1. APA/AST

“Another week, another takeover deal,” says Raymond.

“After Ausnet (AST) has provided exclusive due diligence to Brookfield, APA has announced a takeover proposal for AST.

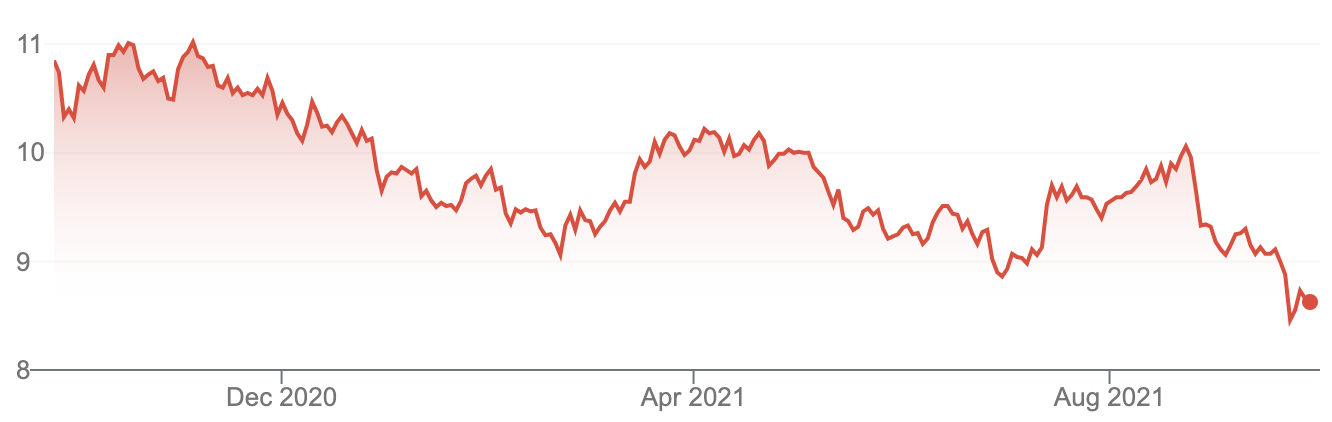

“As you know, APA is a script and cash offer. Based on its current price of $8.66, the implied value of deal is $2.58 (cash $1.82 + 0.0878 APA shares ($8.66 X 0.0878 = $0.76), which is slightly higher than Brookfield’s all cash offer.

“It appears the management has been watching the AST business for a while but the two major shareholders were not interested to sell until now.

“If APA can combine AST business, this will improve its earning uncertainty and environmental, social and governance (ESG) scores.

“The benefit of the APA offer is that part of the proceeds may be entitled to script-for-script capital gains tax (CGT) relief.

“The risk of course is if APA’s stock price continues to go down, then APA’s total offer may be less than the Brookfield cash offer.

“Overall, AST shareholders should sit for the ride.

“For APA shareholders, while there may be short-term uncertainty, it’s still worth holding the stocks given its current 6% yield,” Raymond maintains.

2. BKW results

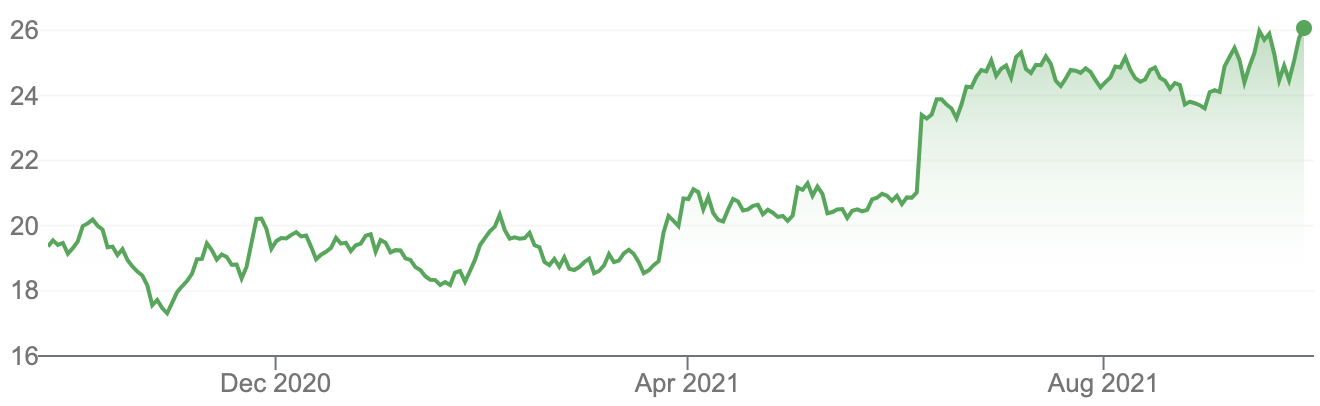

“Brickworks (BKW) announced good results with strong contribution from its Property segment (66% of group EBIT) and its equity holdings in Washington H Soul Pattinson (SOL),” Raymond says.

“The BKW/Goodman partnership continues to see a strong development pipeline and demand for building products is strong in both Australia and the US.

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.