In his latest book, Peter Zeihan warns of two megatrends that will reshape the world: a breakdown in global supply chains and the ageing population.

Zeihan, a geopolitical strategist, has a gloomy view of what to expect this decade and the next. If he’s even half correct, we have much to worry about as the world moves from globalization to de-globalization (and increasingly, regional trading blocs).

De-globalization will occur as global supply chains falter. As America retreats from its position as the global hegemon, it won’t provide the same sort of security guarantee (via the US Navy) that has been a necessary foundation for globalization to occur.

Geopolitical instability will rise, leading to more conflicts between countries and a breakdown in global supply chains. It doesn’t take much for supply chains to falter, given the interdependence of countries that source goods worldwide.

The average new car, for example, has thousand of parts sourced from many countries. Supply blockages or breakdowns in a small number of those parts can cause problems. Just-in-time inventory is great until the inventory doesn’t arrive just in time.

COVID-19 provided a taste of what happens when global supply chains freeze and manufacturers can’t source inputs. Russia’s invasion of Ukraine is another example.

I don’t agree with everything in Zeihan’s book. But de-globalisation is starting to occur (off a low base) as more companies bring their production back closer to their end markets. Think some US companies manufacturing in the US, rather than in China.

History is the best guide. After World War 1, when Britain lost its mantle as the global hegemon, a period of immense geopolitical volatility – headlined by the Great Depression – followed in between the two World Wars.

Perhaps we are seeing the same occurring now as China rises and the US retreats as the global hegemon (partly because of polarisation in domestic US politics, which affects the ability of the US to project its power internationally.)

For Self-Managed Superannuation Funds and other long-term investors, thinking about such trends is important. If the world is entering a sustained period of de-globalisation, what are the best ways to position portfolios for these trends?

As I re-visited Zeihan’s book, I thought about two ways to play de-globalisation. I emphasise these are long-term ideas and should only be a small part of portfolios.

My hope is that the world sees sense and realises globalisation leads to better living standards, less poverty and a better chance to save the climate (de-globalisation will be terrible for climate change). Far fewer companies (or countries) will benefit in the long run from de-globalisation and a more protectionist global economy.

The key is finding better ways to address inequality that results from globalisation and the damage that too much economic growth and industrialisation does to the climate.

Here are the two ideas and the Exchange Traded Funds (ETFs) that provide exposure:

1. Commodity shortages

Energy and food are the obvious winners from supply-chain breakdowns, in the short term at least. Oil prices soared when Russia invaded Ukraine. So, too, the price of wheat. During COVID-19, the price of lumber and numerous other goods soared.

There’s much more to the energy story than supply-chain issues that result from conflicts. As the world embraced net-zero targets, underinvestment in fossil fuels projects in oil and coal has occurred over the past decade.

I’m a big fan of renewables, but unfortunately, the world will need oil and coal for a long time to come, particularly in developing countries. That suggests higher oil prices over time and outperformance the energy sector.

Food, too, has fascinating long-term prospects. As the world’s population grows (before declining birth rates kick in) and more people move into the middle class, food demand will rise. But food supply will be challenged by supply-chain risks, notably in farming machinery and fertilisers. Less arable land to grow crops is another risk.

Expect more spikes in soft commodity prices this decade. Volatility in wheat prices, evident this week, is a sign of things to come. Blockages in maritime trade due to conflicts can have a huge impact on agricultural prices.

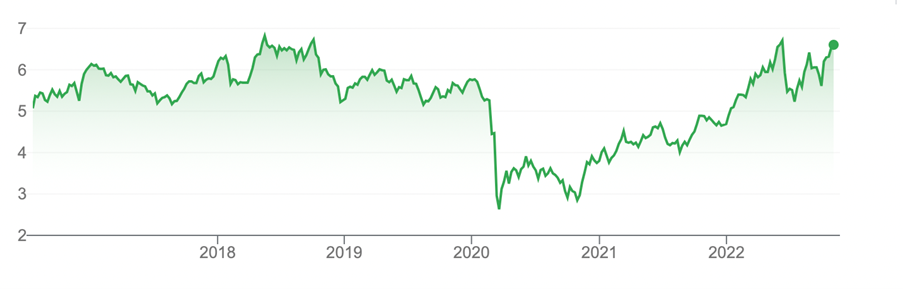

In terms of ETFs, the BetaShares Global Energy Companies ETF (FUEL) Currency Hedged is the best way to play the trend. FUEL provides exposure to 49 of the world’s largest energy stocks.

I prefer owning leading energy companies to investing in synthetic ETFs over oil, which use derivatives and have additional risks. Speculating on short-term moves in the oil price is a mug’s game: who knows what will happen with Middle Eastern and Russian supplies?

In agriculture, the BetaShares Global Agriculture ETF (FOOD) is my preferred long-term exposure. FOOD invests in 60 of the world’s largest agricultural companies. About a third of the ETF is in fertilizers and agriculture chemicals.

Chart 1: BetaShares Global Energy Companies ETF

Source: ASX

2. Ageing population

Zeihan’s book has a long list of alarming statistics and predictions about the ageing global population. As birth rates plummet in Asia and other regions, populations will have a higher average age. That means fewer young people supporting older generations (who have rising healthcare needs), fewer taxpayers and less capital for reinvestment (as Baby Boomers leave the workforce and stop saving).

The United Nations estimates there will be 2 billion people aged over 60 by 2050. Remarkably, about one in five people on the planet will be 60 or older in a period of ageing the UN described as “without parallel in human history”.

SMSF trustees should ensure their portfolio has some exposure to this theme. Talk of an ageing global population is hardly new, but this megatrend is the most powerful of them all, in my view. It has decades to run as birth rates decline and people live longer due to medical advances (assuming enough of us can still get sufficient energy and food).

Among active ETFs, the Fidelity Global Demographics Fund (FDEM) provides targeted exposure to this trend. FDEM’s main themes are population growth, ageing and the rise of middle-class consumers. It’s a good idea for a thematic fund.

Healthcare is another way to play the ageing-population trend. It’s a no-brainer that people will need more healthcare products and services as they age.

The iShares Global Healthcare ETF (IXJ) has been my go-to ETF for global healthcare stocks for many years. IXJ provides exposure to 114 of the world’s largest pharmaceutical, biotechnology and medical-device companies.

IXJ has returned an average 10.7% over 10 years to end-September 2022. It’s no world-beater, but IXJ’s defensive qualities and steady growth over a long period appeal. Global healthcare is an excellent portfolio exposure for long-term investors.

Australian investors willing to buy ETFs that trade on overseas exchanges will find more choices in index funds that specialise in the ageing population. These ETFs include the Long-Term Care ETF (OLD) and Global X Ageing Population ETF (LNGR). Both ETFs trade in the US.

Chart 2: iShares Global Healthcare ETF

Source: ASX

“The End of the World is Just Beginning: Mapping the Collapse of Globalisation”. Peter Zeihan. Harper Business. 2022.

Tony Featherstone is a former managing editor of BRW, Shares and Personal Investor magazines. The information in this article should not be considered personal advice. It has been prepared without considering your objectives, financial situation or needs. Before acting on information in this article consider its appropriateness and accuracy, regarding your objectives, financial situation and needs. Do further research of your own and/or seek personal financial advice from a licensed adviser before making any financial or investment decisions based on this article. All prices and analysis at November 2, 2022.