Here’s the question I keep getting: “How are you playing the banking crisis?” My answer is that I don’t think this will be a serious crisis so I’m still betting on a growth and tech company rebound later in the year.

In fact, this banking crisis of confidence could bring US rate cuts earlier than I thought, which will help the rebound come earlier than it might have if central banks kept up with their madness of excessive rate rises.

Be clear on this: all central banks have done enough with monetary policy, which works with a lag that can be six to 18 months. The effects of all this tightening will come in hard soon. I think the job cuts announced by the likes of Amazon, Google, Atlassian and others all show the Fed’s bark will turn into an inflation-killing bite.

The bond market is now betting on 2023 rate cuts and the expectation of a US recession has shortened. This means we could see some dramatic market moments, but after they dissipate, the rebound will start with beaten-up quality tech companies bound to be the target of the big players on Wall Street and around the world.

I’m not alone on this subject, with analysts from

J.P. Morgan telling CNBC that it “isn’t concerned about Deutsche Bank [1], and investors should focus on the European bank’s solid fundamentals”.

I loved the quote from US central bank boss Jerome Powell on the banking crisis that started with the failures of Silicon Valley Bank and two others: “In the weeks after such interesting events, it is often a bumpy road.” I think Powell knows banking crisis fears will help beat down inflation but he still raised official rates last week by 0.25% (not 0.5%) to show he’s not scared about a banking collapse like we saw in the GFC.

So, I’m looking for 10 top tech stocks that analysts like for the year ahead. If they like them, it must imply they agree with me that a tech/growth stock rebound is out there waiting to happen.

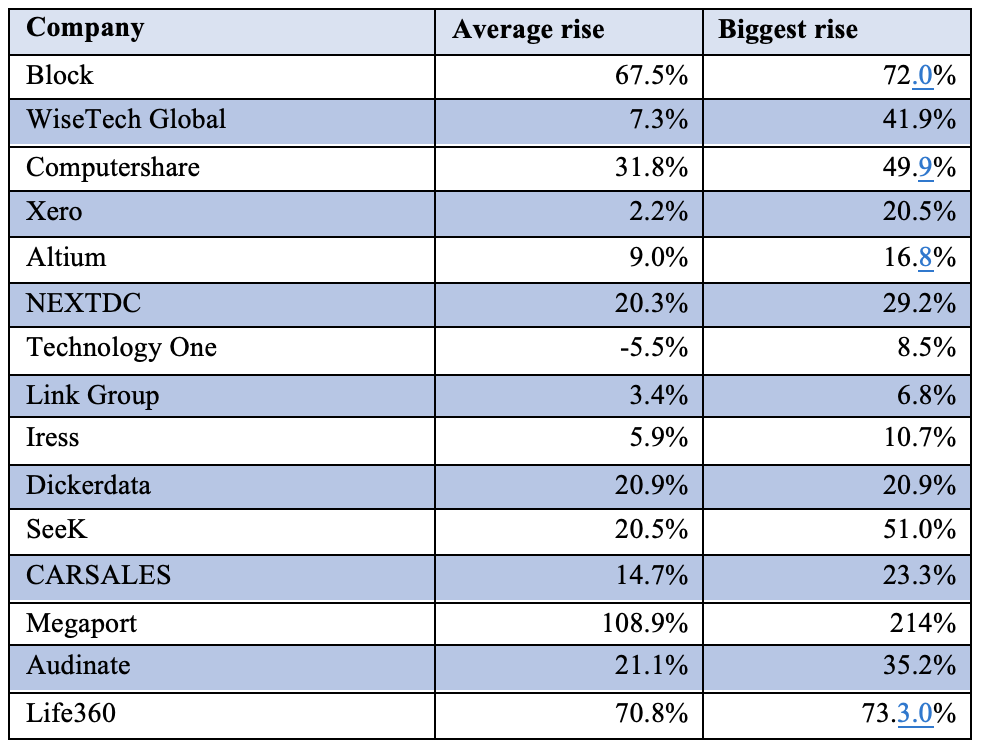

Last year, IG Markets say these were our top 10 tech stocks. Beside them let’s see what the average consensus rise and biggest predicted rise from the experts are. I’ll also throw in a few more that help prove my point that the experts see a tech rebound ahead.

The numbers tell a story that the experts/analysts see enormous potential in many of these companies. It tells me that we should take a tip or two from some of the world’s best investors. I like these four quotes:

- “I will tell you how to become rich. Close the doors. Be fearful when others are greedy. Be greedy when others are fearful.”— Warren Buffett

- “With a good perspective on history, we can have a better understanding of the past and present, and thus a clear vision of the future.”— Carlos Slim Helu

3.”Courage taught me no matter how bad a crisis gets … any sound investment will eventually pay off.” — Carlos Slim Helu

- “Investing should be more like watching paint dry or watching grass grow. If you want excitement, take $800 and go to Las Vegas.”— Paul Samuelson

For me, buying quality companies when they’re cheap and then being patient ultimately pays off.

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances