Regular readers of this column will have noticed the relatively low number of small-cap industrial companies covered this year, at least by my standards.

There was much coverage of top-down trends and themes using Exchange Traded Funds (ETFs); defensive investing strategies to safeguard against inflation; and dividends.

Apart from the occasional story on takeover targets (usually at the editor’s request!), there was limited coverage of small-cap industrials. And even less of speculative micro-cap stocks.

That was by design. As regular readers know, I had a more bearish view on inflation than the market. I disagreed with the view that higher inflation was a transitory response to supply chain bottlenecks during COVID-19.

With higher inflation comes higher interest rates. That’s bad for equities and particularly for small-cap industrials. When volatility spikes, investors rotate out of small-caps and have more of their portfolio in large-caps and cash.

By October 2022, the discount between small-cap industrials and large-cap industrials was at March 2020 levels during the peak of the COVID-19 crisis (when markets crashed) and among the highest in a decade. By discount, I refer to the difference in average small-cap and large-cap Price Earnings multiples in key indices, such as the S&P/ASX Small Ordinaries Index.

The market had seemingly priced a severe recession into small-cap valuations, even though Australia’s economy was more resilient than expected. Investors expect more earnings downgrades next year.

There’s a lot of pain ahead for the Australian economy. The first half of 2023 will be tough as home borrowers are whacked by sharply higher interest rates and as inflation remains stubbornly higher, lifting living costs.

But there’s a good chance the slowdown won’t be as brutal as feared. By mid-2023, the market narrative will swing to talk of interest rate cuts. By late 2023, the first cut could arrive. That’s good for equities, but markets will move in advance of the actual cut.

Don’t get me wrong: I’m not saying we’ll breeze through the slowdown, rate cuts will arrive on cue and equity markets will rebound. It’s going to be a grind higher with bouts of brutal market volatility.

But the smart money will look closer at beaten-up small-cap industrial companies, knowing we will be past peak-earnings pain by mid-2023. When investors become more confident that rates will fall, small-cap industrials will make up lost ground on their large-cap peers.

Before I nominate small- and mid-cap ideas for 2023, some caveats. First, my comments above refer to aggregate PE comparison between small-cap and large-cap industrials. That helps shape the broad direction of small-cap asset allocation, but this is a stock picker’s market. There are always good and bad small-cap ideas, whatever the market condition.

Second, small-caps should form a small part of the portfolio of most investors. Conservative investors should stick mostly to large-caps with reliable, fully franked dividends.

Third, consider using a small-cap fund if you want a portfolio of stocks for diversification and the skills of a manager who specialises in that market That comes with higher fees, but Australia has some excellent small-cap managers.

Here are 13 small- and mid-cap ideas for 2023. Each stock’s current price is shown after the heading.

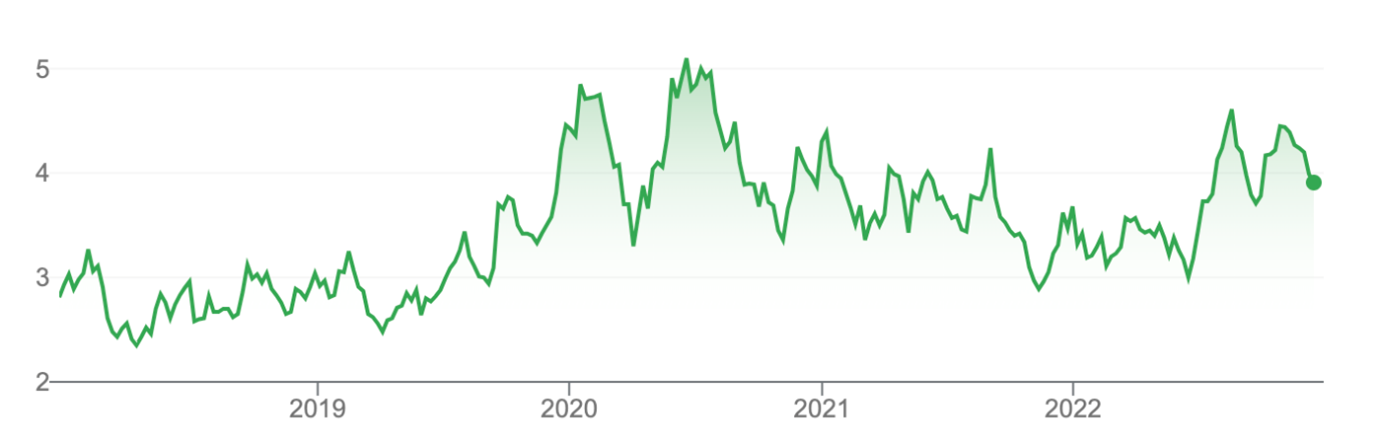

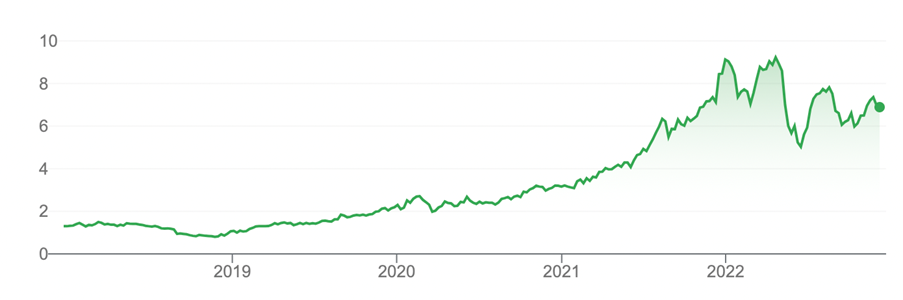

1. Omni Bridgeway (OBL) – $3.84

The litigation funder manages a portfolio of funds that have been raised from external investors to back legal cases. The market is underestimating how much cash Omni Bridgeway will return to shareholders due to the maturation of some of its key funds over the next four years.

Source: Google Finance

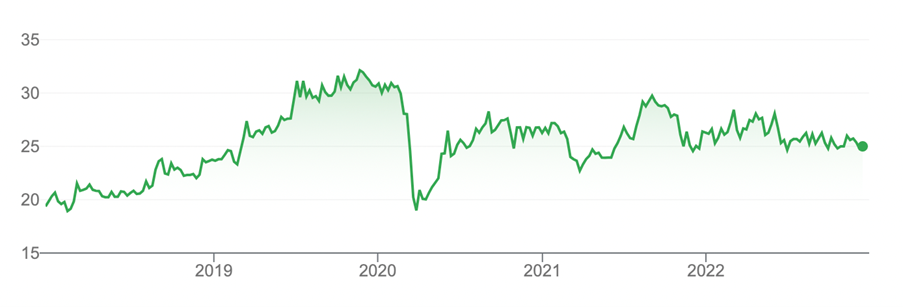

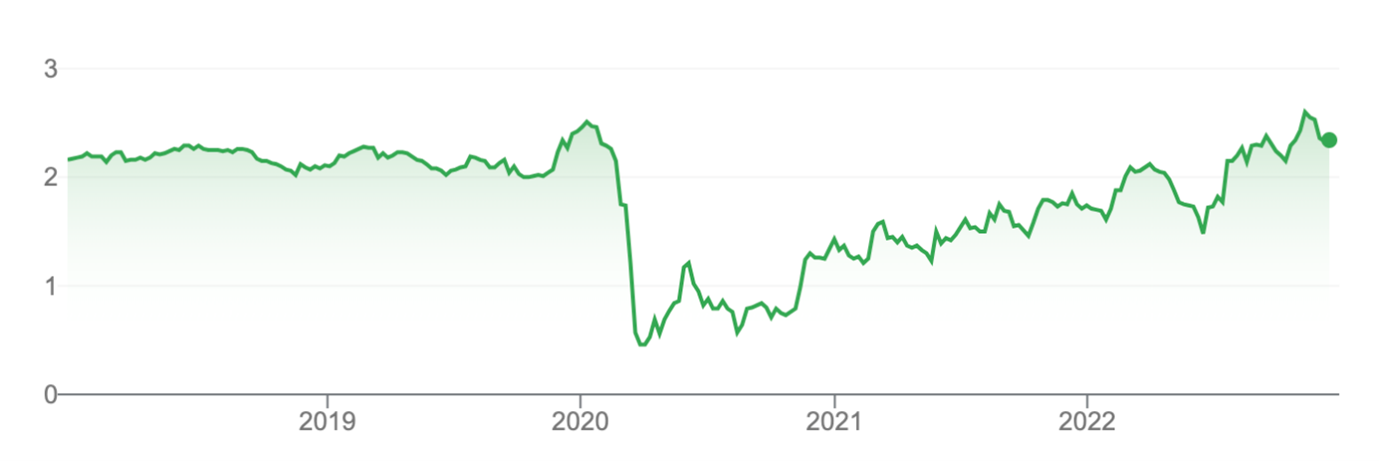

2. EQT Holdings – $24.90

Equity Trustees is an independent trustee and executor company. It makes most of its money from trustee and wealth-management services. Revenue rose 10.4% to $111 million, and net profit gained 12.5% to $24.2 million in FY22. Funds under management, administration and supervision are up almost 50% since FY20. Yet the share price has gone mostly sideways since May 2020. The market is not sufficiently recognising EQT’s progress – a trend that could change in 2023.

Source: Google Finance

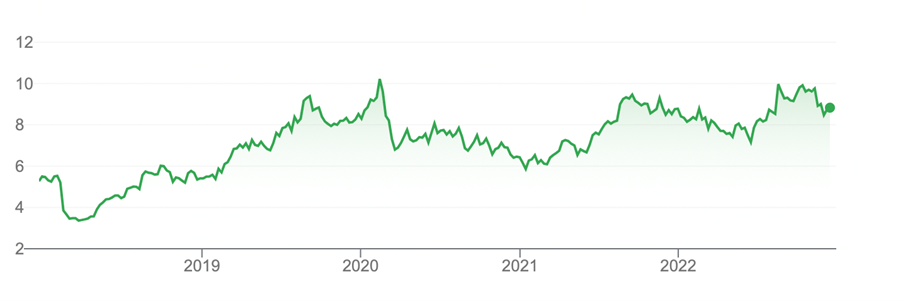

3. IPH (IPH) – $8.82

The international intellectual property services group has clients, including some of the world’s largest companies, in more than 25 countries. Intellectual property advice is a long-term growth market and also reasonably defensive: companies need this advice, regardless of economic conditions. As IPH acquires more firms, it develops greater scale and efficiencies. The well-run company has made good progress in the past few years, but the share price has been rangebound. That could change in 2023.

Source: Google Finance

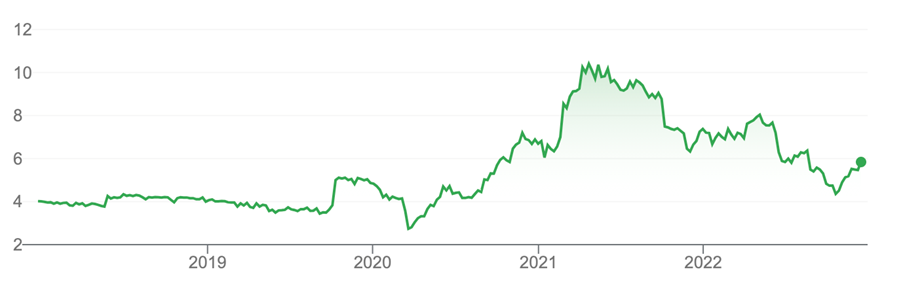

4. Kelsian Group (KLS) – $5.87

The bus and ferry operator struggled in 2022 after it missed out on a few bus-contract tenders. Longer term, Kelsian is a business with excellent assets. Privately run buses are an attractive industry as urban populations grow and more people use public transport. Consensus analyst estimates suggest Kelsian is undervalued. The Queensland-based company is a good fit for a global private-equity firm via takeover if its price languishes.

Source: Google Finance

5. Johns Lyng Group (JLG) – $6.83

Johns Lyng describes itself as “Australia’s largest national disaster responder”. It’s doing more work helping State governments in Victoria and New South Wales after flood events. The company has good growth prospects in the US – it could have years of work from Hurricane Ian there – and is growing through acquisitions. Some brokers value Johns Lyng above $8 a share.

Source: Google Finance

6. IVE Group (IGL)- $2.34

The printing and marketing communications company bought Salmat’s catalogue-distribution business in 2019 and this year acquired Ovato, a printing business competitor, after the Australian Competition and Consumer Commission approved the deal. IVE has cyclicality in its earnings due to its catalogue printing, letterbox drops and marketing-logistics services. But it dominates its market, has some pricing power and looks undervalued for long-term investors as its earnings grow.

Source: Google Finance

7. Data3 (DTL) – $6.76

I outlined a positive view on information-technology service stocks in an earlier column this month, identifying companies like NEXTDC (a data centre owner), Hansen Technologies, Dicker Data and Data3. The last named is the pick of them as it benefits from higher government and corporate spending on IT projects in 2023. Data3’ market is reasonably resilient; companies know they have to keep investing in cybersecurity, digitisation and other technologies.

Source: Google Finance

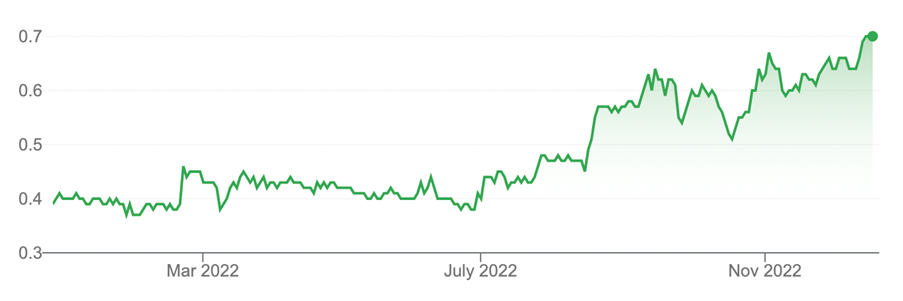

8. MMA Offshore (MRM)- 79 cents

The marine-services business fell off my radar after a long period of underperformance. I started looking at it again this year, partly because I am bullish on energy and also because its price was edging higher. I wish I’d written about MMA sooner: the price has more than doubled from its 52-week low of 34 cents. MMA’s 18 vessels operate in 10 countries, across the energy, government and defence sectors. MMA is benefiting from buoyant conditions in the energy sector and building a strong foothold in renewables, such as wind farms in Taiwan. MMA has strengthened its balance sheet and is making solid progress. Watch the market pay more attention in 2023.

Source: Google Finance

9. IMDEX (IMD) – $2.23

The mining-technology company was a star small-cap in 2020 and 2021 as its share price more than tripled. Small-cap fund managers couldn’t get enough of IMDEX, which has an excellent long-term record and market position. IMDEX provides drilling-optimisation products and technologies; rock-knowledge sensors on rock location, grade, mineralogy and texture, and real-time mining data and analytics through its cloud-based software-as-a-service. The stock tumbled earlier this year as tech stocks lost favour, providing an entry opportunity. As the commodity supercycle goes up a gear in the next few years, I’ll back IMDEX to make new highs in 2023.

Source: Google Finance

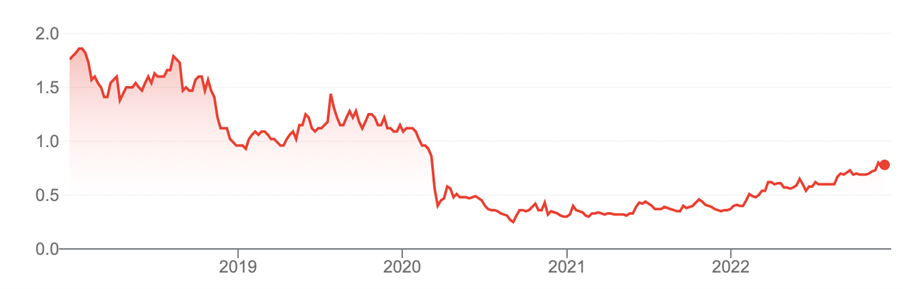

10. Perenti (PRN) – $1.06

The global mining-services stock has disappointed long-term investors. The five-year annualised total return is almost -10%, Morningstar data shows. Perenti had a long list of problems, which, sadly, included worker fatalities. When the company downgraded guidance for FY21 and FY22, the market lost confidence and the price tumbled. In November 2022, Perenti upgraded earnings guidance for FY23 after a solid result. Improving market conditions and a favourable exchange rate are tailwinds for its earnings. Perenti has its doubters, but is arguably among the cheaper mining-services plays. There was a lot to like in its latest result and commentary. That said, the cyclical mining-services sector does not suit conservative investors.

Source: Google Finance

11. Lindsay Australia (LAU) – 68 cents

The North Queensland trucking business has rallied this year as it benefits from a lack of capacity in its market, pricing growth and an improved industry structure. Shifting more of its volume from trucks to rail is also benefiting Lyndsay. After recent gains, Lyndsay is still on an undemanding PE multiple given its potential for faster earnings growth in FY23 and beyond.

Source: Google Finance

`12. Janison Education Group (JAN) – 55 cents

Janison, a provider of digital learning and assessment solutions, has tumbled from a 52-week high of $1.36 to 56 cents, amid the bear market in tech stocks. Education technology has been particularly hard hit, even though edtech has excellent long-term prospects. In November, Janison said it had a strong start to FY23. Longer term, online assessment is a growth market as more people study online. The sell-off in Janison looks overdone – and an opportunity for a private-equity predator to pounce. Watch for more takeovers across the Australian edtech space in 2023.

Source: Google Finance

13. Frontier Digital Ventures (FDV) – 68 cents

The market couldn’t get enough of Frontier in 2020 and 2021 as it increased its market share in online classifieds markets in developing nations. From $1.80 in October 2021, Frontier fell to 68 cents as micro-cap tech stocks were hammered. Frontier achieved operating cash-flow breakeven in the second quarter of 2022. The amount is small, but after years of negative cashflow, it’s a good sign. Longer term, Frontier has investments in a portfolio of online marketplaces that dominate their markets, in emerging countries that will have high online uptake in classified for many years. 2023 could be the year when Frontier turns its potential into profits.

Source: Google Finance

This is my last column for 2022. I wish you and your family a happy and safe holiday season – and all the best for 2023. This column returns later in the New Year.

Tony Featherstone is a former managing editor of BRW, Sharesand Personal Investor The information in this article should not be considered personal advice. It has been prepared without considering your objectives, financial situation or needs. Before acting on information in this article consider its appropriateness and accuracy, regarding your objectives, financial situation and needs. Do further research of your own and/or seek personal financial advice from a licensed adviser before making any financial or investment decisions based on this article. All prices and analysis at December 15, 2022.