One of the United States’ leading big market players, billionaire investor Ron Baron said we’re entering a great buying opportunity phase for stocks and he nominated Lululemon as one of his favourites going forward. His thinking is linked to the fact that everyone is wearing leisurewear and I saw this recently in Heathrow airport where just about everyone was wearing upmarket joggers as they prepared to board the plane.

The fashion world has turned casual with an athletic twist and smart investors pick up on themes or look to what people do every day or every week when trying to work out what companies they should invest in.

So I thought I’d look for the businesses that we deal with all the time in our normal lives trying to put together a portfolio that will do better than 10%, which I think I could get by simply buying an exchange traded fund for our overall stock market such as IOZ, STW or A200.

For diversification reasons, I want at least 10 stocks, but I could entertain more and they need to be supported by the analysts surveyed on FNArena.

Here goes:

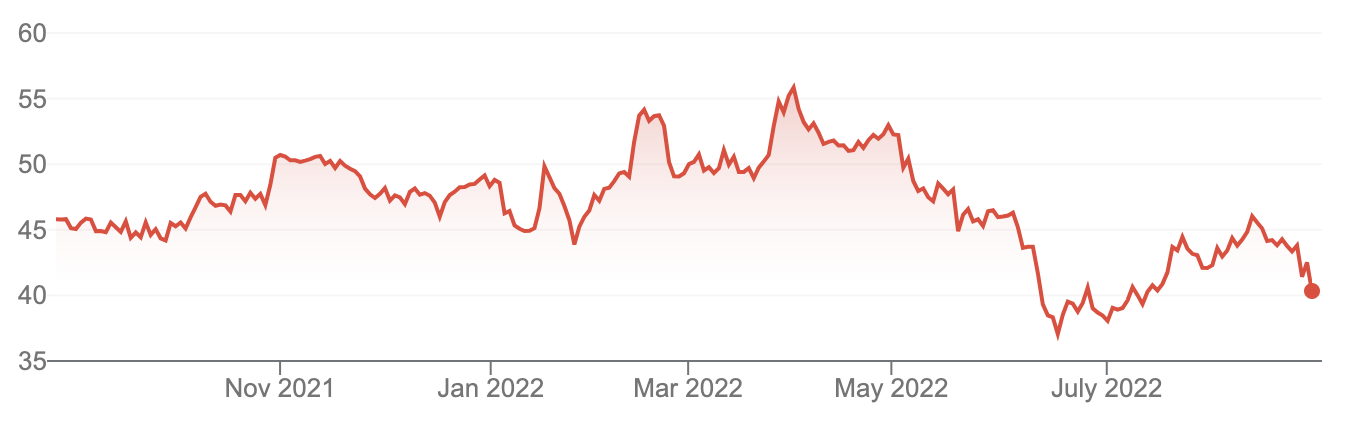

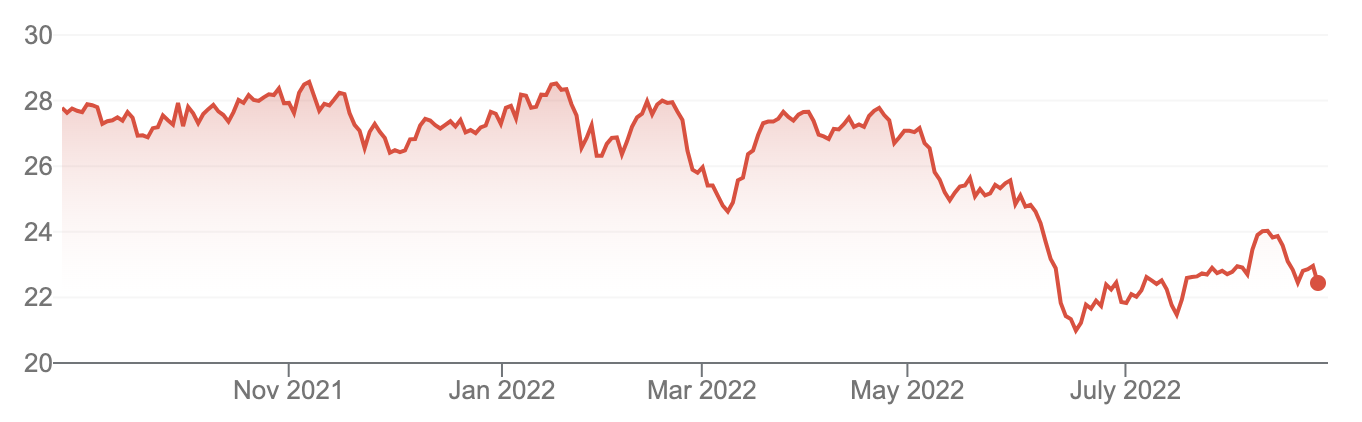

- Telstra Corporation Limited (TLS)

We’re all permanently locked into a relationship with our mobile phones, so TLS is a natural pick for this portfolio. The consensus of the experts who watch this company have an 8.6% rise ahead, with five out of six liking the company and two (Ord Minnett and Morgan Stanley) seeing a 14% gain.

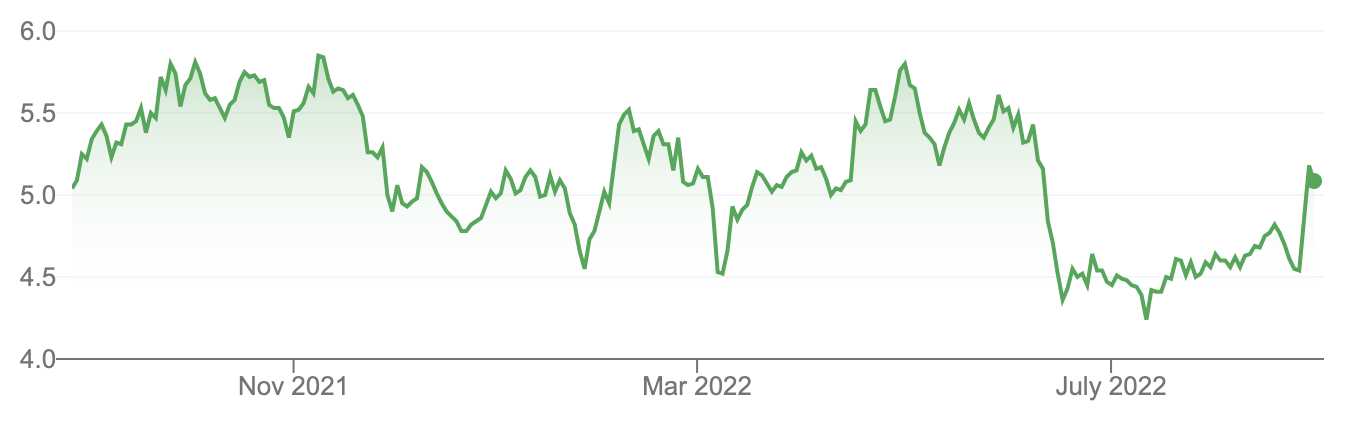

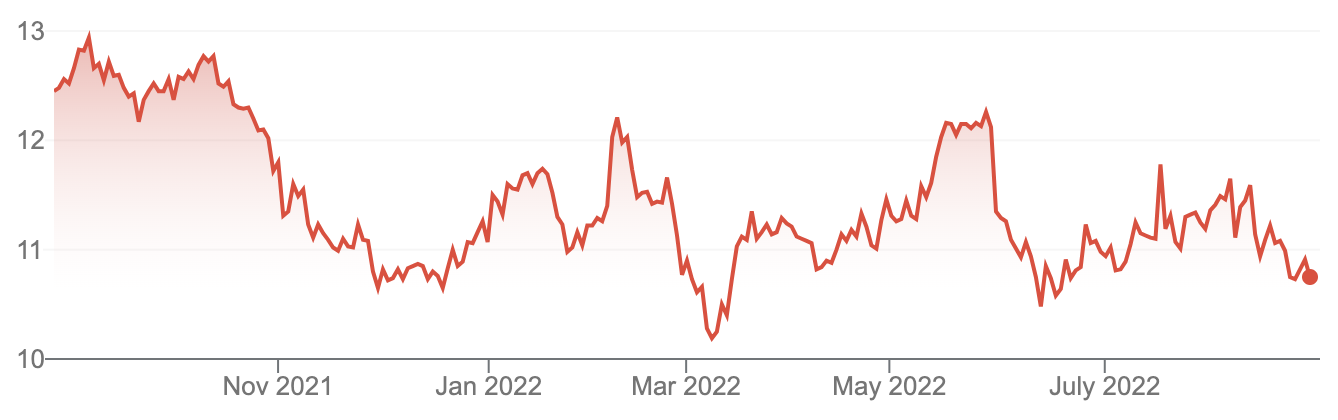

- JB Hi-Fi Limited (JBH)

This stock is a natural for a world increasingly becoming hi-tech. JBH is one of the best retailers in the land. They’re a bit out of favour because we bought a lot during the pandemic and services will be more important for some time, but this business will have a strong link with the Aussie consumer going forward. The consensus rise from the company assessors is 12.1%, with five out of six analysts liking the company. Credit Suisse is tipping a 25% rise, while two others see a 17% jump ahead for its share price.

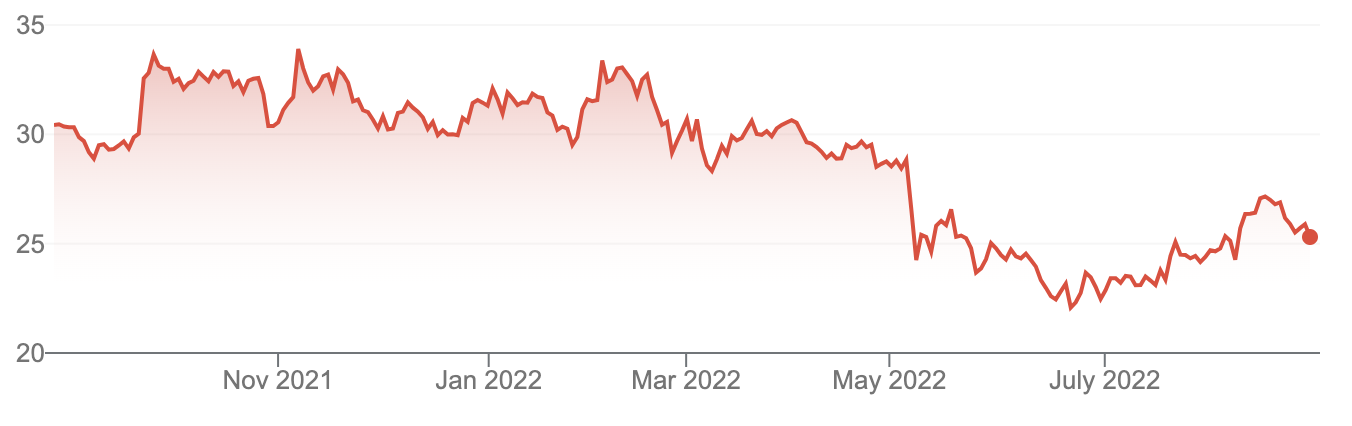

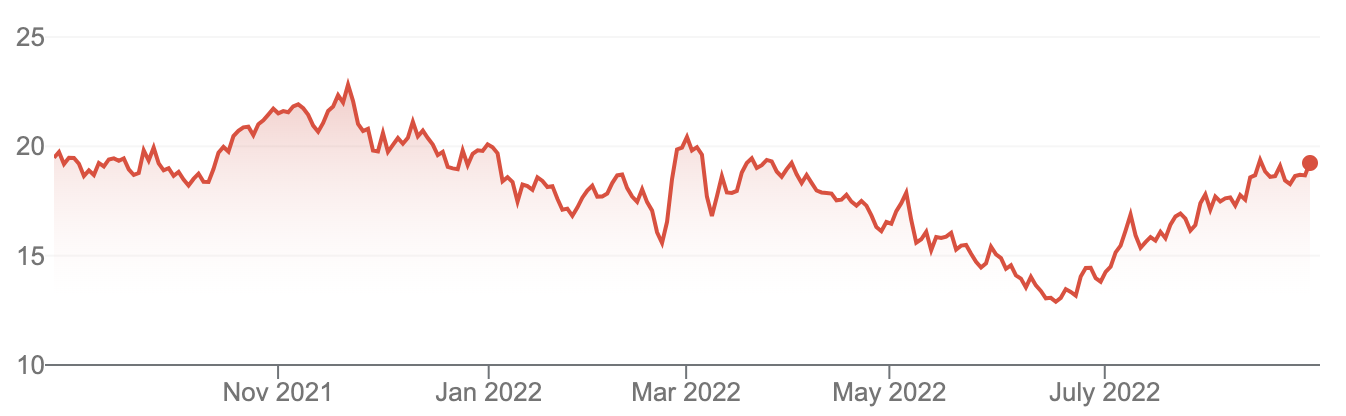

- Qantas Airways Limited (QAN)

QAN is currently under fire for labour supply and covid challenges, but, when we get back to normal and foreign workers return, this traditionally much-loved company will fly high again. And five out of six analysts agree with me, with a 20.9% rise expected. But Ord Minnett is more bullish, with a 39% higher call, while Macquarie tips 36%.

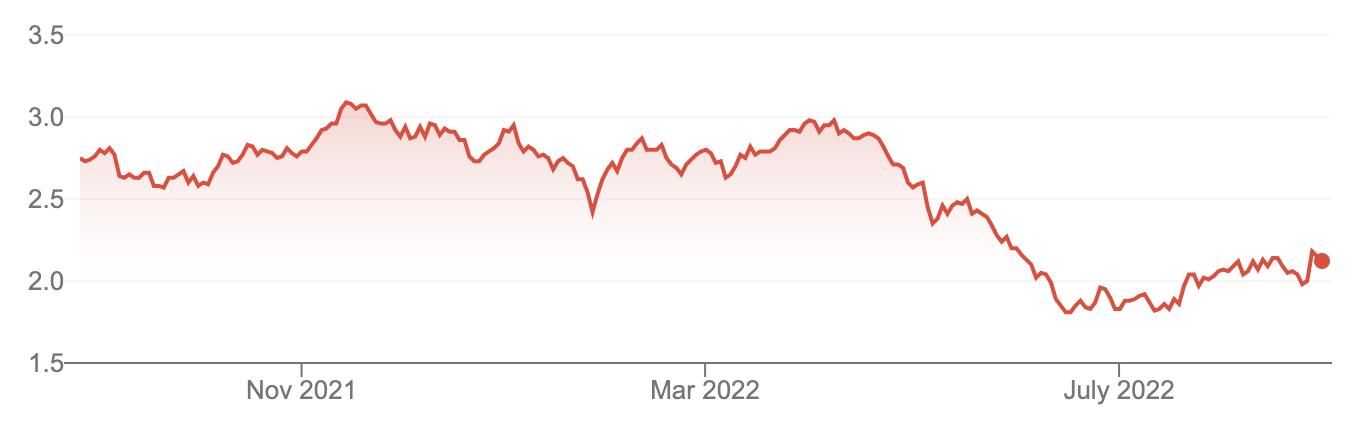

- News Corp (NWS)

There aren’t many Aussies who aren’t connected to News Corp (NWS), either through newspapers, websites, magazines, Foxtel and other businesses. The analysts see a 33.4% rise ahead for the stock, with three out of four giving it the thumbs up. UBS and Credit Suisse are looking at a 47% rise in the near future.

- Nine Entertainment Co Holdings Limited (NEC)

This is a more risky stock because it’s in old media but Nine Entertainment (NEC) recently reported better than expected. And between its free-to-air play, its streaming service Stan, its successful radio network and the newspapers (AFR, SMH and The Age) with their websites, they have a lot of customers. The analysts see a 46.2% rise ahead and five out of five experts agree, with two seeing a 44% rise, Credit Suisse is tipping a 53% jump and Morgan Stanley is expecting a 76% boom! That’s a gutsy call. I’d be happy if this is only a quarter right.

- ANZ Banking Group Limited (ANZ)

Whether we like it or not, we all have to deal with banks, and while I prefer CBA and NAB, both of these are priced to perfection. ANZ has struggled but it’s trying to lift its game, with its eye on Suncorp’s banking business. The analysts see a 17.3% rise ahead, with UBS the most positive with a 30% higher call. Two others see a 26% rise in the wings.

- Suncorp Group Limited (SUN)

Many of us need insurance. ANZ really likes Suncorp (SUN) such that it’s trying to buy it, which makes the company more interesting. The analysts like it too, with five out of six supporting the company and seeing a 20% rise ahead. UBS is really loving it, with a 35% upside forecast for its share price. Three others can see a 19%+ rise ahead.

- Coles Group Limited (COL)

Of course, we’re all going shopping for staples, so Coles (COL) with a 6.2% upside call from the analysts is attractive, especially when the company pays a fair dividend, which with franking credits would take us to a potential 10% return. Five out of six experts think the company’s share price will go higher, with both Citi and Morgans seeing a 13% gain ahead.

- Lovisa Holdings Limited (LOV)

Let’s recognise that young people like fast fashion and a company like Lovisa (LOV) is often singled out as a good company to follow. The consensus rise for LOV is 9.4%. While only three out of five analysts really like the company, Macquarie sees a 26% upside for this business.

- Webjet Limited (WEB)

At the more risky end of these stocks is Webjet (WEB), but I do think the theme going forward is that the travel bug will grow and as Covid becomes less of a threat, the more cautious tourists will join the current thrillseekers who are already hopping on and off planes. The consensus call is 29.3% upside. Six out of six analysts like the business, with Ord Minnett seeing a 48% rise in the pipeline, and three out of four seeing a 30% or higher gain.

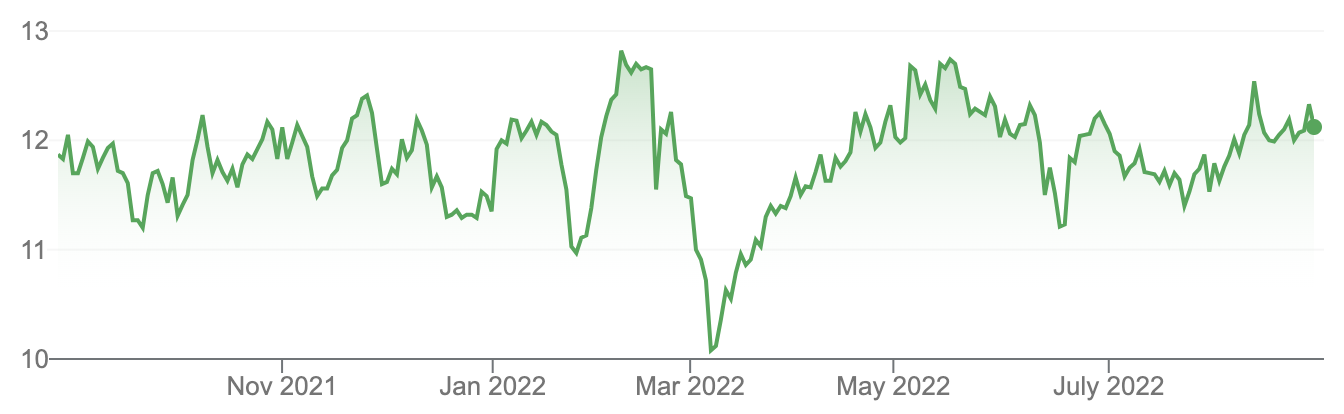

- QBE Insurance Group Limited (QBE)

A bonus throw-in is QBE, which, as an insurer, gains when interest rates rise and that’s what’s happening right now. The consensus rise is a big 27.5%, with seven out of seven experts liking the company. Credit Suisse is tipping a 44% rise in its stock price and three of these business assessors forecast a 20% rise ahead!

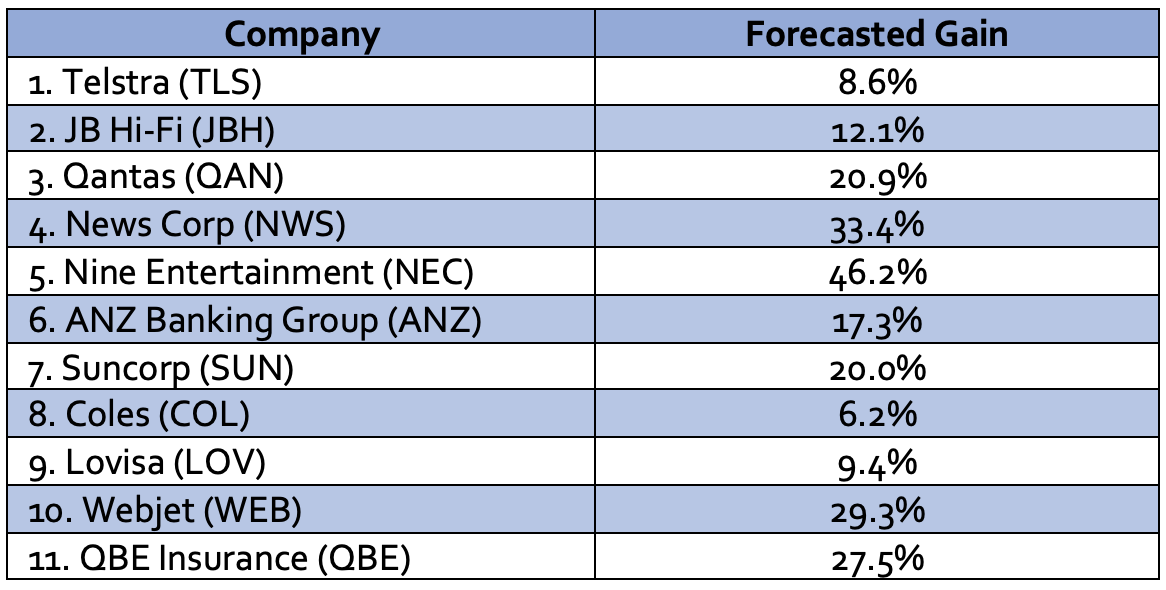

Let’s recap and see what the average rise might be if these analysts are on the money:

That’s about a 21% gain for these 11 stocks. This is based on the average or consensus call. If we looked at the most optimistic calls, the average gain would be a whopping 35%, but that would take a lot for all the optimistic calls to come in on the money.

That said, there’s plenty of food for thought in buying the companies we deal with on a pretty regular basis or companies that are becoming increasingly popular in a rapidly changing world.

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.