“What are some good value mid-cap to small-cap stocks we could buy for the future?” That’s a question Paul and I received at our monthly webinar for Switzer Report subscribers.

To me, the companies I like are my ZEET collection of companies:

- Zip

- Elmo Software

- EML Payments

- Tyro Payments.

But most of you know that, so I went researching to find those companies in the list of ASX-companies that the experts/analysts think have double digit upside.

My bigger list included companies in the top 200, and I’ll quickly share the standout ones such as:

- Bega (BGA) up 29%

- EML up 22.7%

- Nufarm up 29.4%

- Tyro up 25.1%.

But today’s focus is on the smaller cap companies, many of which you might put in the value companies grouping, and these could have a good run ahead from now into 2022, when greater vaccinations meets opening borders and big rebounding economies worldwide.

On Friday on Wall Street, we saw a bit of this move towards value and smaller cap companies, with the better-than-expected US jobs report coming in with 943,000 jobs for July and unemployment falling from 5.7% to 5.4%. This saw 10-year bond yields rise and tech/growth stocks lost friends, as value companies gained them.

Given this, I went looking for ASX-listed companies between numbers 201 to 300, which are smaller cap in capital terms. This group has been neglected of late for big-cap companies. This table shows my point clearly:

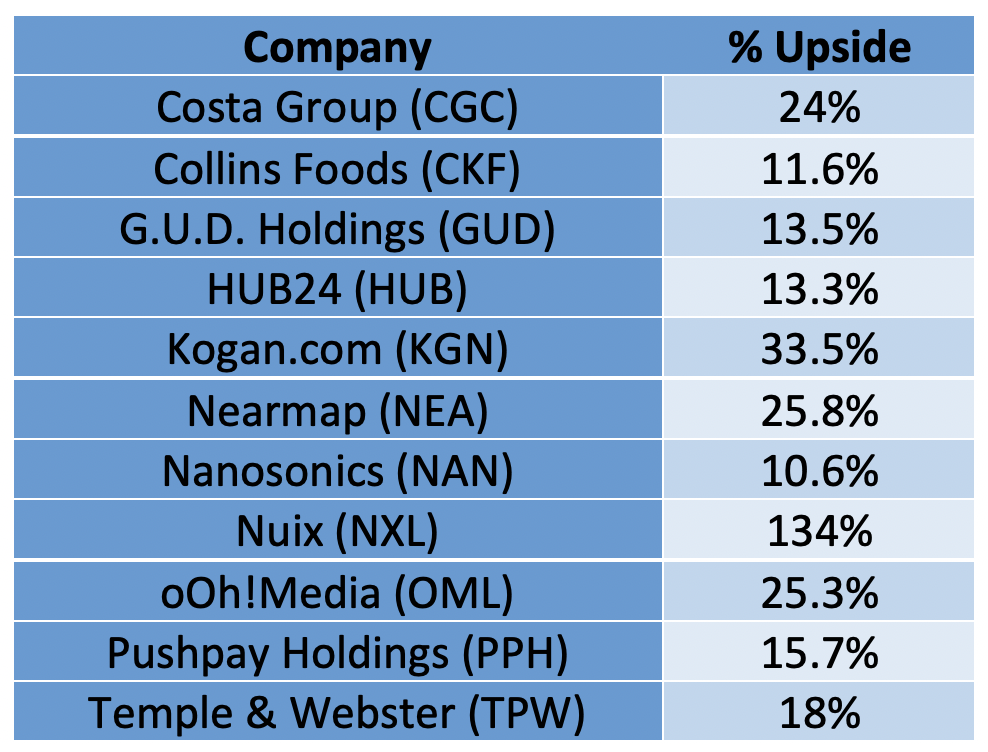

So here’s a list of 11 companies/stocks with double-digit gains ahead, if the experts are on the money in their assessments:

That’s the raw numbers. Here are my short takes on each company.

1. Costa Group (CGC)

Costa Group is a good company but the vagaries of the agriculture business with weather and China demand make me wary about a company now at $3.28, though two analysts see CGC at $4.00 plus. I liked this stock at lower prices but now it’s for weather gamblers so the 24% upside is also a punt.

2. Collins Foods (CKF)

Collins Food Group is a solid company owning the likes of KFC and Taco Bell around the country. This was a $12.70 before lockdown land hit NSW and Victoria and is bound to perform better when 2022 brings more free movement in cities and tourism is on the rise. The 11.6% gain looks believable.

3. G.U.D. Holdings (GUD)

G.U.D. Holdings (GUD) is not a company I know much about but it’s in the automotive aftermarket and water product sectors, which are two sectors with potential. Used cars have seen big price increases and water is a resource that we’re starting to value more highly. The 13.5% price gain doesn’t look outlandish.

4. HUB24 (HUB)

HUB24’s upside is believable. The company is in the financial space, which makes a value stock. It’s taking business off the bigger financial institutions and has a growing, positive reputation.

5. Kogan.com (KGN)

Kogan.com has a 33% upside if the analysts know what they’re talking about. Last Monday, Julia Lee surprised me tipping this stock but she thinks it’s a natural winner out of lockdowns. Julie and others say the customer links will be good for KGN going forward. While the gains look on the high side, I do see the company growing its customer base over time, which will help its share price. The two analysts surveyed by FNArena believe KGN has similar big price rises ahead.

6. Nearmap (NEA)

Nearmap (NEA) can be a disappointing business but the three analysts who’ve looked at the company’s potential have seen the upside future of the stock price as +20.93%, +9.3% and 48.84%. That’s a fair bit of positivity about the company.

7. Nanosonics (NAN)

Nanosonics (NAN) is in the healthcare industry manufacturing and distributing ultrasound probe disinfectors and other related technologies. It’s a good company but the chart says it’s had problems of late and the upside is small considering it’s now at $5.28, but it has been as high as $8.25 in January this year. The health sector is the right space and is one plus for the company. Health care is only up 7.7% for the year and tells me that there’s likely to be rotation into this sector over the next 12 months.

8. Nuix (NXL)

Nuix (NXL) has a 134% gain ahead if the experts are of sound mind! The current share price is $2.63 but its high this year was $11.86 after listing at $5.31. And despite the pathetic performance of its management team and board, the underlying company and what it does is highly rated. I’ve always believed there’d be upside for the patient but it might be a wait. However, if it’s to be 134%, even if you waited three years, it would be around 45% a year! I’ll ‘punt’ on that!

9. oOh!Media (OML)

oOh!Media (OML) is a company that will only do well when we’re properly reopened post high vaccine rates. Once upon a time I saw their airport billboards every week when I flew interstate or in lifts when I was always in CBD buildings. The company’s time will come but it’s still a wait until 2022 and beyond. This one is for the patient but here are the analysts’ upside predictions: +17.65%, +17.65 and +40.52%! The Macquarie smarties think they know more than others.

10. Pushpay Holdings (PPH)

Pushpay Holdings (PPH) has a 15.7% upside and as the religious world gets back to normal, this hi-tech donor management business should do better than now. But there is argument that the big churches in the US have been recruited and the smaller ones are harder and more expensive work for the company. You might need divine help to see this company deliver as much as 15.7%, but some upside is believable.

11. Temple & Webster (TPW)

Temple & Webster (TPW) has its supporters based on the same argument used by Julia for Kogan. I think these guys still have a “Temple and who?” issue with their marketing to a wider audience but if they get that right they could be a surprise package, as a homewares and furniture retailer. The analysts are pretty positive with speculated gains of 30.72% and 19.44% but Macquarie is only expecting a 2.94% gain.

So there they are. And what will I go for? More Nuix as I’m a patient investor and I’m tempted to give Kogan and Temple & Webster a go because I do think online retail is here to stay. Meanwhile I suspect HUB24 will be a beneficiary of the turnoff factor for financial institutions. And finally, Ooh Media one day will benefit from a more normal world that learnt to get over this ‘damn’ Coronavirus.

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.