in the past two years with its technology development, client acquisition and product extensions.

The company has an attractive business model in a fast-growing market. Like all good tech companies, the software is highly scalable to other markets. As Xref attracts more corporates that need to check more resumes, it can upsell them into other high-margin services.

Xref is due for a share-price pullback or pause after its recent rally. But the business should have stronger tailwinds in 2022 and 2023 as higher labour-market turnover boosts demand for online reference-checking services.

Chart 1: Xref

2. IntelliHR (IHR)

The HR technology company has developed and commercialised a cloud-based people-management platform. Corporates use the software to digitise their HR function (paperless records) and fully automate it online. The technology also has people compliance, performance management and feedback and wellness tools.

IntelliHR’s big selling point is the analytics within its software. There is a lot of competing tech available to automate HR processes and the paperwork that comes with it. IntelliHR captures data to produce real-time people insights and analytics to help drive performance.

It’s interesting technology, particularly as companies allow more people with knowledge-based jobs to work remotely for longer. Managers will need better HR technology to measure employee performance and productivity, and what they think about their employers.

It feels a bit like Big Brother, but I can imagine how managers and HR teams would extract great value from data that collects people’s insights and predicts behaviour. For example, IntelliHR algorithms can monitor positive or negative text messages in an organisation to gauge sentiment.

The spike in negative employment sentiment could be a forerunner of an increase in firm turnover as unhappy people quit. As labour-market turnover rises during the Great Resignation, companies will need smarter technology to keep their best people and lift productivity.

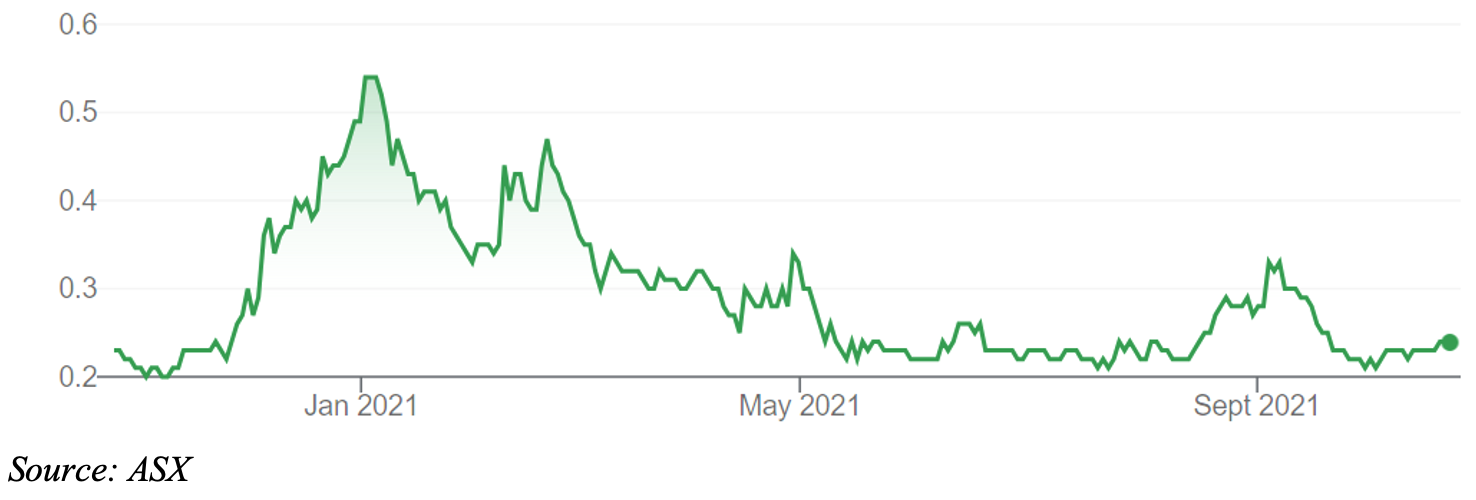

IntelliHR rallied last year as the market latched on to its prospects in the HR sector, and global potential (the company’s proportion of global clients is growing quickly). From a 52-week high of 59 cents, IntelliHR has sunk to 22 cents, even though its prospects are improving.

The business is growing quickly off a small base. Contracted annual recurring revenue increased to $4.66 million in the September quarter – almost double the same period a year ago. Contracted subscriber numbers increased 121% to 43,784.

Capitalised at $72 million, IntelliHR is too small for most fund managers. A $2.5 million investment by Bevan Slattery, a widely followed tech entrepreneur, into IntelliHR in August 2020 created interest in the stock. But its price has disappointed this year.

That provides a better entry point for prospective investors. It’s early days for IntelliHR (in terms of commercialisation) and there is much competition in HR tech. Still, there’s a lot to like about HR tech that uses AI to develop employee insights, particularly during a period of higher labour-market turnover in 2022 and possibly 2023.

Like all good software-as-a-service stocks, IntelliHR’s offering has global scalability, high margins, and recurring revenue. The big hope is the pandemic and the Great Resignation trend encourages more companies to take their HR tech up several notches to keep workers.

If that happens, IntelliHR is positioned to attract more customers here and offshore.

Chart 2: IntelliHR

Tony Featherstone is a former managing editor of BRW, Shares and Personal Investor magazines. The information in this article should not be considered personal advice. It has been prepared without considering your objectives, financial situation or needs. Before acting on information in this article consider its appropriateness and accuracy, regarding your objectives, financial situation and needs. Do further research of your own and/or seek personal financial advice from a licensed adviser before making any financial or investment decisions based on this article. All prices and analysis at 27 October 2021.