For weeks, my computer has hassled me about “cloud storage”. It sent notifications that my cloud storage was almost full. Then, upon exceeding that storage, I received a barrage of messages – across multiple devices – that I needed to upgrade my storage.

I did so partly because I needed to back-up files in the cloud. And partly to stop the annoying notifications (extra cloud storage was only a few dollars a month).

The surprise was how quickly my initial cloud storage was exceeded. I’m not a big storer of videos, photos or other data-rich materials. But within months of using a new cloud-storage system, I was upgrading to a plan with 10 times more storage.

This experience reminded me that cloud computing is one of the great technology megatrends of our time. And why investors seeking exposure to a recovery in tech stocks should focus on the most powerful structural trends within the sector.

To recap, in last week’s column I suggested putting tech exposure on portfolio watchlists with a view to buying later this year when there is more clarity on the inflation/interest rate outlook and whether the current rally is sustainable or, as I suspect, a bear market trap. I argued that investors with higher risk tolerance could buy tech now; more conservative investors should wait a little longer.

I suggested focusing on the market’s high-quality tech companies – the so-called FANG stocks – using the ETF FANG+ Exchange Traded Fund (FANG). The BetaShares Nasdaq 100 ETF was an option for broader tech exposure (in addition to other sectors).

Another option is focusing on trends within tech. Two of my favourites are cloud computing and semiconductors. The latter has fantastic long-term prospects as more devices require semiconductor chips for the Internet of Things (connected devices). Seemingly every new device has a semiconductor chip.

However, China’s recent escalation of hostilities towards Taiwan is a wild card for semiconductor supply (Taiwan is a dominant producer of them). From a risk/return perspective, cloud computing is the more attractive trend for now.

Cloud computing has eye-catching growth prospects. The industry will have a compound annual growth of almost 20% to 2028, reaching US$1.25 trillion in value by then, according to Research and Markets, a global forecaster. Few industries are as attractive.

However, care is needed with headline-grabbing forecasts from industry consultants and research. But even if one halves that growth forecast, cloud computing has exceptional long-term prospects as more data is captured, stored and analysed.

Big data equals big storage. As firms capture ever more information on their customers, manufacturing processes and industry conditions, they will need extra data storage. Also, as more video is produced (think facial recognition), data-storage requirements will expand.

If I need 10 times more cloud storage for day-to-day work activities (admittedly from low initial storage), imagine what companies will need as they collect an ocean of written, audio and video data and use Artificial Intelligence to analyse it.

This will create huge tailwinds for cloud-computing companies that could last a year or decades. Not all cloud-computing firms will succeed, but it’s hard to think of a better long-term investment trend in tech than data storage. In some ways, these data storers are a new type of utility or infrastructure provider.

Yes, cloud-computing trends are hardly new. But the opportunity is using current market weakness to buy into attractive tech megatrends at better prices.

In my experience, investors underestimate the power and longevity of the strongest megatrends, believing it’s too late to invest just as the trend starts to become more sustainable.

Here are two ways to play the cloud-computing trend:

1. NextDC Limited (NXT)

NextDC (NXT) has become this market’s go-to stock for cloud-computing exposure. The Brisbane-based company was worth $80 million when it listed on the ASX in 2010 through an Initial Public Offering. NextDC is now worth $5.2 billion.

A 10-year average annualised return of almost 20% has made NextDC one of this market’s best-performed companies. Investors who were lucky enough to get the stock in the float have cleaned up, but NXT still has a long way to grow.

NextDC has 10 operational data centres, two under construction and three in planning, according to its FY22 half-year result presentation pack. As NextDC adds data-storage capacity, its contracted utilisation rate continues to edge higher.

This earnings “flywheel” is a beautiful thing for investors. NextDC is adding more space and renting out a high proportion of that space over time, due to the strength of its facilities. It had 82% constructed utilisation at its facilities in the first half of FY22.

NextDC customer numbers have grown from 933 in the second half of FY18 to 1,569 in the first half of FY22. It’s a simple story: more companies are wanting state-of-the-art storage facilities for their data and extra connections at NextDC facilities.

More customers utilising more space at NextDC facilities creates that visible, recurring revenue the market places a big valuation premium on.

Barriers to entry are a lesser-considered part of NXT’s prospects. I have written favourably on NextDC several times in the past decade, principally because data centres are harder to build than is widely realised. Finding and securing prime CBD locations with access to water and enough renewable energy to power/cool data centres is not easy. For years, the market underestimated NXT’s “early-mover advantage” in cloud computing.

At its half-year result, NextDC slightly upgraded its full-year revenue and earnings guidance. More will be known when NextDC reports its full-year FY22 result later this month, but the half-year upgrade reinforces the resilience of its business model and the quality of its execution and strategy.

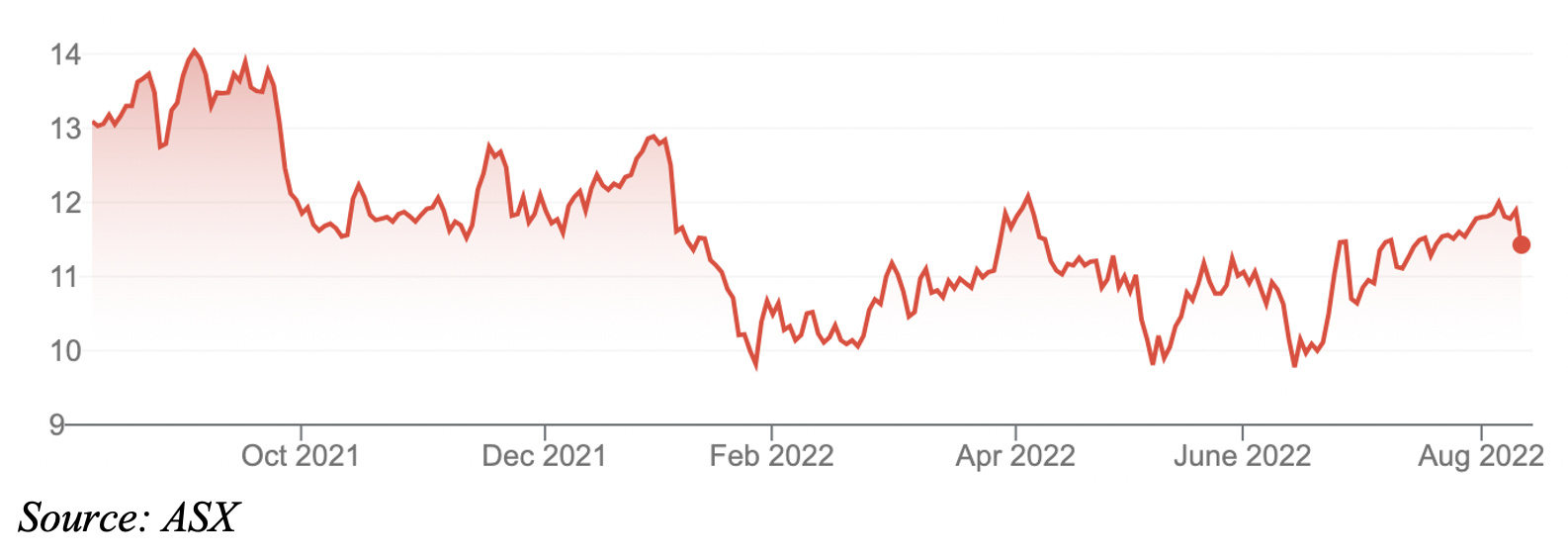

NXT fell from a 52-week high of $14.09 to a low of $9.57 during the market sell-off this year. The stock has since recovered to $11.43.

A consensus broking target of $13.83 suggests NXT is undervalued at the current price. Care is always needed with the “consensus”, but for once it looks about right for NXT. I can see the stock getting back to its previous high in the next 12-18 months.

NextDC Limited (NXT)

2. BetaShares Cloud Computing ETF (CLDD)

The ASX has a limited choice in cloud-computing stocks. After NextDC, Macquarie Telecom (MAQ) is the best bet for specialist exposure. Industry property star Goodman Group (GMG) has data centres among its vast property-management assets. Smaller firms, such as Megaport (MP1), also provide exposure to the trend. But most action in cloud computing is overseas.

The BetaShares Cloud Computing ETF is a simple, low-cost tool to gain exposure to a diversified portfolio of global cloud-computing stocks. Bought and sold like a share on the ASX, CLDD includes 35 cloud-computing stocks, mostly in the US.

Its top holdings are DigitalOcean, Zoom Video Communications, Dropbox Inc, Qualys, salesforce.com and Netflix. As with any ETF, always look “under the bonnet” to ensure the stocks provide sufficient exposure to your favoured trend.

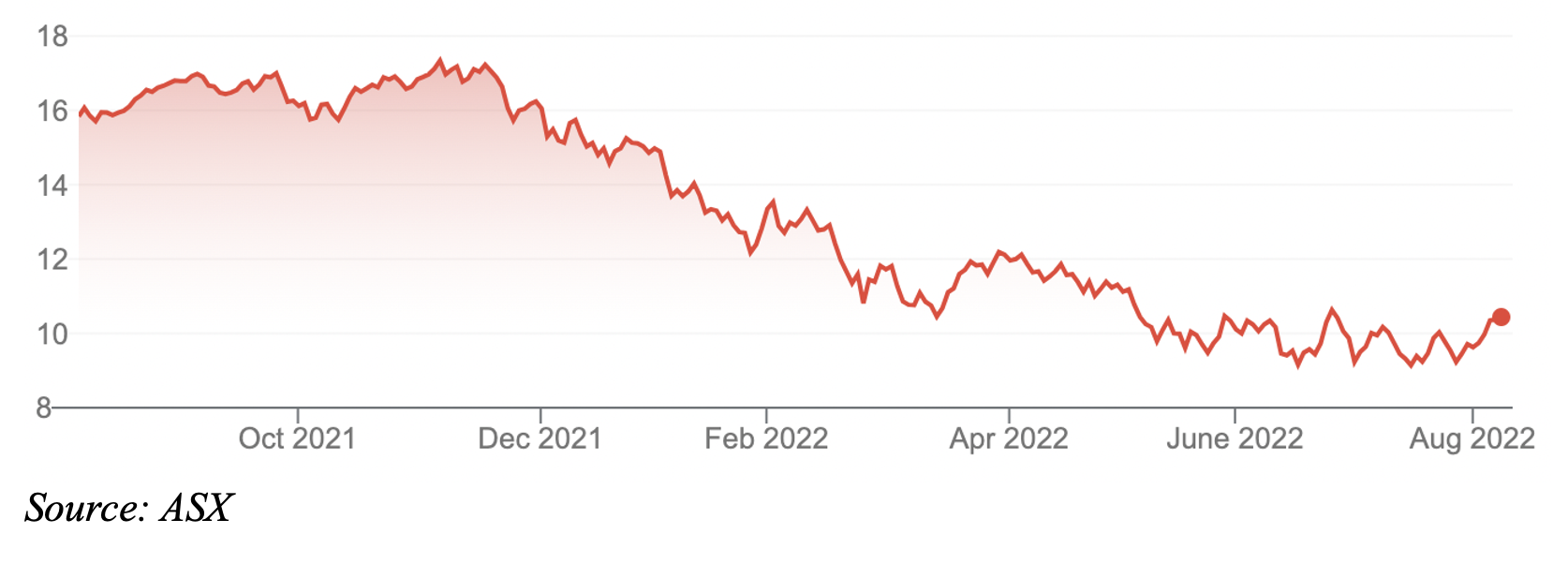

CLDD has been hammered, returning -34.8% over six months. If, like me, you believe the global tech sector has bottomed (or is close to bottoming), CLDD appeals.

The ETF is reasonably concentrated and doesn’t include the big cloud players, such as Amazon. But its constituents do a good job of providing global exposure to cloud-computing software, infrastructure and property.

BetaShares notes that much of the world’s digital data and software applications are still maintained outside the cloud. That suggests there’s a long runway of growth ahead for quality cloud-computing service providers.

BetaShares Cloud Computing ETF (CLDD)

Tony Featherstone is a former managing editor of BRW, Shares and Personal Investor magazines. The information in this article should not be considered personal advice. It has been prepared without considering your objectives, financial situation or needs. Before acting on information in this article consider its appropriateness and accuracy, regarding your objectives, financial situation and needs. Do further research of your own and/or seek personal financial advice from a licensed adviser before making any financial or investment decisions based on this article. All prices and analysis at 10 August 2022.