One of the great lessons of investing is that short sellers aren’t always right. When they get it wrong, they can get caught in a short squeeze that forces up the share price. With this in mind, I thought I’d do the grunt work and see what positive views the analysts might have about those companies that are heavily shorted.

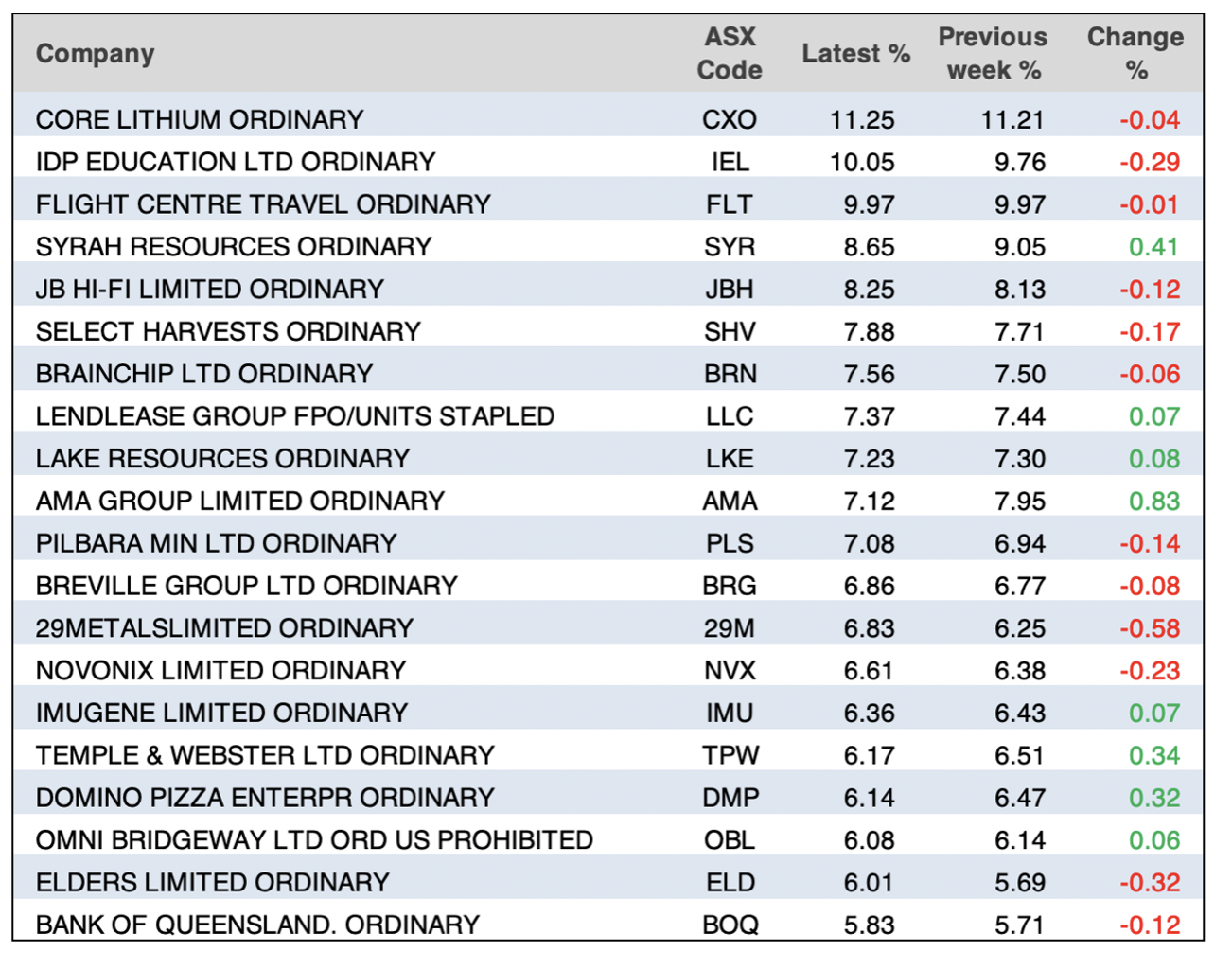

First up, here’s the list that we showed you on Saturday:

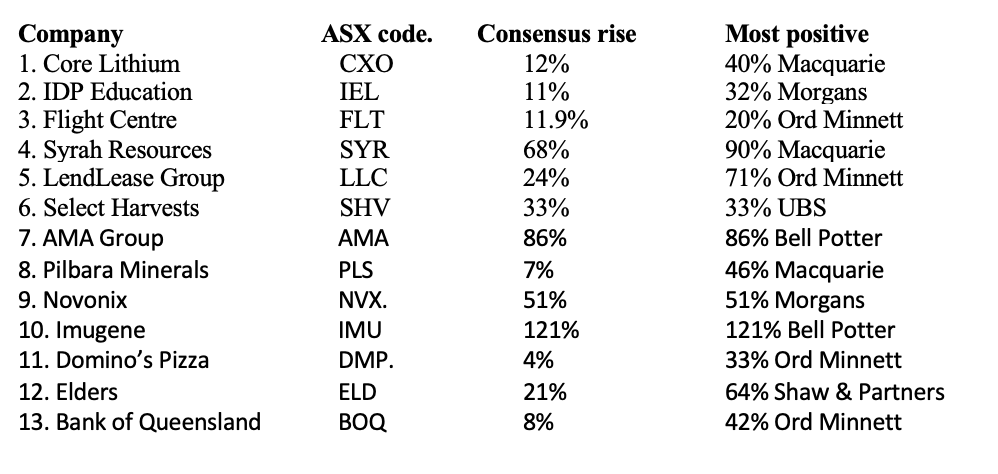

Now, what I intend to find are those companies where the analysts have a very positive view on the stock price. I dropped some companies from the above table because the analysts simply didn’t cover them. So, here goes:

After the above analysis, only two companies covered by many analysts have been given the strong thumbs up, with no negative rating. These two companies are Flight Centre (FLT) and Syrah Resources (SYR). The former has one analyst seeing a 20% upside, while the latter has one expert seeing a 90% gain. In fact, there are two analysts with the same forecast for SYR but there are only three analysts surveyed by FNArena. Five out of five forecasters liked FLT.

Select Harvests and AMA Group were totally supported, with big gains of 33% and 86% respectively, and while analysts agree on the gains ahead, there are only two brokers covering these companies. When there’s only a small number of analysts, I’m less enthusiastic about investing in the companies they’re rating.

An interesting one is LendLease, which had four out of five analysts supporting the company’s future share price. The only negative was a small one, while Ord Minnett tipped a 71% gain.

Another intriguing company is Domino’s, as the table above shows. The consensus rise is only 4% but Morgans, Ord Minnett and Morgan Stanley see solid gains ahead, while UBS and Citi slam the pizza maker with a 21.7% price fall.

Companies such as Breville, JB Hi-Fi and Temple & Webster missed the cut because they’re retailers and retail is on the nose, following 12 rate rises.

Pilbara Minerals (PLS) had 4 out of 5 supporters but the gains were small, except for Macquarie, which gave PLS a 46% upside call! On the other hand, Morgan Stanley sees a 15% price slump ahead.

One worth thinking about is Elders, which had four out of five analysts liking the company, with the only negative assessor coming with a 0.55% price fall. My only worry is that this is an agricultural company with El Nino coming, which could bring the threat of low rainfalls and droughts.

Every company on the shorted list has a notable reason for being wary of the business going forward. Flight Centre faces the interest rate impact on discretionary spending. LendLease has the falling values of office blocks they own. PLS and Core Lithium have questions about whether lithium’s price has gone too high and whether alternative technologies will challenge lithium’s role in the growth of batteries.

With Bank of Queensland, the nagging question is whether it’s a ‘basket case’ bank. I didn’t like that two banks i.e., Macquarie and Citi were the negative assessors of BOQ with the analysts’ survey.

I’m not making a recommendation but Macquarie seeing a 46% gain for PLS is interesting and their 90% call for Syrah Resources, with three out of three analysts really liking the company’s prospects, will keep me watching this business. I’d add that Macquarie is seen as an industry expert on the resources sector but it doesn’t mean they can’t get it wrong.

The one surprise package for the short sellers could be IDP Education but it does worry me that it is the second-highest shorted stock. Against that, four out of six analysts like the company and the range of predicted upside calls goes from 14% to 33% from Morgan Stanley.

Betting against short sellers can be risky, but when you get it right, the short sellers have to scurry to buy and that can be greatly rewarding for those who invest in shorted stocks!

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances