One unignorable trend since June 16 is that whenever markets think inflation could be ready to fall and/or interest rate rises could be less than expected, tech stocks get bought.

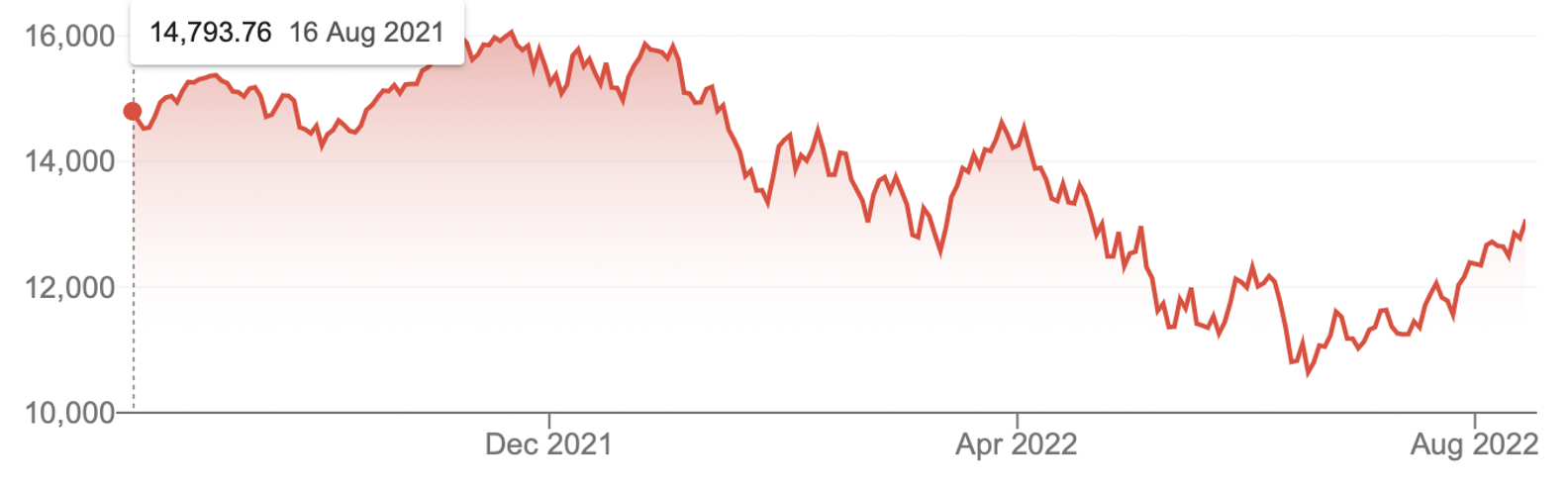

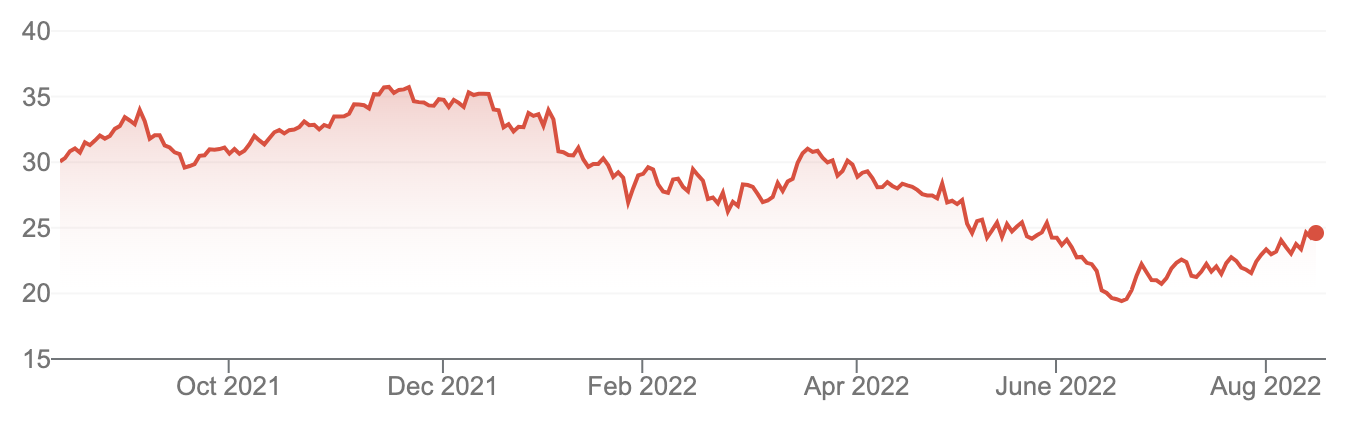

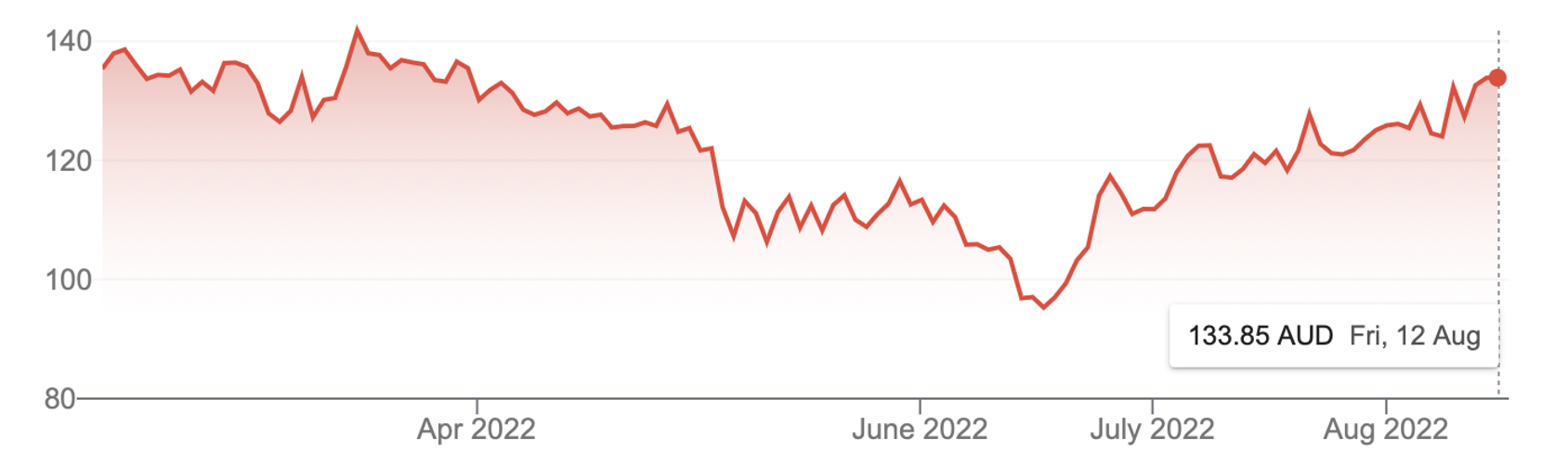

This re-loving of tech stocks after a spectacular break-up from virtually day one of 2022 (as if it was a New Year’s resolution) shows up more in the bounce-back on the Nasdaq Composite, as reflected in the chart below.

Nasdaq Composite

The ‘hate’ session on tech stocks actually started a year ago, as it was obvious that interest rates had to rise to fight inflation. But the real disdain kicked in on January 3 this year.

That sell-off took the Nasdaq into bear market territory, down 33% at one stage. But since mid-June, the index is up 22%.

I can’t make any promises that markets won’t sell off again but I am betting with my own money that one day, when inflation really looks like it’s sliding, tech stocks will be bought again by the big players in the US and we’ll follow suit.

Consequently, I’m interested to see what the analysts surveyed by FNArena think are the top 10 tech stocks. So here goes:

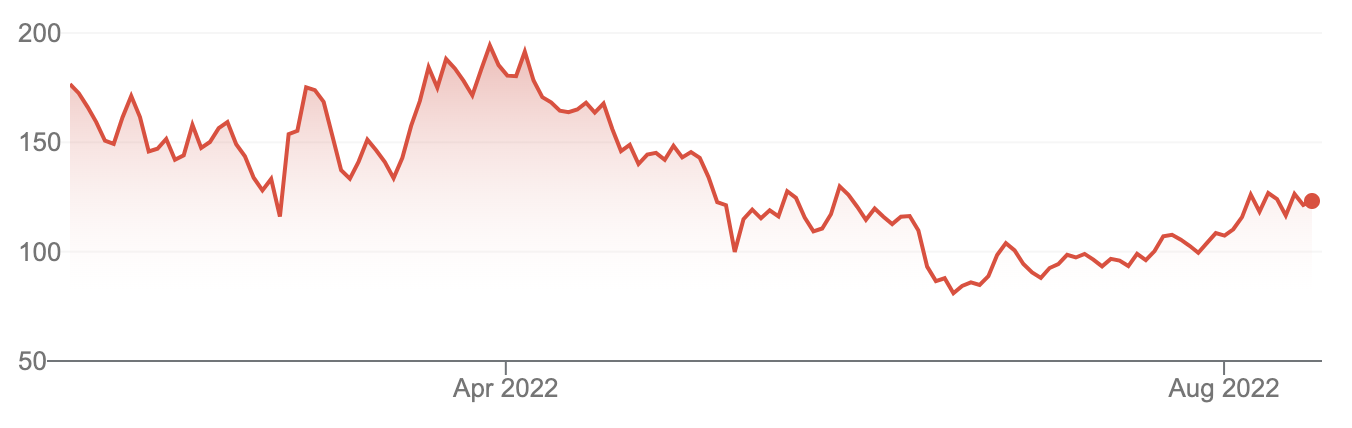

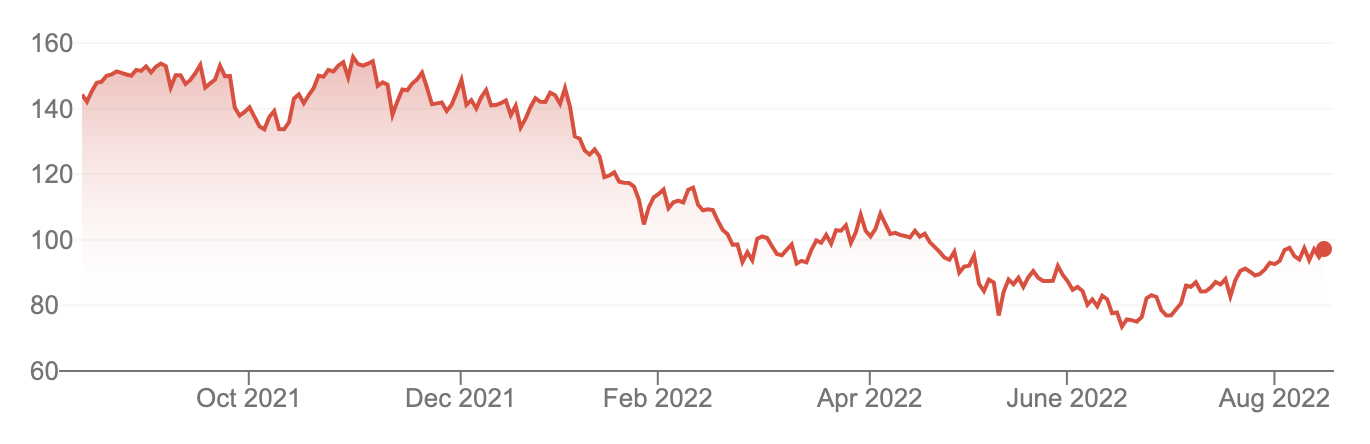

1. Block Inc. (SQ2) which now houses Afterpay and Square is now at $121.39 and has a 7% upside on average, but the biggest supporter and only analyst nowadays is Macquarie, which thinks it could go to $130.

Block Inc CDI (SQ2)

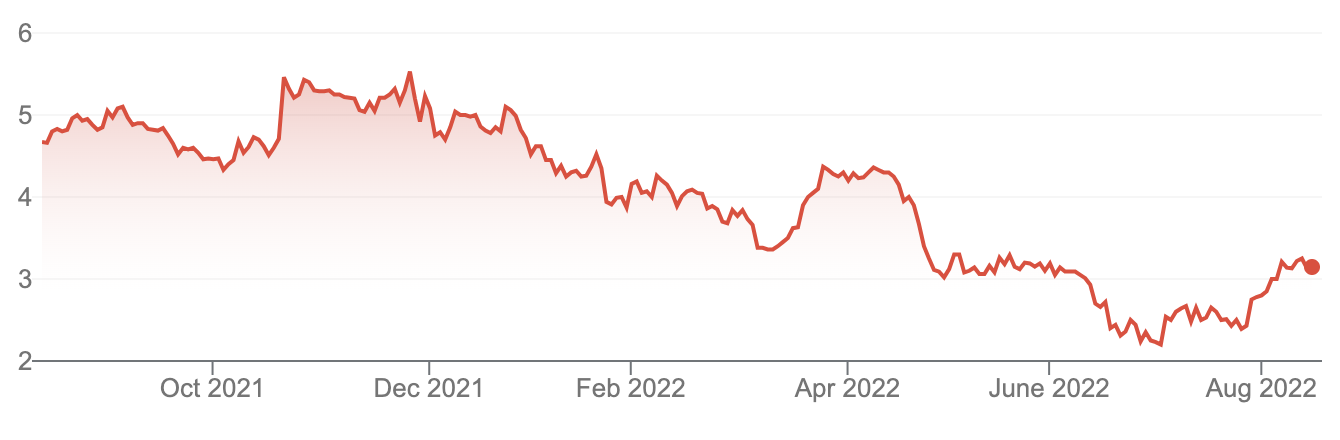

2. Elmo Software (ELO) is currently priced at $3.13 and the rise tipped is 11.8%, but that comes from the only analyst covering the stock.

Elmo Software Limited (ELO)

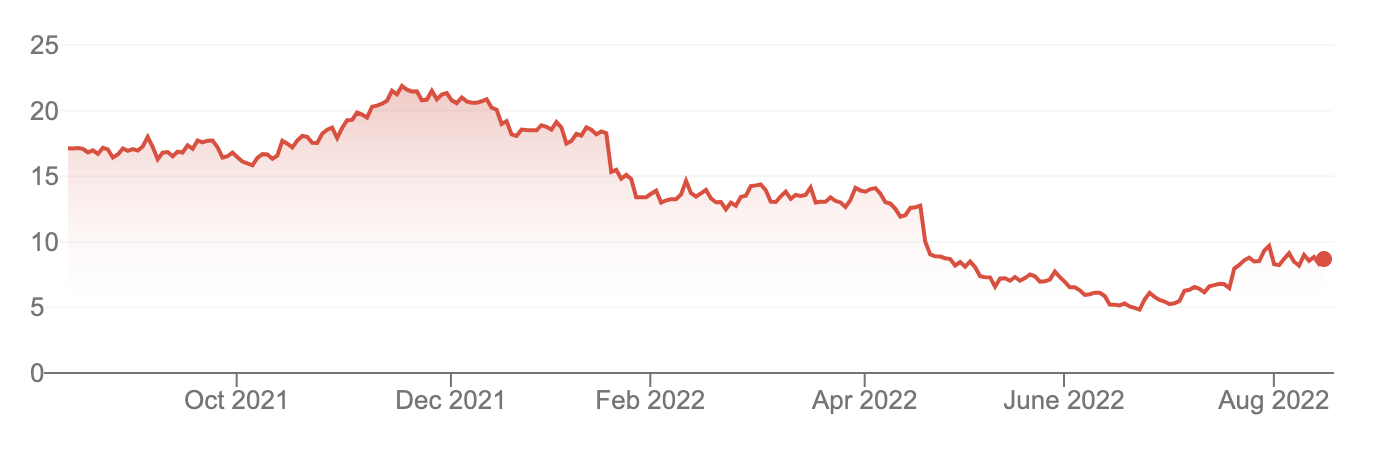

3. Tyro Payments (TYR) is now priced at $1.05 and the target price is $2.13, which implies a 103.2% gain. Four out of five analysts like the company and the biggest fan is Morgan Stanley, with a $4.70 price target. If this expert is right, that would be a 347.62% gain! As a shareholder, I hope they’re right.

Tyro Payments Limited (TYR)

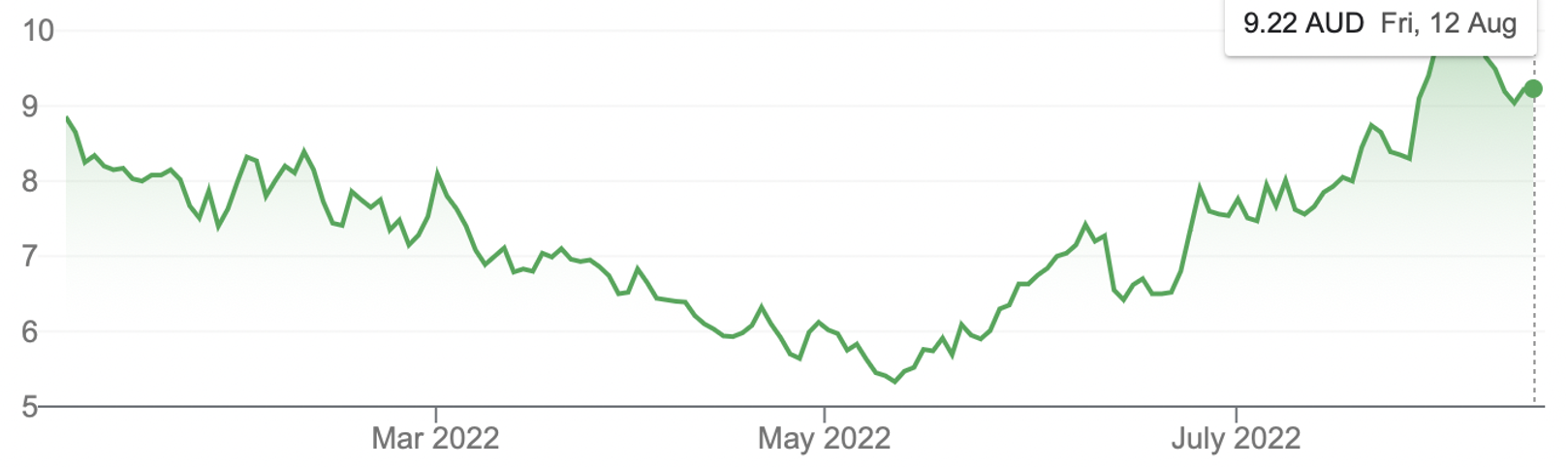

4. Audinate (AD8) has had a nice run recently and while the analysts see an average rise of only 2.2%, UBS sees it is more like 6.8% higher from its current price of $9.22. I think this company has real potential the more and more we get the world back to normal and not worrying about Covid. I’m really sorry I didn’t take my own advice on this company!

Audinate Group Limited (AD8)

5. Altium (ALU) is currently priced at $30.07 and the consensus guess is that it could be 4.9% higher in the not too distant future. The most optimistic about the company’s prospects is Morgan Stanley, which forecasts a 16.4% rise but Macquarie sees a 16.2% fall ahead. Three out of four analysts like the company.

Altium Limited (ALU)

6. Seek (SEK) is the quality end of the tech space and is currently copping backlash from a tight labour market, a lack of workers and the probable impact of rapidly rising interest rates that should slow our economy down. However, the consensus rise in this company’s share price is 31.4%, taking the current price of $24.25 to $31.40. Six out of seven analysts like the company’s prospects with the most onside analyst being Credit Suisse which expects a 52.16% rise in share price in the future.

Seek Limited (SEK)

7. Xero (XRO) is also at the quality end of the tech sector and the average expected rise is 4.4% with the current share price at $94.75. Morgan Stanley is the biggest fan with a target price of $148, which implies a 56.2% rise!

Xero Limited (XRO)

8. Megaport (MP1), like Audinate, has world-class technology and should be a winner as the world gets back to normal. The current price is $8.31 and the average consensus rise is 34.3%, which would take the price to $11.16. The biggest believer in the company’s potential is UBS which can see an 86.52% rise ahead. As a shareholder, I hope this tipster is on the money.

Megaport Limited (MP1)

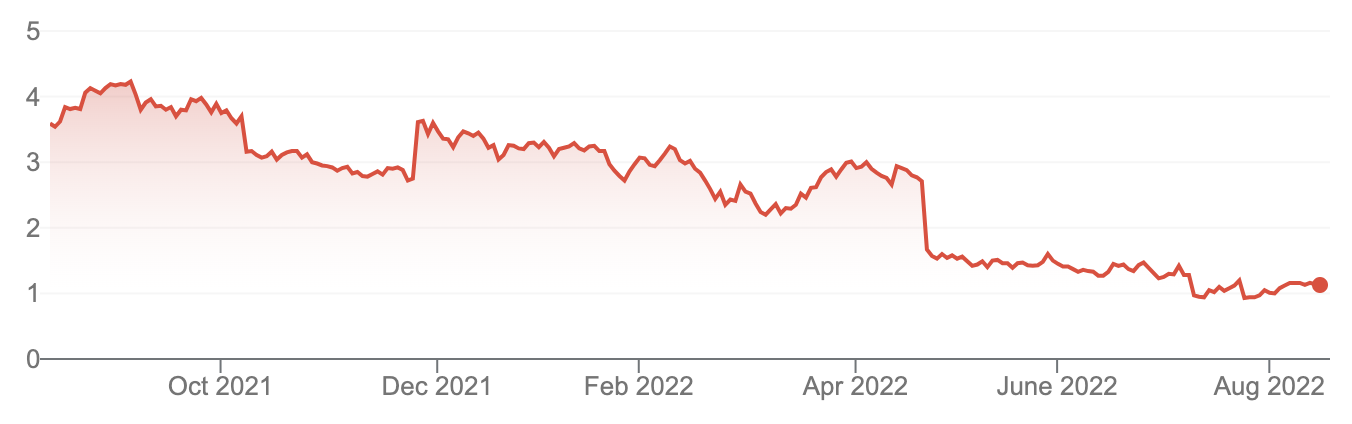

9. EML Payments (EML) is a troubled business but a lot of people see this company as having potential with the average rise specked at 117.8%, which would take its price from the current $1.14 to $2.48. Three analysts assess the company and two like it with the greatest supporter being Macquarie which sees a 202% upside. The company has a new CEO — Emma Shand — who is going to base herself in London, undoubtedly, to sort out the company’s problems with the central bank of Ireland, to be sure, to be sure!

EML Payments Limited (EML)

10. NextDC (NXT) is now at $11.29 and is like an infrastructure play within tech, so it’s a safer way to play this more risky sector of the market. The average expected rise is 22.4% and seven out of seven analysts like the company going forward and the biggest supporter is Morgan Stanley with a 37.29% higher target price of $13.50. This long-term chart of NXT shows how it rises, goes sideways and then kicks up again. I suspect that pattern will be sustained as we use more internet services.

NextDC Limited (NXT)

If you like catchy buzzwords such as FAANG stocks, these stocks in this list can be called BETA ASX MEN, but then again, maybe not!

I’ve left out some companies such as Wisetech Global because it has already risen in price over the past year —49.46% — which underlines its quality.

Wisetech Global Limited (WTC)

Another tech-like company is Carsales.Com (CAR), which has only fallen 5.04% this year. The analysts see a 6.2% rise ahead, with UBS and Morgan Stanley forecasting a 15.47% rise!

Carsales.Com Limited (CAR)

REA could also be thrown in as a quality tech business and we’ve been talking about this company for months, especially on my TV show and it has delivered, as this chart shows.

REA Group Limited (REA)

REA has rebounded 40% since June 17, which I think reinforces my message that tech eventually gets re-loved and that loves starts firstly with quality businesses that make profits but will extend to others with potential, as time goes by and interest rate rise fears dissipate.

Buying quality and waiting has always been a great strategy.

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.